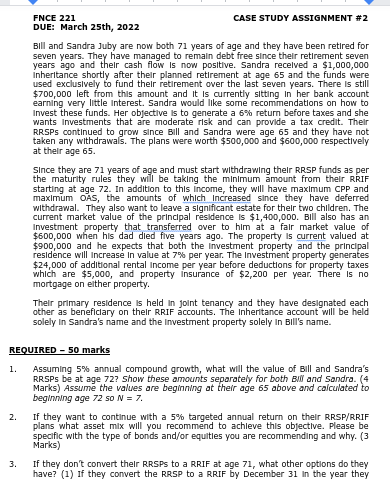

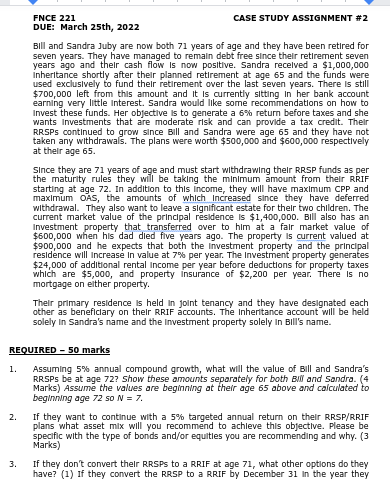

FNCE 221 CASE STUDY ASSIGNMENT #2 DUE: March 25th, 2022 Bill and Sandra Juby are now both 71 years of age and they have been retired for seven years. They have managed to remain debt free since their retirement seven years ago and their cash flow is now positive. Sandra received a $1,000,000 Inheritance shortly after their planned retirement at age 65 and the funds were used exclusively to fund their retirement over the last seven years. There is still $700,000 left from this amount and it is currently sitting in her bank account earning very little interest. Sandra would like some recommendations on how to Invest these funds. Her objective is to generate a 6% return before taxes and she wants Investments that are moderate risk and can provide a tax credit. Their RRSPs continued to grow since Bill and Sandra were age 65 and they have not taken any withdrawals. The plans were worth $500,000 and $600,000 respectively at their age 65. Since they are 71 years of age and must start withdrawing their RRSP funds as per the maturity rules they will be taking the minimum amount from their RRIF starting at age 72. In addition to this income, they will have maximum CPP and maximum OAS, the amounts of which Increased since they have deferred withdrawal. They also want to leave a significant estate for their two children. The current market value of the principal residence is $1,400,000. Bill also has an Investment property that transferred over to him at a fair market value of $600,000 when his dad died five years ago. The property is current valued at $900,000 and he expects that both the investment property and the principal residence will increase in value at 7% per year. The Investment property generates $24,000 of additional rental Income per year before deductions for property taxes which are $5,000, and property insurance of $2,200 per year. There is no mortgage on either property. Their primary residence is held in joint tenancy and they have designated each other as beneficiary on their RRIF accounts. The Inheritance account will be held solely in Sandra's name and the investment property solely In Bill's name. REQUIRED - 50 marks 1. Assuming 5% annual compound growth, what will the value of Bill and Sandra's RRSPs be at age 72? Show these amounts separately for both Bill and Sandra. (4 Marks) Assume the values are beginning at their age 65 above and calculated to beginning age 72 so N = 7. 2. If they want to continue with a 5% targeted annual return on their RRSP/RRIF plans what asset mix will you recommend to achleve this objective. Please be specific with the type of bonds and/or equities you are recommending and why. (3 Marks) 3. If they don't convert their RRSPs to a RRIF at age 71, what other options do they have? (1) if they convert the RRSP to a RRIF by December 31 In the year they FNCE 221 CASE STUDY ASSIGNMENT #2 DUE: March 25th, 2022 Bill and Sandra Juby are now both 71 years of age and they have been retired for seven years. They have managed to remain debt free since their retirement seven years ago and their cash flow is now positive. Sandra received a $1,000,000 Inheritance shortly after their planned retirement at age 65 and the funds were used exclusively to fund their retirement over the last seven years. There is still $700,000 left from this amount and it is currently sitting in her bank account earning very little interest. Sandra would like some recommendations on how to Invest these funds. Her objective is to generate a 6% return before taxes and she wants Investments that are moderate risk and can provide a tax credit. Their RRSPs continued to grow since Bill and Sandra were age 65 and they have not taken any withdrawals. The plans were worth $500,000 and $600,000 respectively at their age 65. Since they are 71 years of age and must start withdrawing their RRSP funds as per the maturity rules they will be taking the minimum amount from their RRIF starting at age 72. In addition to this income, they will have maximum CPP and maximum OAS, the amounts of which Increased since they have deferred withdrawal. They also want to leave a significant estate for their two children. The current market value of the principal residence is $1,400,000. Bill also has an Investment property that transferred over to him at a fair market value of $600,000 when his dad died five years ago. The property is current valued at $900,000 and he expects that both the investment property and the principal residence will increase in value at 7% per year. The Investment property generates $24,000 of additional rental Income per year before deductions for property taxes which are $5,000, and property insurance of $2,200 per year. There is no mortgage on either property. Their primary residence is held in joint tenancy and they have designated each other as beneficiary on their RRIF accounts. The Inheritance account will be held solely in Sandra's name and the investment property solely In Bill's name. REQUIRED - 50 marks 1. Assuming 5% annual compound growth, what will the value of Bill and Sandra's RRSPs be at age 72? Show these amounts separately for both Bill and Sandra. (4 Marks) Assume the values are beginning at their age 65 above and calculated to beginning age 72 so N = 7. 2. If they want to continue with a 5% targeted annual return on their RRSP/RRIF plans what asset mix will you recommend to achleve this objective. Please be specific with the type of bonds and/or equities you are recommending and why. (3 Marks) 3. If they don't convert their RRSPs to a RRIF at age 71, what other options do they have? (1) if they convert the RRSP to a RRIF by December 31 In the year they