Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fogey Corp. is conservatively managed. Outstanding debt is adjusted to maintain a constant ratio of debt to enterprise value of 10%. The beta of Fogey's

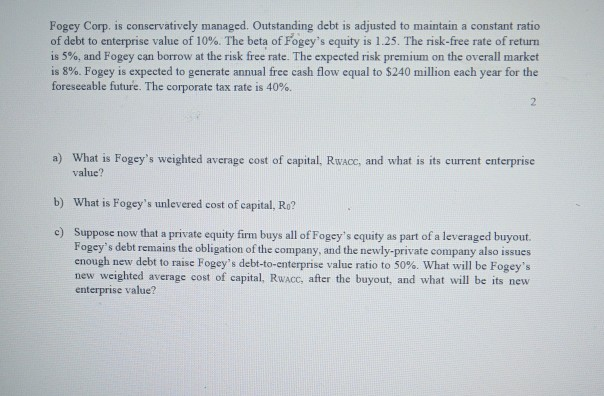

Fogey Corp. is conservatively managed. Outstanding debt is adjusted to maintain a constant ratio of debt to enterprise value of 10%. The beta of Fogey's equity is 1.25. The risk-free rate of return is 5%, and Fogey can borrow at the risk free rate. The expected risk premium on the overall market is 8%. Fogey is expected to generate annual free cash flow equal to $240 million each year for the foreseeable future. The corporate tax rate is 40%. a) What is Fogey's weighted average cost of capital, Rwaoc, and what is its current enterprise value? b) What is Fogey's unlevered cost of capital, Ro? c) Suppose now that a private equity firm buys all of Fogey's equity as part of a leveraged buyout. Fogey's debt remains the obligation of the company, and the newly-private company also issues enough new debt to raise Fogey's debt-to-enterprise value ratio to 50%. What will be Fogey's new weighted average cost of capital, Rwacc, after the buyout, and what will be its new enterprise value? Fogey Corp. is conservatively managed. Outstanding debt is adjusted to maintain a constant ratio of debt to enterprise value of 10%. The beta of Fogey's equity is 1.25. The risk-free rate of return is 5%, and Fogey can borrow at the risk free rate. The expected risk premium on the overall market is 8%. Fogey is expected to generate annual free cash flow equal to $240 million each year for the foreseeable future. The corporate tax rate is 40%. a) What is Fogey's weighted average cost of capital, Rwaoc, and what is its current enterprise value? b) What is Fogey's unlevered cost of capital, Ro? c) Suppose now that a private equity firm buys all of Fogey's equity as part of a leveraged buyout. Fogey's debt remains the obligation of the company, and the newly-private company also issues enough new debt to raise Fogey's debt-to-enterprise value ratio to 50%. What will be Fogey's new weighted average cost of capital, Rwacc, after the buyout, and what will be its new enterprise value

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started