Question

FluTech has a year end of 31 March and acquired Equipment A and Equipment B on 1 Apr 2010. The estimated useful life at acquisition

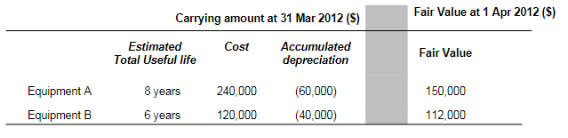

FluTech has a year end of 31 March and acquired Equipment A and Equipment B on 1 Apr 2010. The estimated useful life at acquisition is 8 years for Equipment A and 6 years for Equipment B. Both items are depreciated on a straight-line basis with no estimated residual value. For Equipment, the entity applies the revaluation model under IAS 16. For both items, there was no revaluation adjustment prior to 1 Apr 2012. However, there is a sudden change in fair value on 1 Apr 2012 as below.  On 31 Mar 2013, no revaluation adjustment is required. On 31 Mar 2014, Equipment A has a fair value of 135,000 and Equipment B was sold on that date for cash $80,000. The entity uses elimination method for revaluation adjustment. It makes an annual transfer from its revaluation surplus reserve to retained earnings in respect of excess depreciation. Required: (Ignore tax. Narratives explaining the journal entries are not required. You may calculate all amounts to the nearest dollar.) (a) Prepare all journal entries associated with Equipment A and Equipment B, separately, as required under all relevant IFRS from 1 Apr 2012 to 31 March 2014. Year-end journal entries to close income and expense items to balance sheet equity are not required.

On 31 Mar 2013, no revaluation adjustment is required. On 31 Mar 2014, Equipment A has a fair value of 135,000 and Equipment B was sold on that date for cash $80,000. The entity uses elimination method for revaluation adjustment. It makes an annual transfer from its revaluation surplus reserve to retained earnings in respect of excess depreciation. Required: (Ignore tax. Narratives explaining the journal entries are not required. You may calculate all amounts to the nearest dollar.) (a) Prepare all journal entries associated with Equipment A and Equipment B, separately, as required under all relevant IFRS from 1 Apr 2012 to 31 March 2014. Year-end journal entries to close income and expense items to balance sheet equity are not required.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started