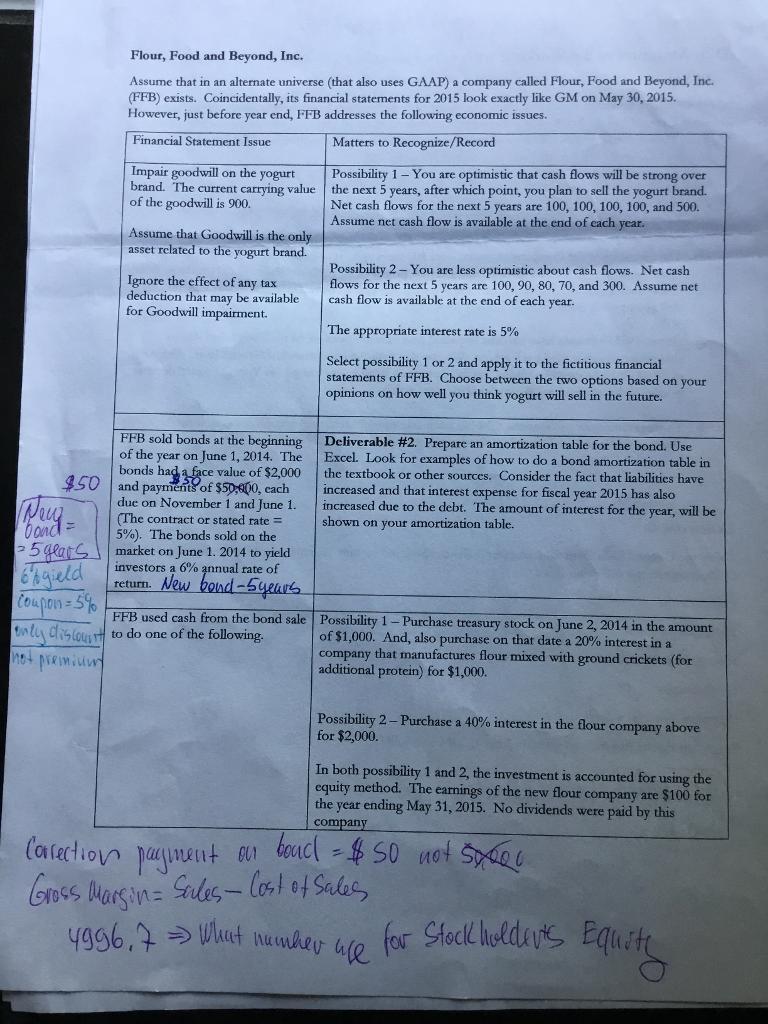

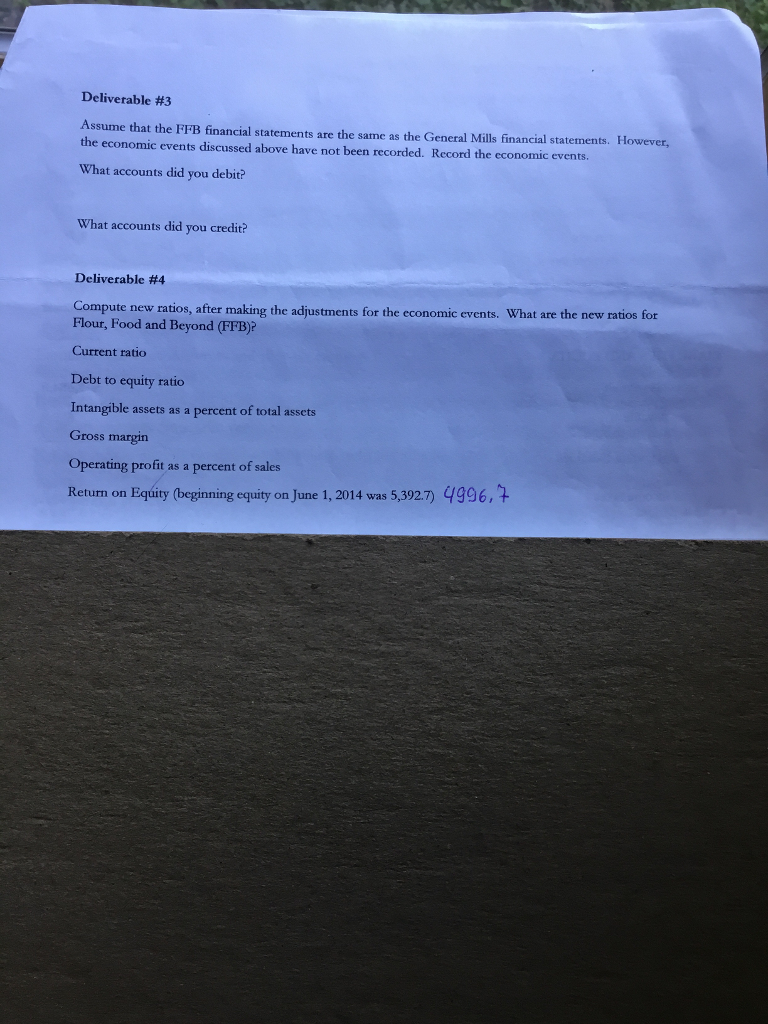

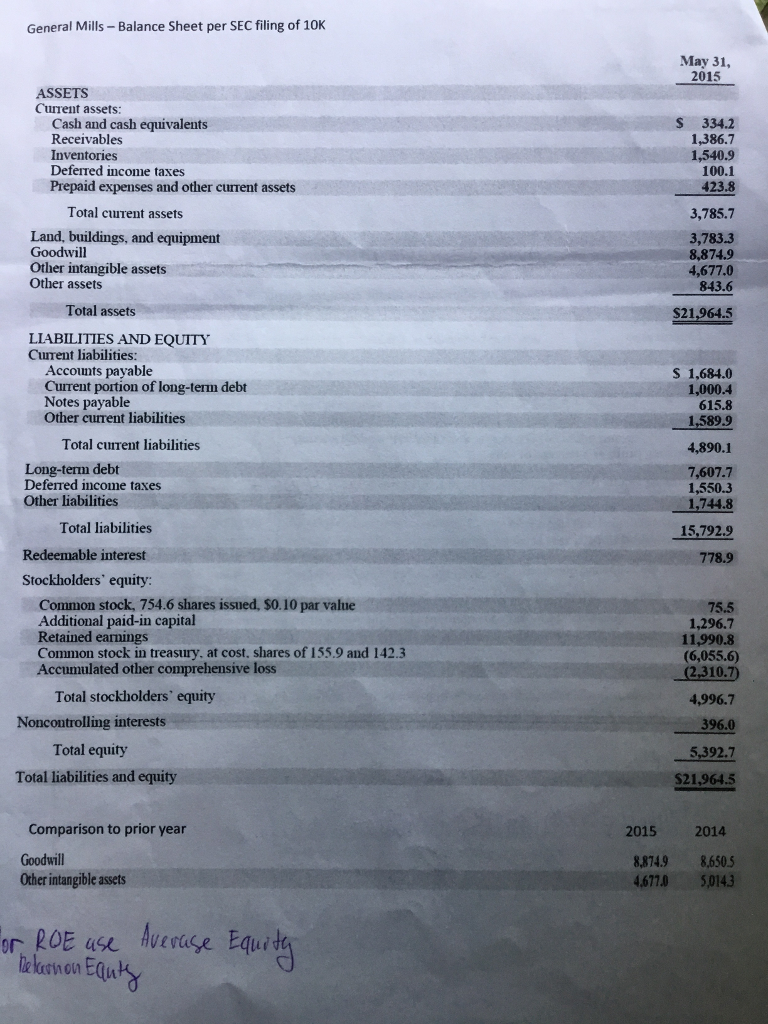

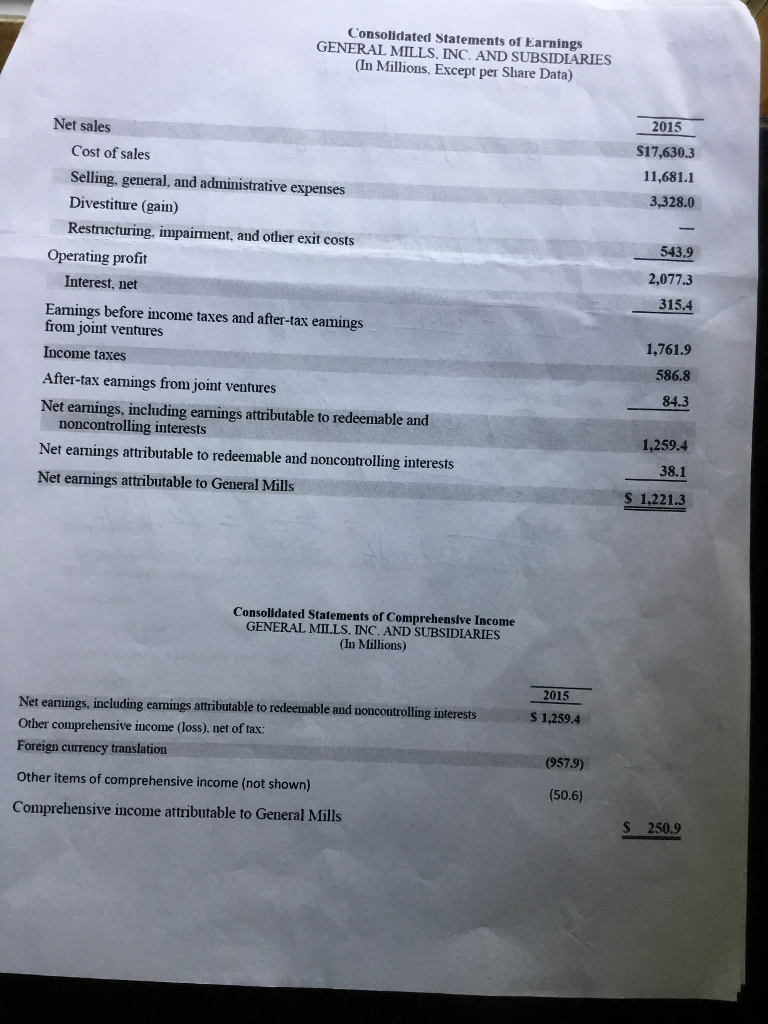

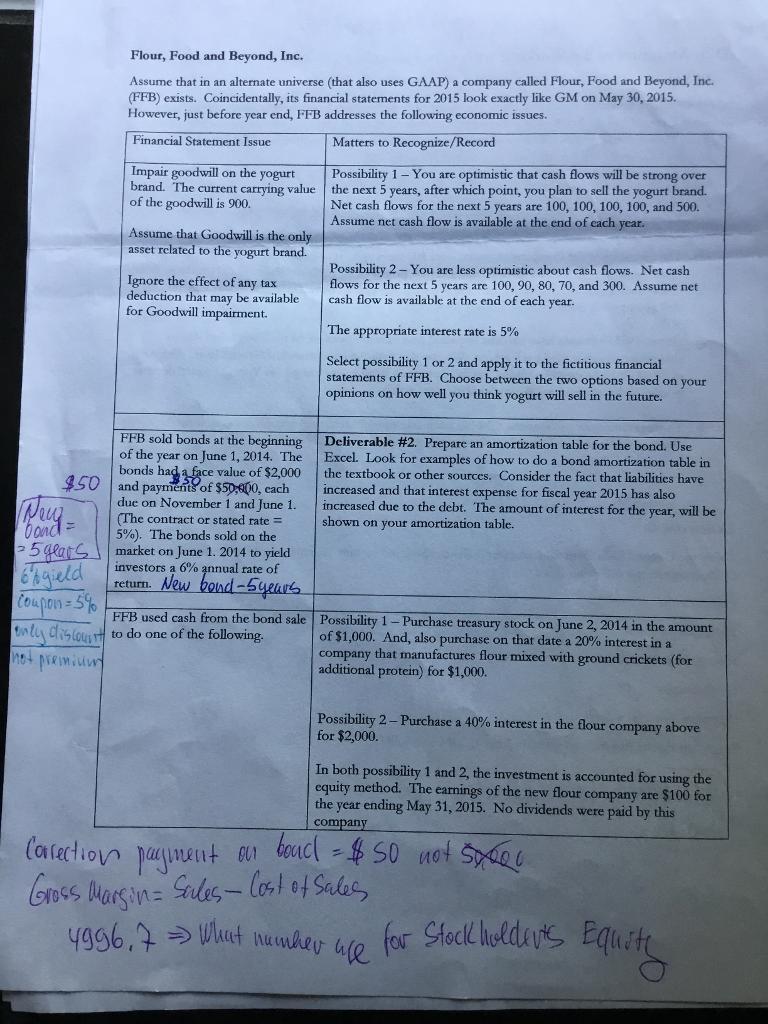

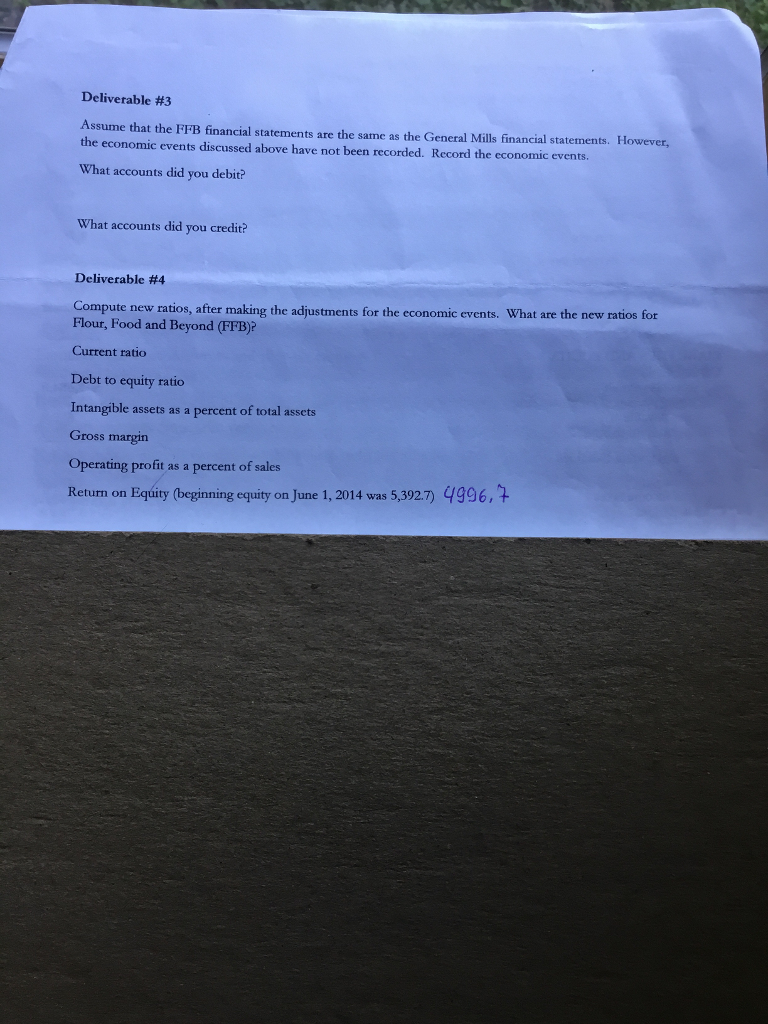

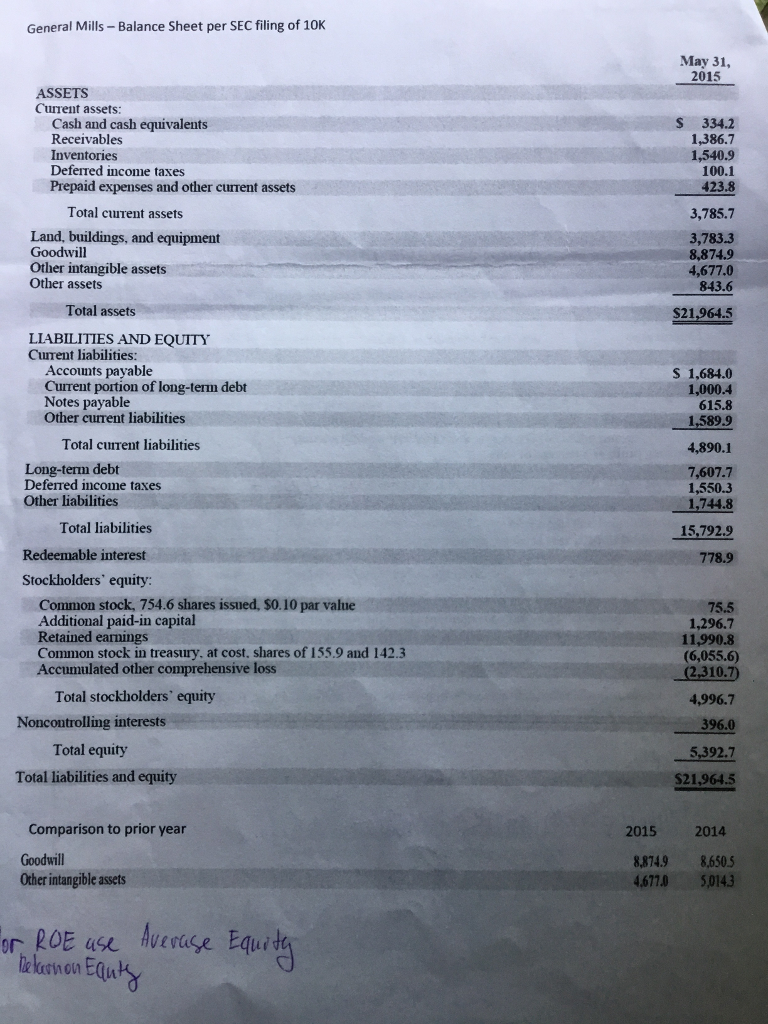

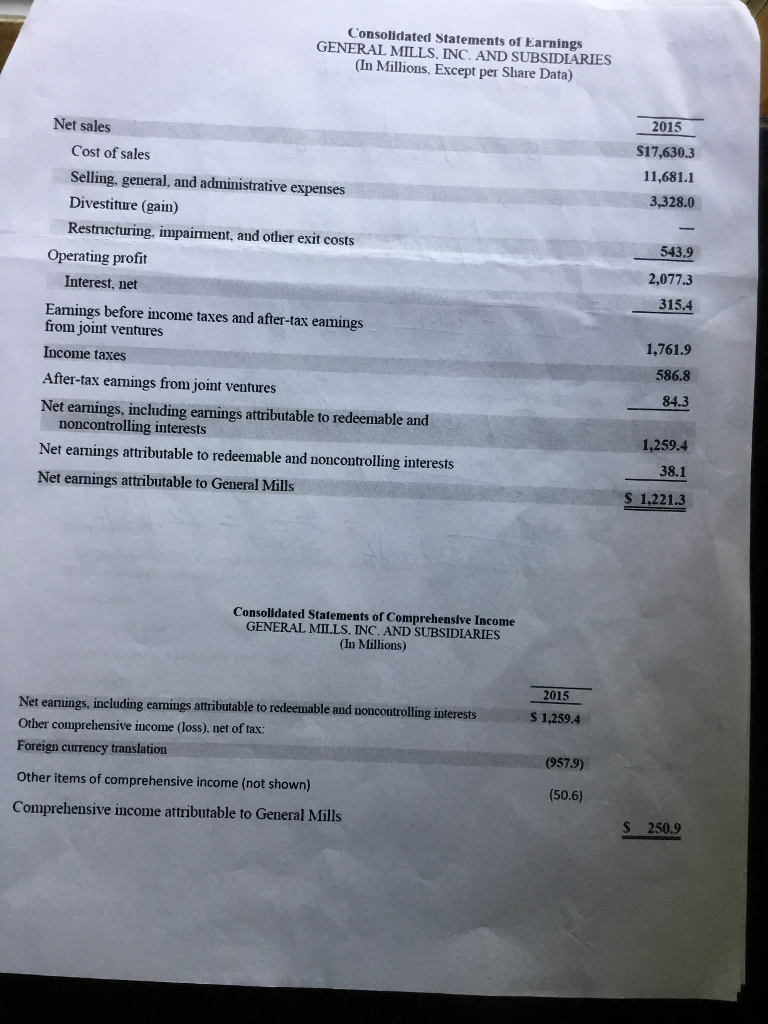

Flour, Food and Beyond, Inc. Assume that in an alternate universe (that also uses GAAP) a company called Flour, Food and Beyond, Inc. (FFB) exists. Coincidentally, its financial statements for 2015 look exactly like GM on May 30, 2015. However, just before year end, FFB addresses the following economic issues Financial Statement Issue Matters to Recognize/Record Impair goodwill on the yogurtPossibility 1- You are optimistic that cash lows will be strong over brand. The current carrying value the next 5 years, after which point, you plan to