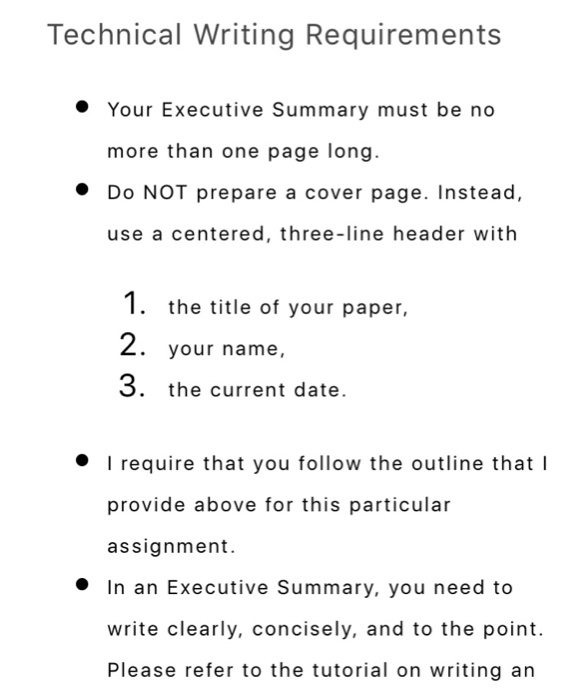

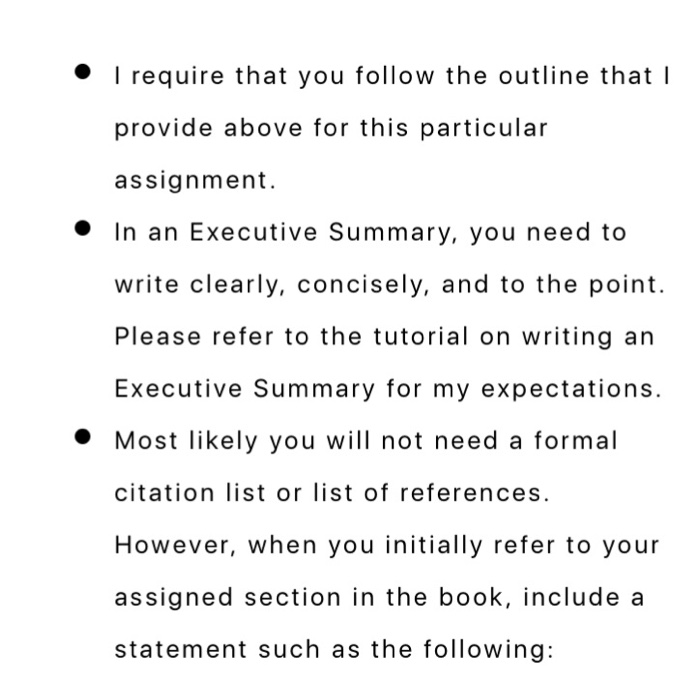

Follow instructions and read the 3 pages and provide an executive summary of 1 page with sources cited.

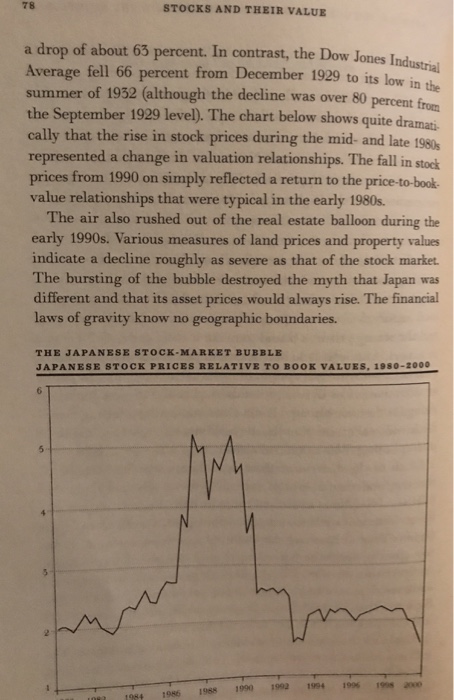

STOCKS AND THEIR VALUE 76 The Japanese Yen for Land and Stocks So far, I have covered only U.S. speculative bubbles. It is tant to note that we are not alone. Indeed, one of the largest apanese and busts of the late twentieth century involvedtheJap real estate and stock markets. From 1955 to 1990, the value of real estate increased more than 75 times. By 1990, the total va all Japanese property was estimated at nearly $20 trillion more than 20 percent of the entire world's wealth and about to the total value of the world's stock markets. America is twent and yet Japasis times bigger property in 1990 was appraised to be worth five times as American property. Theoretically, the Japanese could have bought all the property in America by selling off metropolitan Tokyo. Just selling the Imperial Palace and its grounds at their appraised value would have raised enough cash to buy all of California. much as all The stock market countered by rising like a helium balloo on a windless day. Stock prices inereased 100-fold from 1955 to 1990. At their peak, in December 1989, Japanese stocks had a total market value of about $4 trillion, almost 1.5 times the value of all U.S. equities and close to 45 percent of the world's equity-market capitalization. Firm-foundation investors were aghast at such figures. They read with dismay that Japanese stocks sold at more than 60 times earnings, almost 5 times book value, and more than 200 times dividends. In contrast, U.S stocks sold at about 15 times earnings, and London equities sold at 12 times earnings. The high prices of Japanese stocks were even more dramatic on a company by company comparison. The value of NTT Corporation, Japay telephone giant, which was privatized during the boom, the value of AT&T, IBM, Exxon, General Electric, and Ge Motors put together Supporters of the stock market had answers to all the objections that could be raised. Were price-earnings r stratosphere? "No," said the salespeople at Kabuto-cho (auns Wall Street). "Japanese earnings are understated relative earnings because depreciation charges are overstated a ratios 1 to US and earning STOCKS AND THEIR VALUE 76 The Japanese Yen for Land and Stocks So far, I have covered only U.S. speculative bubbles. It is tant to note that we are not alone. Indeed, one of the largest apanese and busts of the late twentieth century involvedtheJap real estate and stock markets. From 1955 to 1990, the value of real estate increased more than 75 times. By 1990, the total va all Japanese property was estimated at nearly $20 trillion more than 20 percent of the entire world's wealth and about to the total value of the world's stock markets. America is twent and yet Japasis times bigger property in 1990 was appraised to be worth five times as American property. Theoretically, the Japanese could have bought all the property in America by selling off metropolitan Tokyo. Just selling the Imperial Palace and its grounds at their appraised value would have raised enough cash to buy all of California. much as all The stock market countered by rising like a helium balloo on a windless day. Stock prices inereased 100-fold from 1955 to 1990. At their peak, in December 1989, Japanese stocks had a total market value of about $4 trillion, almost 1.5 times the value of all U.S. equities and close to 45 percent of the world's equity-market capitalization. Firm-foundation investors were aghast at such figures. They read with dismay that Japanese stocks sold at more than 60 times earnings, almost 5 times book value, and more than 200 times dividends. In contrast, U.S stocks sold at about 15 times earnings, and London equities sold at 12 times earnings. The high prices of Japanese stocks were even more dramatic on a company by company comparison. The value of NTT Corporation, Japay telephone giant, which was privatized during the boom, the value of AT&T, IBM, Exxon, General Electric, and Ge Motors put together Supporters of the stock market had answers to all the objections that could be raised. Were price-earnings r stratosphere? "No," said the salespeople at Kabuto-cho (auns Wall Street). "Japanese earnings are understated relative earnings because depreciation charges are overstated a ratios 1 to US and earning