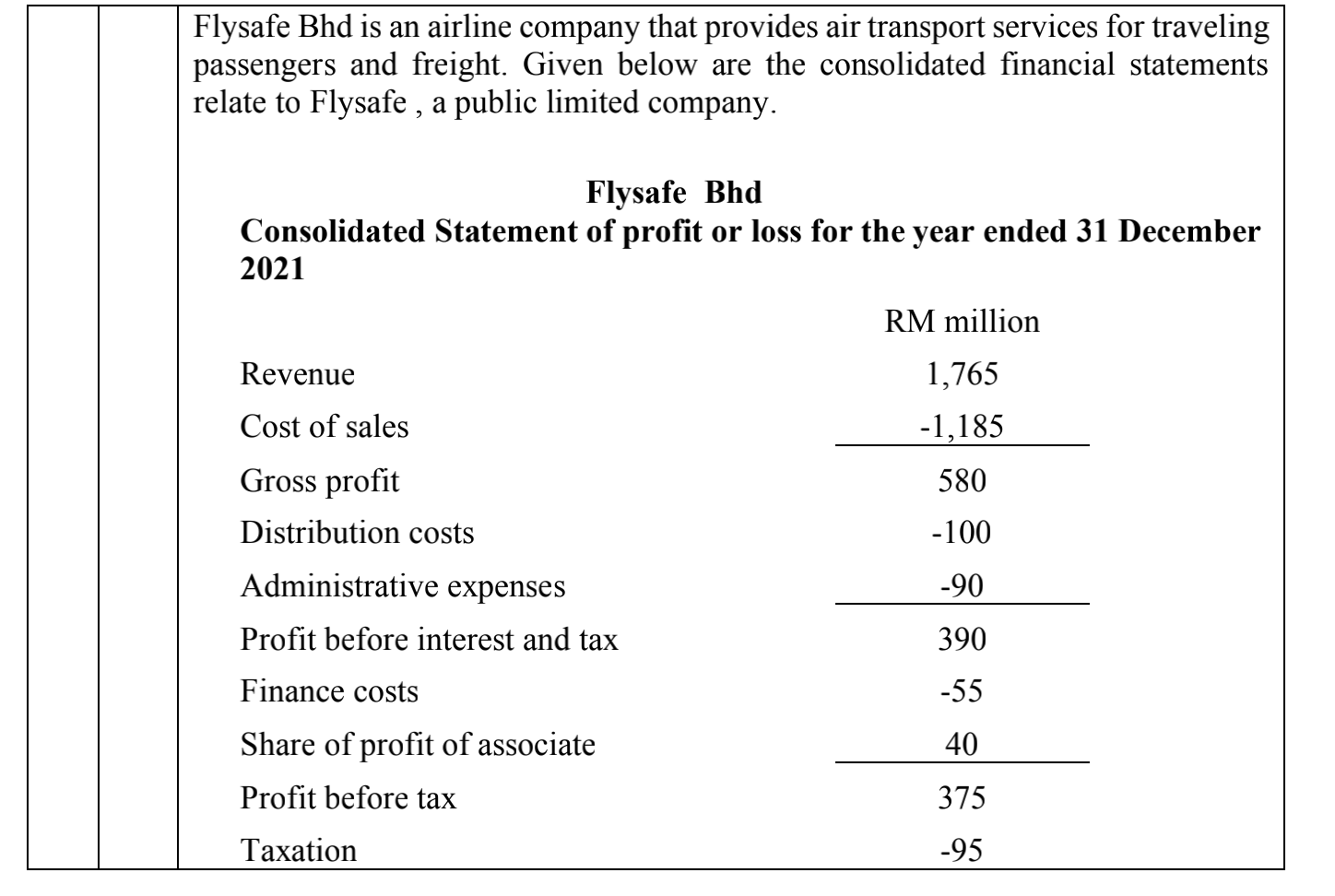

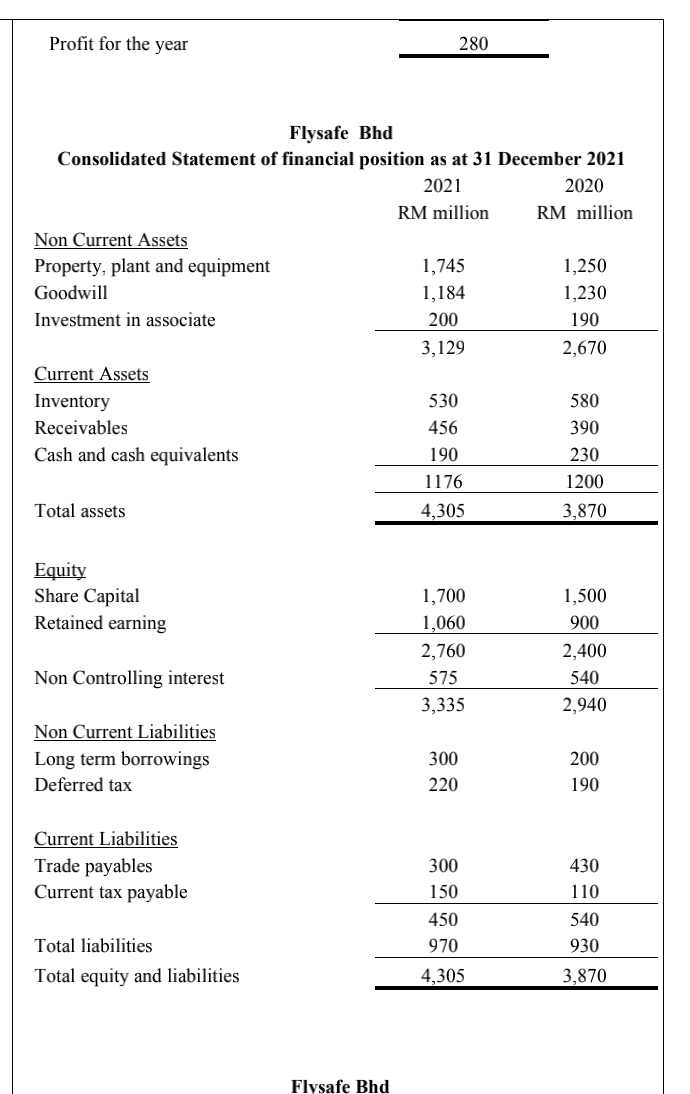

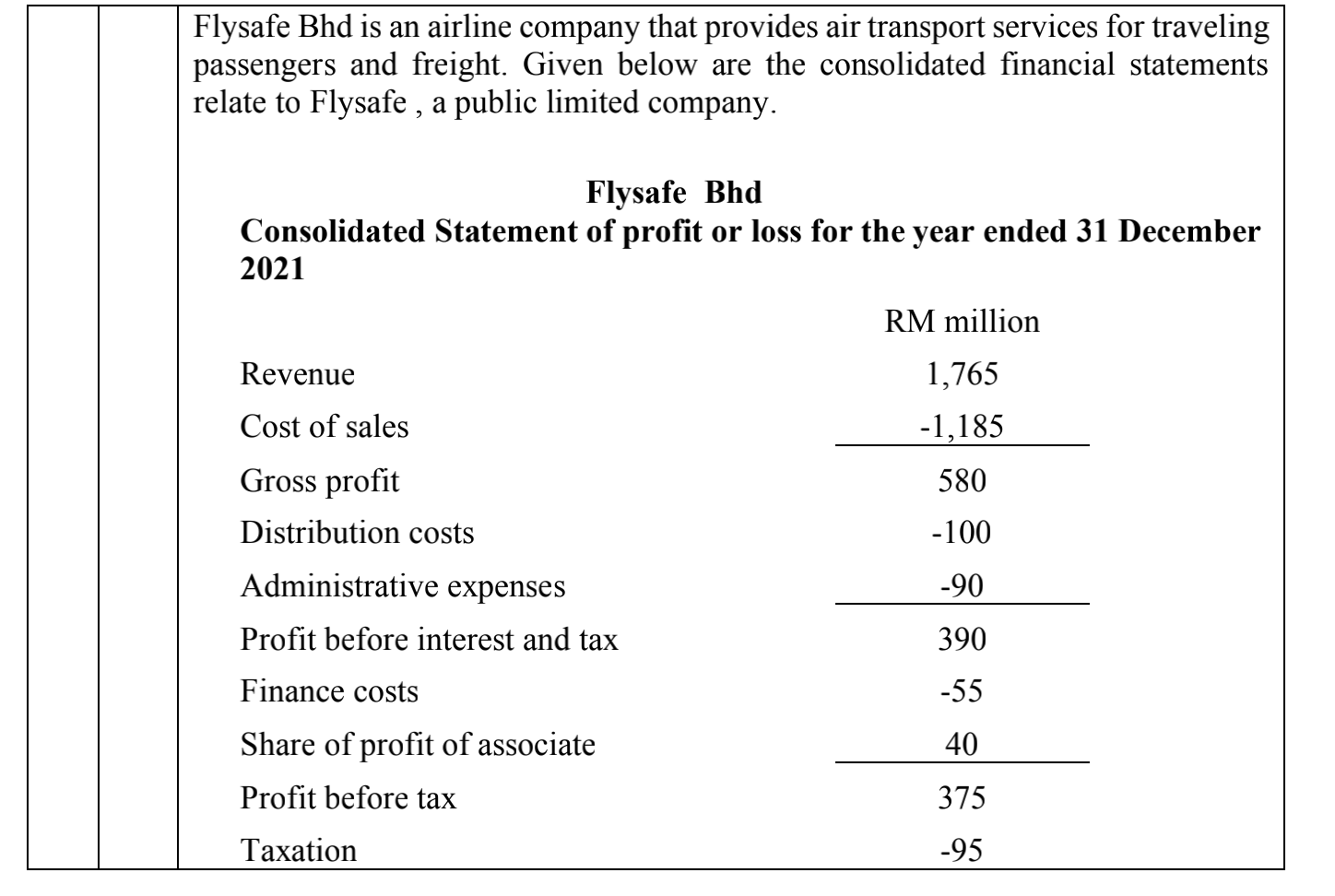

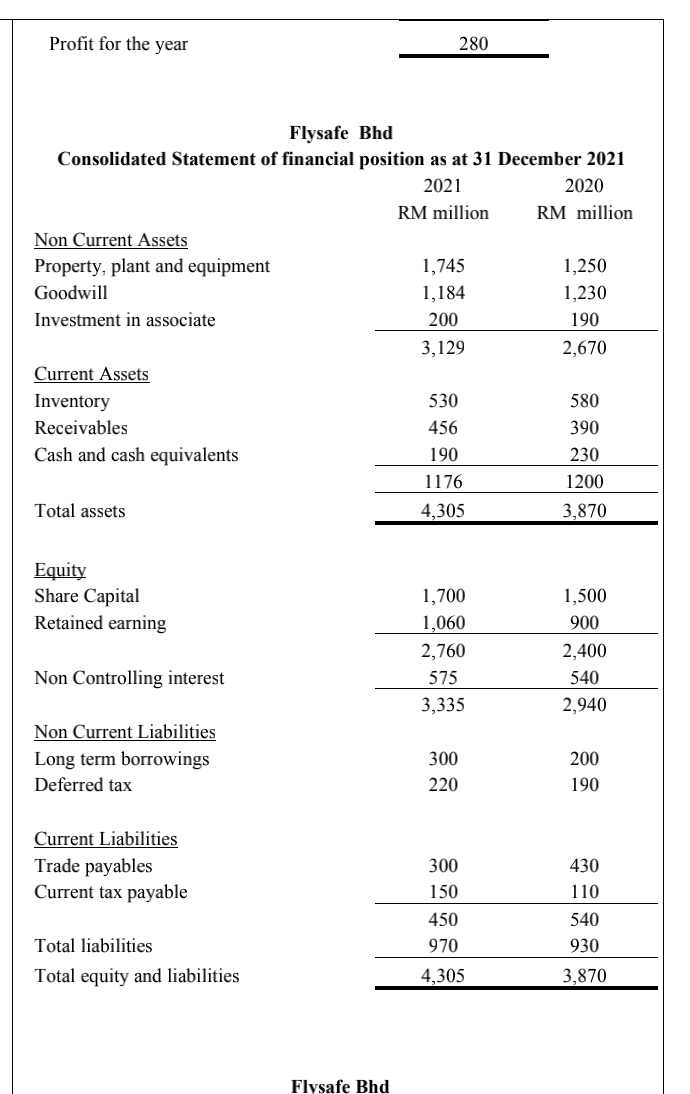

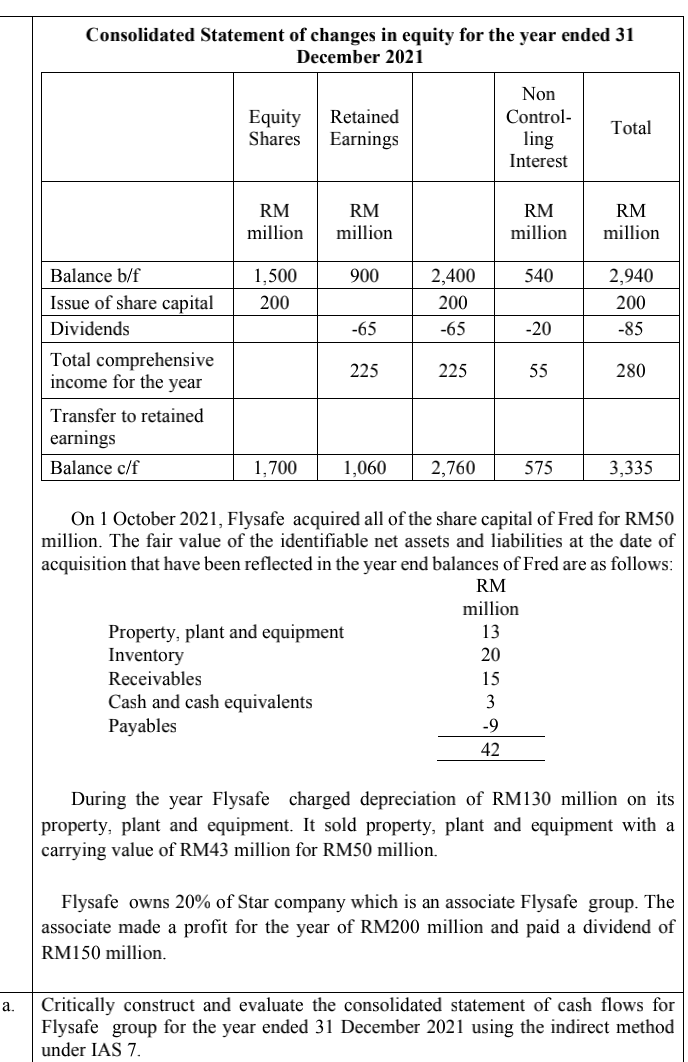

Flysafe Bhd is an airline company that provides air transport services for traveling passengers and freight. Given below are the consolidated financial statements relate to Flysafe , a public limited company. Flysafe Bhd Consolidated Statement of profit or loss for the year ended 31 December 2021 RM million Revenue 1,765 -1,185 Cost of sales 580 -100 Gross profit Distribution costs Administrative expenses Profit before interest and tax Finance costs -90 390 -55 40 Share of profit