Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Using the detailed formula for ICC and the following information, calculate the annual finished product inventory carrying cost for Apple iPads. (put in table,

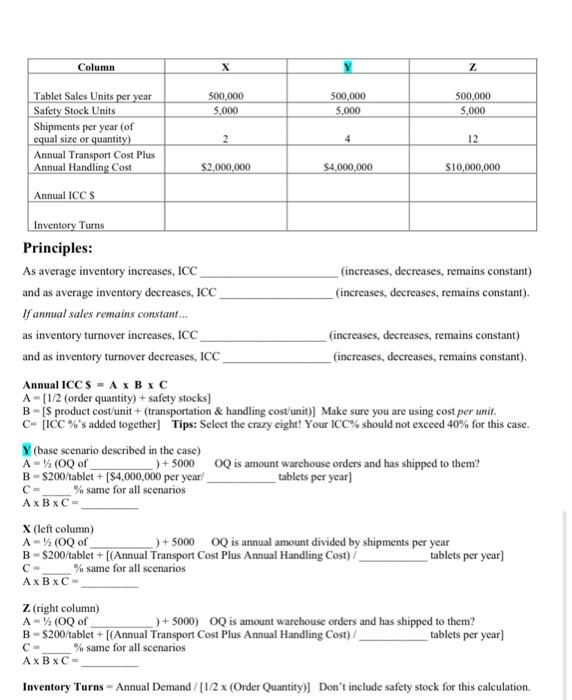

Using the detailed formula for ICC and the following information, calculate the annual finished product inventory carrying cost for Apple iPads. (put in table, column Y)) Apple stores the tablets that it produces in its only company field warchouse. The warehouse received one tablet shipment each quarter this year. Each shipment contained 125,000 tablets. The warehouse kept a safety stock of 5,000 tablets. Demand was 125,000 tablets per quarter from retailers. Apple sold the tablets to retailers for $750 each. Apple's variable manufacturing (i.e., production) costs were $200 per tablet. Apple's fixed manufacturing costs averaged $125 per tablet. The transport cost from plant to warehouse location was $3,500,000 per year. The handling costs to receive and store shipments for the year was $500,000. The costs just described for transportation and handling, when combined, equal S4,000,000. Cost data collected (as a percent of inventory value): Cost of capital borrowed to finance inventory (7%) Opportunity cost of capital (10%) Taking inventory (cycle counting) in warehouse (4%) Warehouse manager salary (12%) Annual warehouse depreciation (11%) State inventory tax (4%) Insurance on inventory (5%) Inventory relocation (2%) Inventory obsolescence cost (3%) Fire damage of warehouse inventory (2%) Inventory damage in warehouse (6%) Inventory theft in warchouse (4%) Calculation: The current inventory turnover is times per year. Place the annual ICC and inventory turnover calculated for questions 1 and 2 in the Y column of the table below. Using the data provided in question 1 and the table below, fill in the rest of the table by calculating annual ICC and inventory tumover for the other two inventory strategies. Show calculations. Note: the text in question I uses information for column Y on the next page, when you calculate columns X & Z, some of the information used to calculate Annual ICC and Inventory Turns may change, so be careful and read the table! Column Tablet Sales Units per year Safety Stock Units 500,000 500,000 5,000 500,000 5,000 5,000 Shipments per year (of equal size or quantity) Annual Transport Cost Plus Annual Handling Cost 12 $2,000,000 $4,000,000 S10,000,000 Annual ICC S Inventory Turns Principles: As average inventory increases, ICC (increases, decreases, remains constant) and as average inventory decreases, ICC _ (increases, decreases, remains constant). If annual sales remains constant. as inventory turnover increases, ICC (increases, decreases, remains constant) and as inventory turnover decreases, ICC (increases, decreases, remains constant). Annual ICC S = A x B x C A-[12 (order quantity) + safety stocks] B- is product cost'unit + (transportation & handling cost'unit)] Make sure you are using cost per unit. C- [IcC %'s added together] Tips: Select the crazy eight! Your ICC% should not exceed 40% for this case. Y (base scenario described in the case) A-% (OQ of B- $200/tablet + [S4,000,000 per year/ C= + 5000 0Q is amount warehouse orders and has shipped to them? tablets per year] % same for all scenarios Ax BxC- X (left column) A-% (OQ of B- S200/tablet + [(Annual Transport Cost Plus Annual Handling Cost)/ + 5000 OQ is annual amount divided by shipments per year tablets per year) % same for all scenarios C- AXBXC- Z (right column) A- % (OQ of B- $200/tablet + [(Annual Transport Cost Plus Annual Handling Cost)/ + 5000) OQ is amount warehouse orders and has shipped to them? tablets per year) % same for all scenarios AXBXC- Inventory Turns- Annual Demand /[1/2 x (Order Quantity)] Don't include safety stock for this calculation.

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

From the list of costs as of inventory Value the m...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started