Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tiffany is considering investing in one of two investment projects. She has two options: The first project is conducted by the Australian government, which

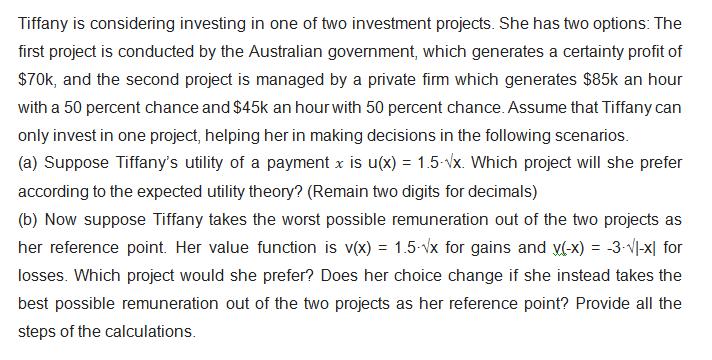

Tiffany is considering investing in one of two investment projects. She has two options: The first project is conducted by the Australian government, which generates a certainty profit of $70k, and the second project is managed by a private firm which generates $85k an hour with a 50 percent chance and $45k an hour with 50 percent chance. Assume that Tiffany can only invest in one project, helping her in making decisions in the following scenarios. (a) Suppose Tiffany's utility of a payment x is u(x) = 1.5-x. Which project will she prefer according to the expected utility theory? (Remain two digits for decimals) (b) Now suppose Tiffany takes the worst possible remuneration out of the two projects as her reference point. Her value function is v(x) = 1.5-x for gains and y(-x) = -3-|-x for losses. Which project would she prefer? Does her choice change if she instead takes the best possible remuneration out of the two projects as her reference point? Provide all the steps of the calculations.

Step by Step Solution

★★★★★

3.58 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

In this question part A project 1 UX15 sqrtx UX15 sq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started