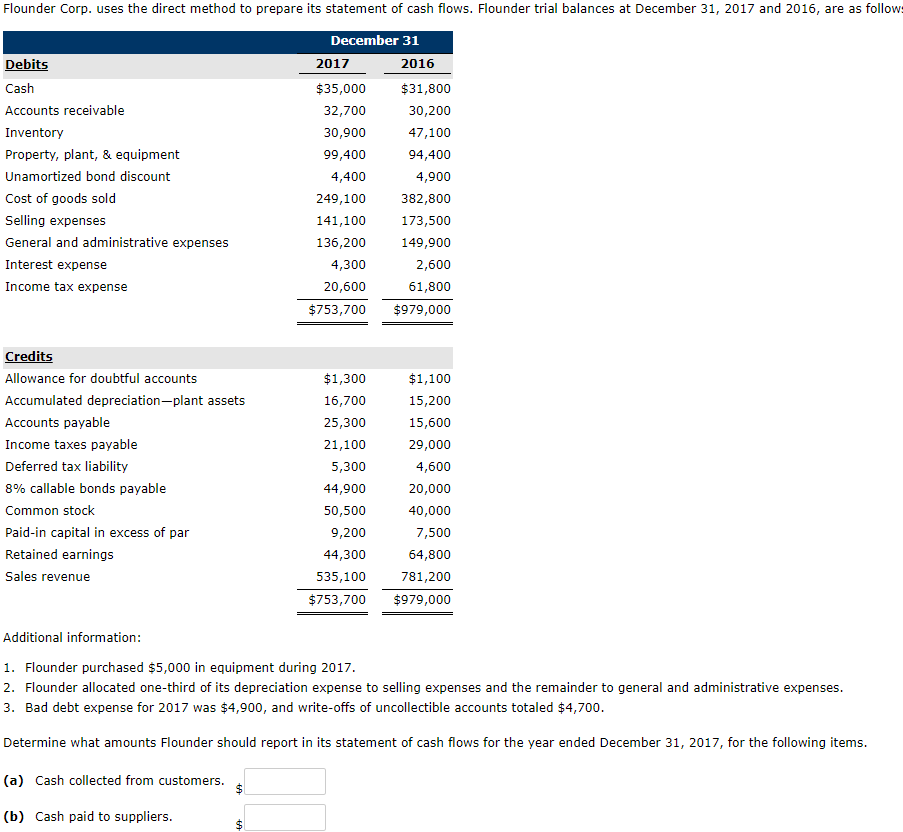

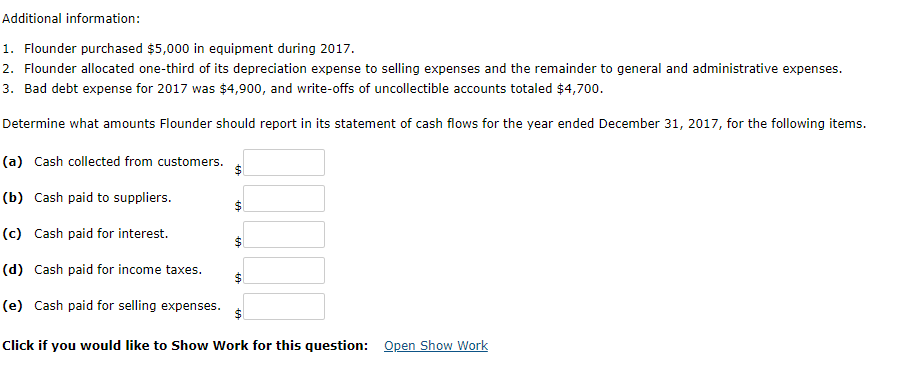

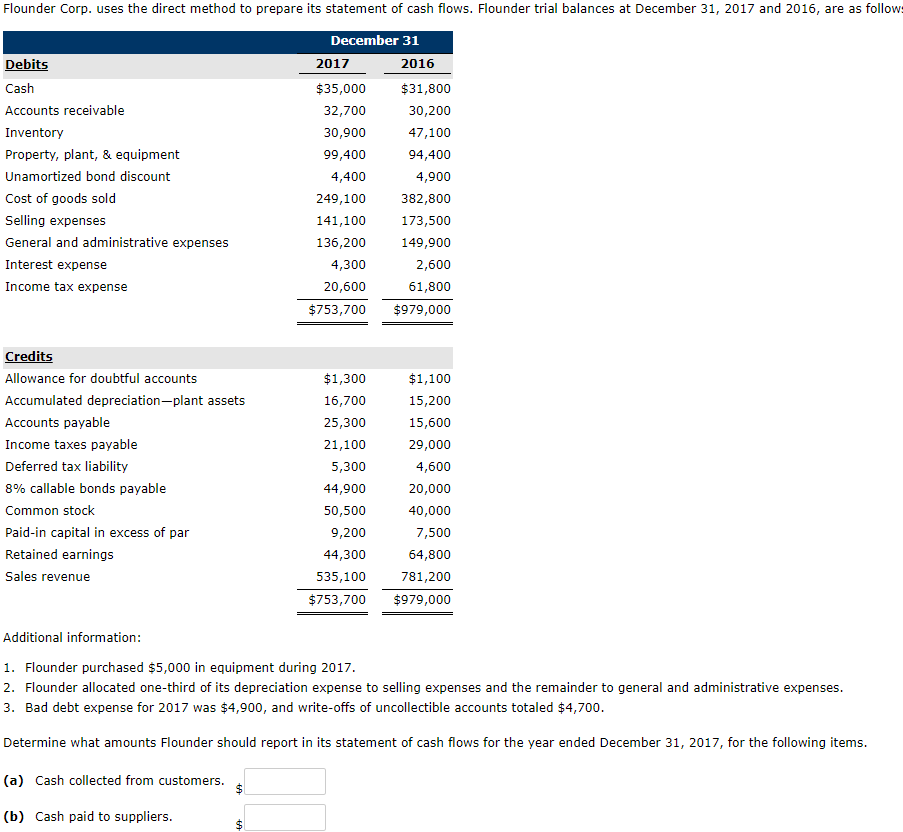

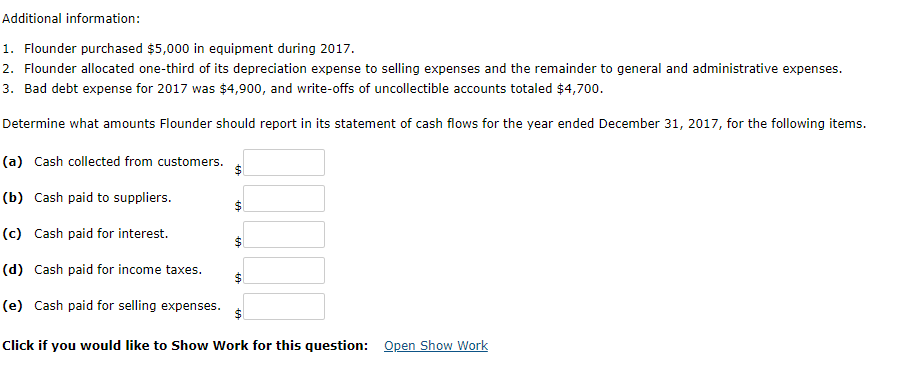

Flounder Corp. uses the direct method to prepare its statement of cash flows. Flounder trial balances at December 31, 2017 and 2016, are as follows December 31 Debits 2017 2016 Cash $35,000 $31,800 Accounts receivable 32,700 30,200 30,900 Inventory 47,100 Property, plant, & equipment 99,400 94,400 Unamortized bond discount 4,900 4,400 Cost of goods sold 249,100 382,800 Selling expenses 173,500 141,100 General and administrative expenses 149,900 136,200 Interest expense 4,300 2,600 Income tax expense 20,600 61,800 $753,700 $979,000 Credits Allowance for doubtful accounts $1,300 $1,100 Accumulated depreciation-plant assets 16,700 15,200 Accounts payable 25,300 15,600 Income taxes payable 21,100 29,000 Deferred tax liability 5,300 4,600 8% callable bonds payable 44,900 20,000 Common stock 50,500 40,000 Paid-in capital in excess of par 9,200 7,500 Retained earnings 44,300 64,800 Sales revenue 535,100 781,200 $753,700 $979,000 Additional information: 1. Flounder purchased $5,000 in equipment during 2017. 2. Flounder allocated one-third of its depreciation expense to selling expenses and the remainder to general and administrative expenses. 3. Bad debt expense for 2017 was $4,900, and write-offs of uncollectible accounts totaled $4,700. Determine what amounts Flounder should report in its statement of cash flows for the year ended December 31, 2017, for the following items. (a) Cash collected from customers. (b) Cash paid to suppliers. 24 Additional information: 1. Flounder purchased $5,000 in equipment during 2017. 2. Flounder allocated one-third of its depreciation expense to selling expenses and the remainder to general and administrative expenses. 3. Bad debt expense for 2017 was $4,900, and write-offs of uncollectible accounts totaled $4,700. Determine what amounts Flounder should report in its statement of cash flows for the year ended December 31, 2017, for the following items. (a) Cash collected from customers. 24 (b) Cash paid to suppliers. (c) Cash paid for interest. (d) Cash paid for income taxes. (e) Cash paid for selling expenses. $1 Open Show Work Click if you would like to Show Work for this