Question

FluTech has a year end of 31 March and acquired Equipment A and Equipment B on 1 Apr 2010. The estimated useful life at acquisition

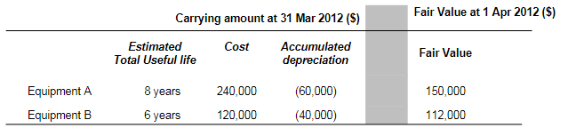

FluTech has a year end of 31 March and acquired Equipment A and Equipment B on 1 Apr 2010. The estimated useful life at acquisition is 8 years for Equipment A and 6 years for Equipment B. Both items are depreciated on a straight-line basis with no estimated residual value. For Equipment, the entity applies the revaluation model under IAS 16. For both items, there was no revaluation adjustment prior to 1 Apr 2012. However, there is a sudden change in fair value on 1 Apr 2012 as below.  On 31 Mar 2013, no revaluation adjustment is required. On 31 Mar 2014, Equipment A has a fair value of 135,000 and Equipment B was sold on that date for cash $80,000. The entity uses elimination method for revaluation adjustment. It makes an annual transfer from its revaluation surplus reserve to retained earnings in respect of excess depreciation.

On 31 Mar 2013, no revaluation adjustment is required. On 31 Mar 2014, Equipment A has a fair value of 135,000 and Equipment B was sold on that date for cash $80,000. The entity uses elimination method for revaluation adjustment. It makes an annual transfer from its revaluation surplus reserve to retained earnings in respect of excess depreciation.

Required (Ignore tax. Narratives explaining the journal entries are not required. You may calculate all amounts to the nearest dollar)

(c) Assume the entity instead uses proportional method for revaluation adjustment. Prepare journal entries associated with Equipment A from 1 Apr 2012 to 31 March 2013. Equipment B is NOT required.

Fair Value at 1 Apr 2012 (5) Carrying amount at 31 Mar 2012 (5) Estimated Cost Accumulated Total Useful life depreciation Fair Value Equipment A Equipment B 8 years 6 years 240,000 120,000 (60,000) (40,000) 150,000 112,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started