of associate Profit before tax 375 Taxation -95 Profit for the year 280 Flysafe Bhd Consolidated Statement of financial position as at 31 December 2021 2021 2020 RM million RM million Non Current Assets Property, plant and equipment 1,745 1,250 Goodwill 1,184 1,230 Investment in associate 200 190 3,129 2,670 Current Assets Inventory 530 580 Receivables 456 390 Cash and cash equivalents 190 230 1176 1200 Total assets 4,305 3,870 Equity Share Capital Retained earning 1,700 1,060 2,760 575 3,335 1,500 900 2,400 Non Controlling interest 540 2,940 Non Current Liabilities Long term borrowings Deferred tax 300 220 200 190 Current Liabilities Trade payables Current tax payable 300 150 430 110 540 450 970 930 Total liabilities Total equity and liabilities 4,305 3,870 Flysafe Bhd Consolidated Statement of changes in equity for the year ended 31 December 2021 Equity Shares Retained Earnings Non Control- ling Interest Total RM million RM million RM million RM million 900 540 1,500 200 2,400 200 2,940 200 -85 -65 -65 -20 Balance b/f Issue of share capital Dividends Total comprehensive income for the year Transfer to retained earnings Balance c/f 225 225 55 280 1,700 1,060 2,760 575 3,335 On 1 October 2021, Flysafe acquired all of the share capital of Fred for RM50 million. The fair value of the identifiable net assets and liabilities at the date of acquisition that have been reflected in the year end balances of Fred are as follows: RM million Property, plant and equipment 13 Inventory 20 Receivables 15 Cash and cash equivalents 3 Payables -9 42 During the year Flysafe charged depreciation of RM130 million on its property, plant and equipment. It sold property, plant and equipment with a carrying value of RM43 million for RM50 million. Flysafe owns 20% of Star company which is an associate Flysafe group. The associate made a profit for the year of RM200 million and paid a dividend of RM150 million. a. Critically construct and evaluate the consolidated statement of cash flows for Flysafe group for the year ended 31 December 2021 using the indirect method under IAS 7