Answered step by step

Verified Expert Solution

Question

1 Approved Answer

FN 3 4 7 : Investments CFA Exam Case Background Stephenson, age 5 5 and single, is a surgeon. Stephenson has accumulated a $ 2

FN : Investments

CFA Exam Case

Background

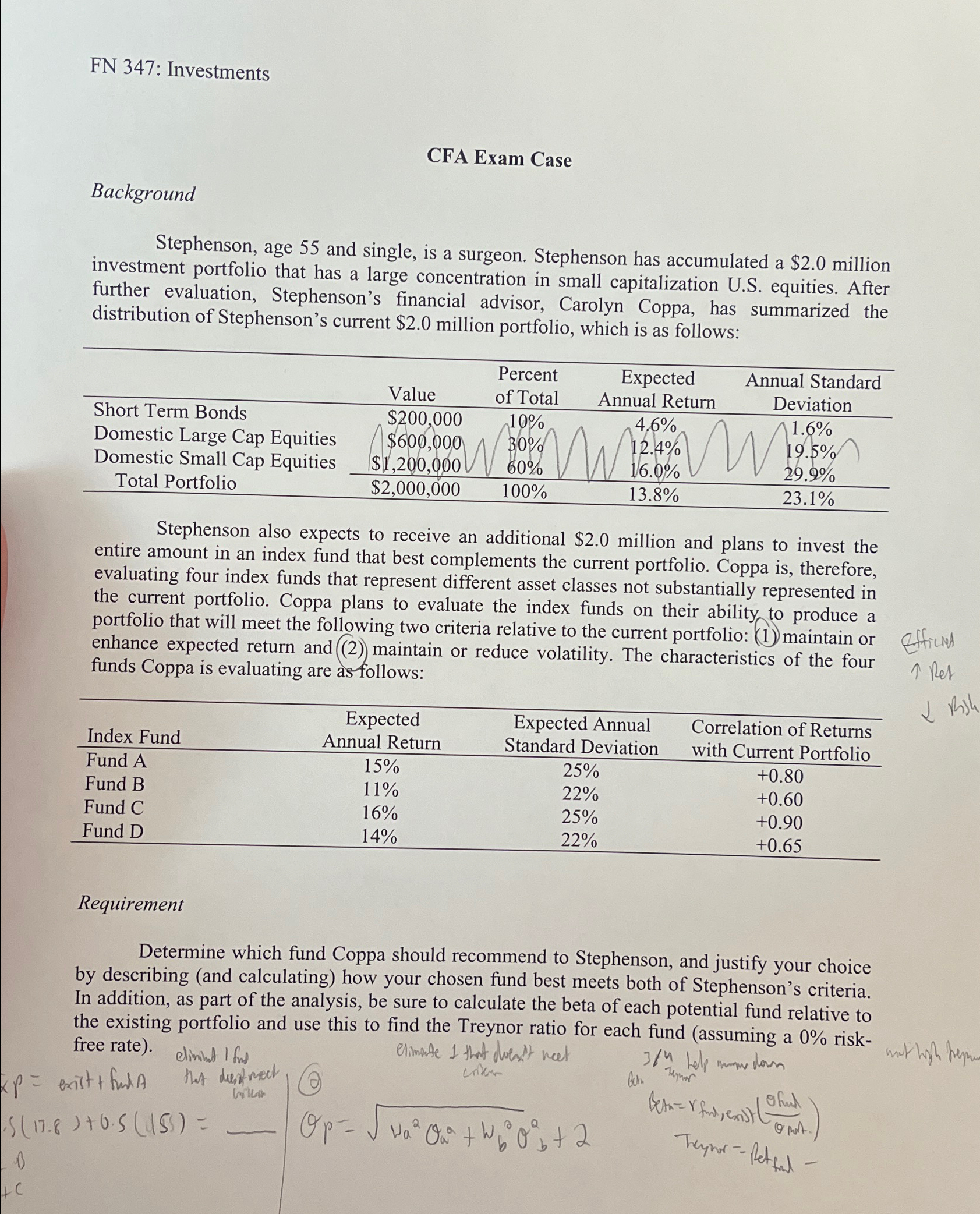

Stephenson, age and single, is a surgeon. Stephenson has accumulated a $ million investment portfolio that has a large concentration in small capitalization US equities. After further evaluation, Stephenson's financial advisor, Carolyn Coppa, has summarized the distribution of Stephenson's current $ million portfolio, which is as follows:

Stephenson also expects to receive an additional $ million and plans to invest the entire amount in an index fund that best complements the current portfolio. Coppa is therefore, evaluating four index funds that represent different asset classes not substantially represented in the current portfolio. Coppa plans to evaluate the index funds on their ability to produce a portfolio that will meet the following two criteria relative to the current portfolio: maintain or enhance expected return and maintain or reduce volatility. The characteristics of the four funds Coppa is evaluating are as follows:

tableIndex Fund,tableExpectedAnnual ReturntableExpected AnnualStandard DeviationtableCorrelation of Returnswith Current PortfolioFund AFund BFund CFund D

efficied

Ret

Requirement

Determine which fund Coppa should recommend to Stephenson, and justify your choice by describing and calculating how your chosen fund best meets both of Stephenson's criteria. In addition, as part of the analysis, be sure to calculate the beta of each potential fund relative to the existing portfolio and use this to find the Treynor ratio for each fund assuming a riskfree rate

exist thas A that duent meat

bah.

fond, ensi

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started