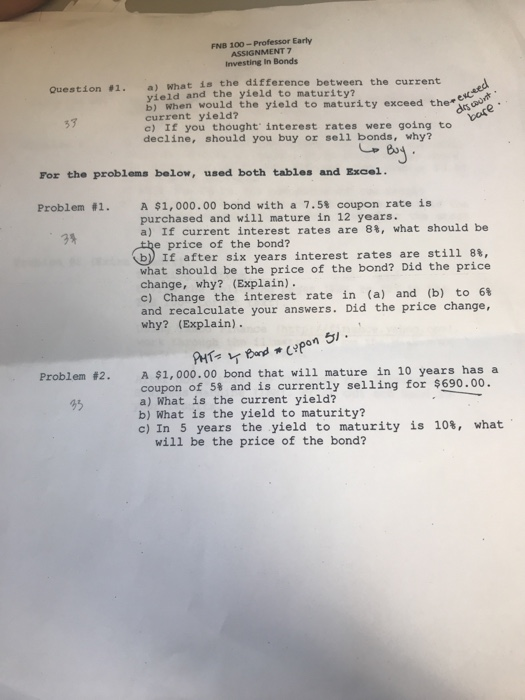

FNB 100-Professor Early ASSIGNMENT 7 Investing in Bonds a) what is the difference between the current yield and the yield to maturity? b) When would the yield to maturity exceed the* current yield? c) If you thought interest rates were going to decline, should you buy or sell bonds, why? Question #1. For the problems below, used both tables and Excel. #1. A $1,000.00 bond with a 7.5% coupon rate is purchased and will mature in 12 years. a) If current interest rates are 8%, what should be Problem e price of the bond? b) If after six years interest rates are still 8, what should be the price of the bond? Did the price change, why? (Explain). c) Change the interest rate in (a) and (b) to 6% and recalculate your answers. Did the price change, why? (Explain) on 5 A $1,000.00 bond that will mature in 10 years has a coupon of 5% and is currently selling for $690.00. a) What is the current yield? b) What is the yield to maturity? c) In 5 years the yield to maturity is 10%, what #2. Problem 25 will be the price of the bond? FNB 100-Professor Early ASSIGNMENT 7 Investing In Bonds What is the difference between the current #1. a) yield and the yield to maturity? b) when would the yield to maturity exceed the current yield? c) If you thought interest rates were going to decline, should you buy or sell bonds, why? Buy lems below, used both tables and Excel. A $1,000.00 bond with a 7.5% coupon rate is purchased and will mature in 12 years. rrant interest rates are 88, what should ouj For the problems below, used both tables and Excel. Problem #1. A $1,000.00 bond with a 7.5% coupon rate is 5 purchased and will mature in 12 years. a) If current interest rates are 8%, what should be e price of the bond? b) If after six years interest rates are still 88, what should be the price of the bond? Did the price change, why? (Explain). c) Change the interest rate in (a) and (b) to 6% and recalculate your answers. Did the price change, why? (Explain). 2 0 A $1,000.00 bond that will mature in 10 years has a Problem #2. 8 coupon of 5% and is currently selling for $690.00 a) What is the current yield? b) What is the yield to maturity? c) In 5 years the yield to maturity is 10%, what 23 1 will be the price of the bond