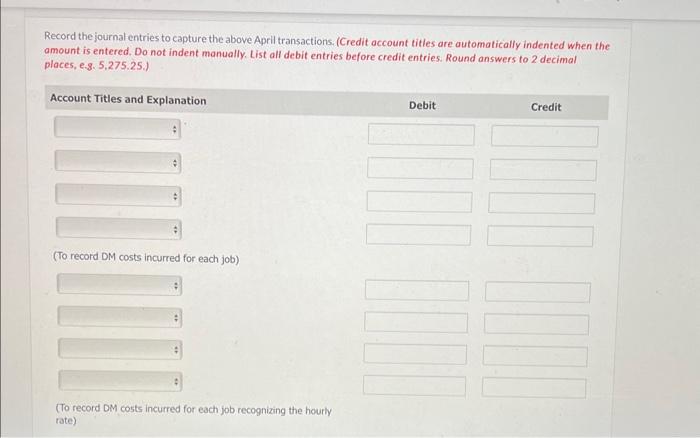

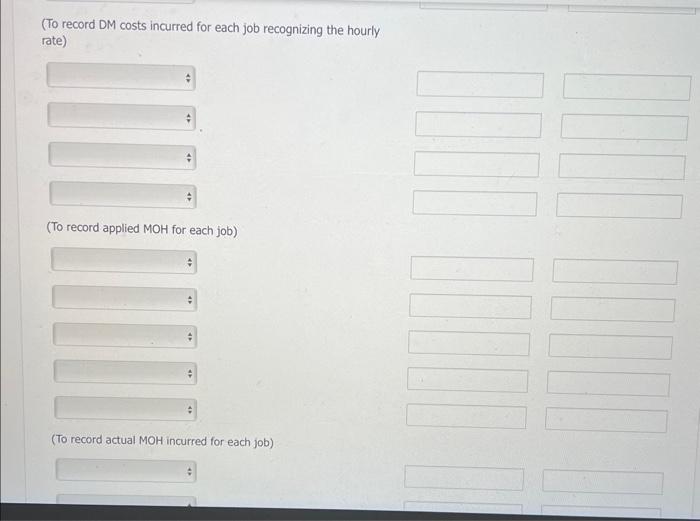

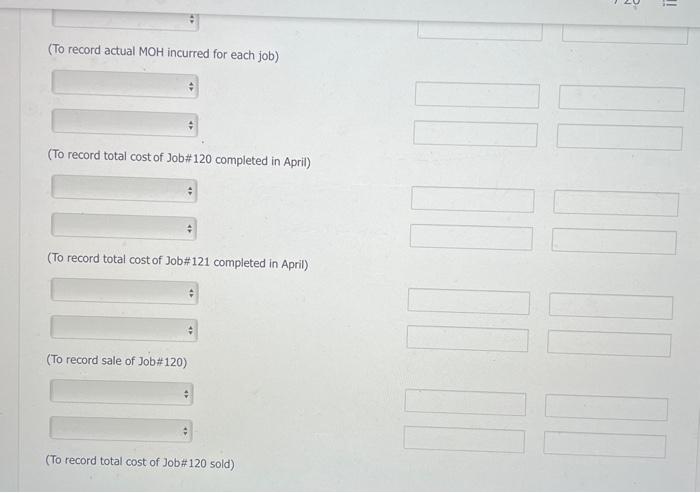

Flounder makes and delivers delicious meals, either ordered directly off its menu or customized to its customer's 'specifications (e.g. meatless or with jalapeos). The company sells its meals to individual households as well as businesses and organizations throughout the metro area, In determining its financial situation at the end of April. Flounder's accountant considered the jobs in process at the beginning of the month, along with costs and work done on jobs throughout April. and tallied costs to date on jobs that were not yet finished at the end of April, as follows. 1. At March 31 , Job #120 was the only job in inventory, and it was not yet finished. At that point, it had direct material costs of $51 and had used 26 direct labor hours. 2. During April, Flounder requisitioned the followed direct materials costs for these jobs: $620 for Job #120, $380 for Job #121, and $910 for Job #122. 3. During April, Flounder used the following direct labor hours for these jobs: 48 hours for Job #120, 126 hours for Job #121, and 161 hours for Job #122. 4. During April, the following MOH costs were recognized: depreciation on plant assets $1,860, utility costs for the plant yet to be paid $480, and salary for plant supervisor $2,860 ( $1,430 had been paid; $1,430 was accrued). 5. By the end of April, Job # 120 had been completed and sold (on credit). Job #121 was completed but not yet sold, and Job #122 had not yet been completed. Flounder's direct labor cost is $15 /hour. It allocates MOH on the basis of direct labor hours. At the beginning of the year, the company expected total MOH costs to be $175,840 and direct labor hours to be 12,560 . Flounder sets its selling price at 150% of its product. costcos2 Record the journal entries to capture the above April transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. Round answers to 2 decimal places, e.g. 5,275.25.) (To record DM costs incurred for each job recognizing the hourly rate) (To record applied MOH for each job) (To record actual MOH incurred for each job) (To record actual MOH incurred for each job) (To record total cost of Job#120 completed in April) (To record total cost of Job#121 completed in April) (To record sale of Job#120) (To record total cost of Job#120 sold)