sell the yogurt brand. of the goodwill is 900. Net cash flows for the next 5 years are 100, 100, 100, 100, and 500. Assume net cash flow is available at the end of cach year. Assume that Goodwill is the only asset rclated to the yogurt brand Possibility 2 - You are less optimistic about cash flows. Net cash flows for the next 5 years are 100, 90, 80, 70, and 300. Assume net Ignore the effect of any tax deduction that may be available cash flow is available at the end of each year. for Goodwill impairment. The appropriate interest rate is 5% Select possibility 1 or 2 and apply it to the fictitious financial statements of FFB. Choose between the two options based on your opinions on how well you think yogurt will sell in the future. FFB sold bonds at the beginning Deliverable #2 Prepare an amortization table for the bond. Use of the year on June 1, 2014. The Excel. Look for examples of how to do a bond amortization table in bonds h and payment of $500, acincreased and that interest expense for fiscal year 2015 has also due on November 1 and June 1. The contract or stated rate 5%). The bonds sold on the ce value of $2,000 the textbook or other sources. Consider the fact that liabilitics have 950 increased due to the debt. The amount of interest for the year, will be shown on your amortization table. 5gat market on June 1. 2014 to yield investors a 6% annual rate of 50 Coupon 5 Possibility 1-Purchase treasury stock on June 2, 2014 in the amount of $1,000. And, also purchase on that date a 20% interest in a company that manufactures flour mixed with ground crickets (for additional protein) for $1,000. loto do one of the following. Possibility 2-Purchase a 40% interest in the flour company above for $2,000. In both possibility 1 and 2, the