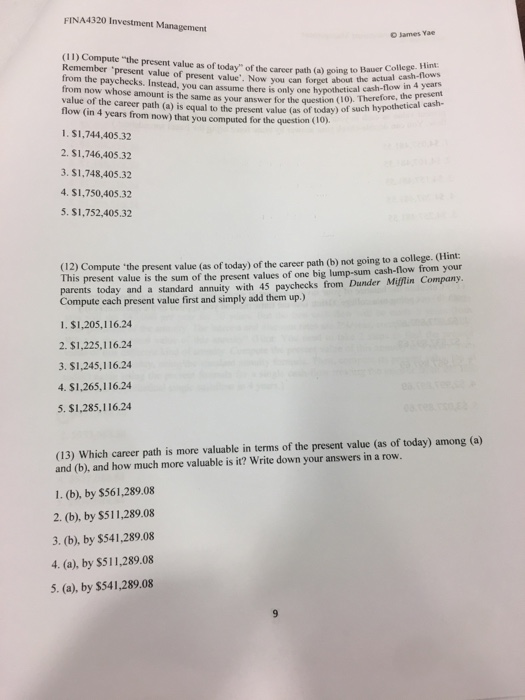

FNA4320 Investment Management D James Yae (11) Compute "the present value as of today" of the career path (a) going to Remember 'present value of present value. Now you can forget about the atua from the paychecks. Instead, you can assume there is only one o). Therefore from now whose amount is the same as your answer for the question cythctical casn value of the career path (a) is equal to the present value (as of today) of su flow (in 4 years from now) that you computed for the question (10) Bauer College. Hint hypothetical cash-flow in 4 years the present efore, 1. $1,744,405.32 2. $1,746,405.32 3. $1,748,405.32 4. $1,750,405.32 5. $1,752,405.32 Compute "the present value (as of today) of the career path (b) not going to a college. (Hint: Th is present value is the sum of the present values of one big lump-sum cash-flow from your parents today and a standard annuity with 45 paychecks from Dunder Mifflin Company. Compute each present value first and simply add them up.) 1. $1,205,116.24 2. $1,225,116.24 3. $1,245,116.24 4. $1,265,116.24 5. $1,285,116.24 and (b), and how much more valuable is it? Write down your answers in a row. 1. (b), by $561,289.08 2. (b), by $511,289.08 3. (b), by $541,289.08 4. (a), by $511,289.08 5. (a), by $541,289.08 (13) Which career path is more valuable in terms of the present value (as of today) among (a) FNA4320 Investment Management D James Yae (11) Compute "the present value as of today" of the career path (a) going to Remember 'present value of present value. Now you can forget about the atua from the paychecks. Instead, you can assume there is only one o). Therefore from now whose amount is the same as your answer for the question cythctical casn value of the career path (a) is equal to the present value (as of today) of su flow (in 4 years from now) that you computed for the question (10) Bauer College. Hint hypothetical cash-flow in 4 years the present efore, 1. $1,744,405.32 2. $1,746,405.32 3. $1,748,405.32 4. $1,750,405.32 5. $1,752,405.32 Compute "the present value (as of today) of the career path (b) not going to a college. (Hint: Th is present value is the sum of the present values of one big lump-sum cash-flow from your parents today and a standard annuity with 45 paychecks from Dunder Mifflin Company. Compute each present value first and simply add them up.) 1. $1,205,116.24 2. $1,225,116.24 3. $1,245,116.24 4. $1,265,116.24 5. $1,285,116.24 and (b), and how much more valuable is it? Write down your answers in a row. 1. (b), by $561,289.08 2. (b), by $511,289.08 3. (b), by $541,289.08 4. (a), by $511,289.08 5. (a), by $541,289.08 (13) Which career path is more valuable in terms of the present value (as of today) among (a)