Answered step by step

Verified Expert Solution

Question

1 Approved Answer

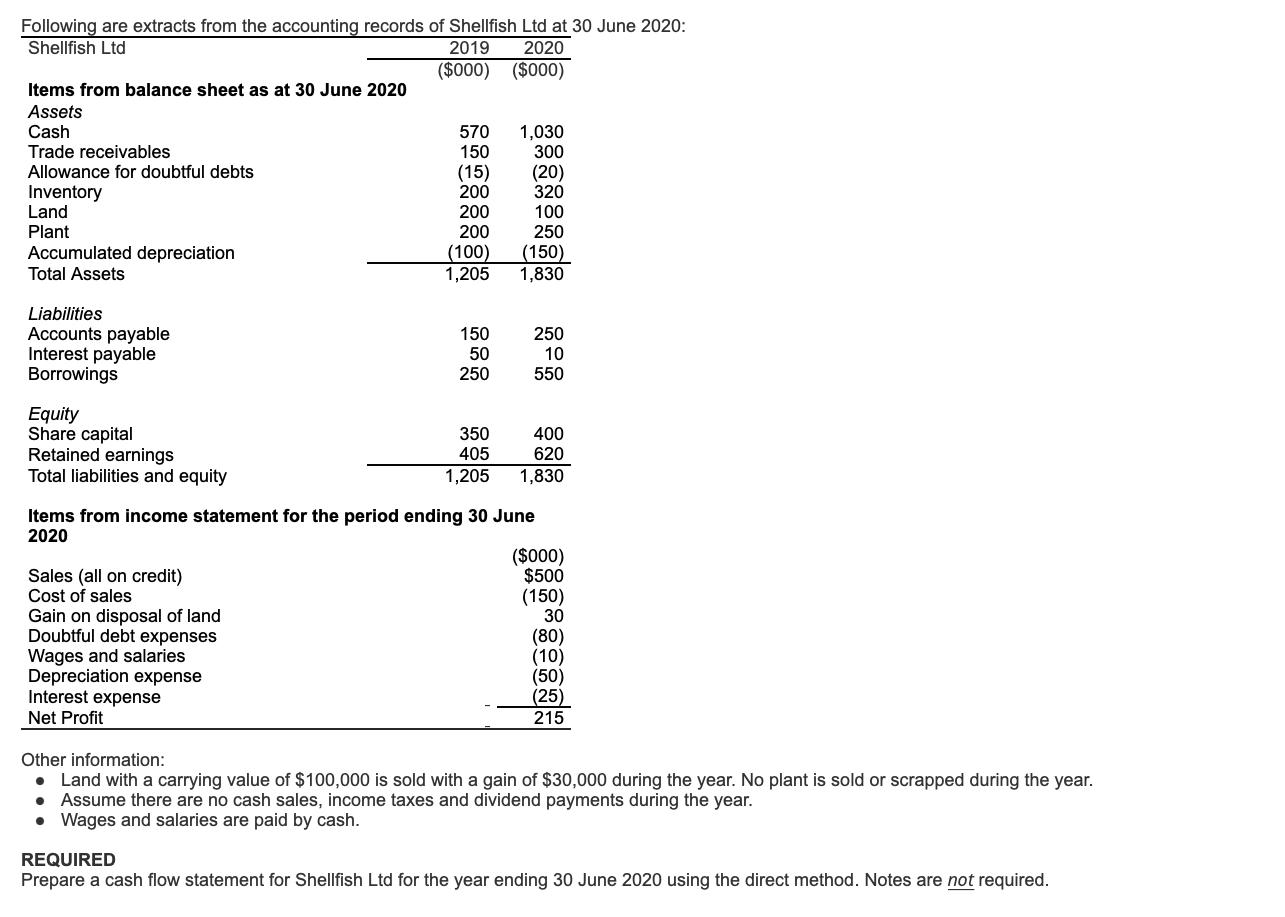

Following are extracts from the accounting records of Shellfish Ltd at 30 June 2020: Shellfish Ltd 2019 2020 ($000) ($000) Items from balance sheet

Following are extracts from the accounting records of Shellfish Ltd at 30 June 2020: Shellfish Ltd 2019 2020 ($000) ($000) Items from balance sheet as at 30 June 2020 Assets Cash Trade receivables Allowance for doubtful debts Inventory Land Plant Accumulated depreciation Total Assets Liabilities Accounts payable Interest payable Borrowings Equity Share capital Retained earnings Total liabilities and equity Sales (all on credit) Cost of sales 570 150 Gain on disposal of land Doubtful debt expenses Wages and salaries Depreciation expense Interest expense Net Profit (15) 200 200 200 (100) 1,205 150 50 250 350 405 1,205 1,030 300 (20) 320 100 250 (150) 1,830 250 10 550 Items from income statement for the period ending 30 June 2020 400 620 1,830 ($000) $500 (150) 30 (80) (10) (50) (25) 215 Other information: Land with a carrying value of $100,000 is sold with a gain of $30,000 during the year. No plant is sold or scrapped during the year. Assume there are no cash sales, income taxes and dividend payments during the year. Wages and salaries are paid by cash. REQUIRED Prepare a cash flow statement for Shellfish Ltd for the year ending 30 June 2020 using the direct method. Notes are not required.

Step by Step Solution

★★★★★

3.36 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Cash flow from operating Activities Cash Received fream Customer sales SHELLFISH LTD Statement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started