investment is accounted for using the equity method. The earnings of the new flour company are $100 for the year ending May 31, 2015. No dividends were paid by this company Flour, Food and Beyond, Inc. Assume that in an alternate universe (that also uses GAAP) a company called Flour, Food and Beyond, Inc. (FFB) exists. Coincidentally, its financial statements for 2015 look exactly like GM on May 30, 2015. However, just before year end, FFB addresses the following economic issues Financial Statement Issue Matters to Recognize/Record Impair goodwill on the yogurtPossibility 1- You are optimistic that cash lows will be strong over brand. The current carrying value the next 5 years, after which point, you plan to sell the yogurt brand. of the goodwill is 900. Net cash flows for the next 5 years are 100, 100, 100, 100, and 500. Assume net cash flow is available at the end of cach year. Assume that Goodwill is the only asset rclated to the yogurt brand Possibility 2 - You are less optimistic about cash flows. Net cash flows for the next 5 years are 100, 90, 80, 70, and 300. Assume net Ignore the effect of any tax deduction that may be available cash flow is available at the end of each year. for Goodwill impairment. The appropriate interest rate is 5% Select possibility 1 or 2 and apply it to the fictitious financial statements of FFB. Choose between the two options based on your opinions on how well you think yogurt will sell in the future. FFB sold bonds at the beginning Deliverable #2 Prepare an amortization table for the bond. Use of the year on June 1, 2014. The Excel. Look for examples of how to do a bond amortization table in bonds h and payment of $500, acincreased and that interest expense for fiscal year 2015 has also due on November 1 and June 1. The contract or stated rate 5%). The bonds sold on the ce value of $2,000 the textbook or other sources. Consider the fact that liabilitics have 950 increased due to the debt. The amount of interest for the year, will be shown on your amortization table. 5gat market on June 1. 2014 to yield investors a 6% annual rate of 50 Coupon 5 Possibility 1-Purchase treasury stock on June 2, 2014 in the amount of $1,000. And, also purchase on that date a 20% interest in a company that manufactures flour mixed with ground crickets (for additional protein) for $1,000. loto do one of the following. Possibility 2-Purchase a 40% interest in the flour company above for $2,000. In both possibility 1 and 2, the investment is accounted for using the equity method. The earnings of the new flour company are $100 for the year ending May 31, 2015. No dividends were paid by this company