Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Admiralty Co. has operated a fleet of cruise ships that travel to a variety of destinations, predominately the Caribbean and South East Asia. In

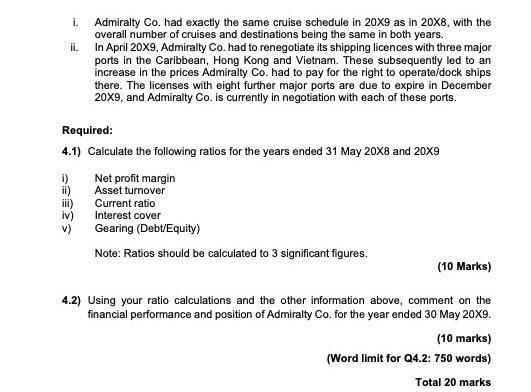

Admiralty Co. has operated a fleet of cruise ships that travel to a variety of destinations, predominately the Caribbean and South East Asia. In its early voyages, Admiralty Co. experienced strong growth, but in recent periods, stakeholders have criticised the company for a lack of investment in its non-current assets. Admiralty's financial statement extracts are presented below: Statement of financial position as at 31 May: Non-current assets Property, plant and equipment Intangible assets (note ii) Total non-current assets Current assets Inventories Trade receivables Cash Total current assets Total assets Equity & Liabilities Equity shares Retained earnings Revaluation surplus Total equity Non-current liabilities 6% loan notes Current liabilities Trade payables 6% loan notes Total current liabilities 20X9 '000 Revenue Profit from operations Finance costs Cash generated from operations 317,000 20,000 337,000 580 6,100 9,300 15,980 352,980 3,000 44,100 145,000 192,100 130,960 20X8 '000 20X9 '000 154,000 12,300 (9,200) 18,480 174,000 16,000 190,000 490 6,300 22,100 28,890 218,890 3,000 41,800 0 44,800 10,480 4,250 19, 19,440 29,920 23,690 Total equity and liabilities 352,980 218,890 Other extracts from Admiralty Co's financial statements for the years ended 31 May: The following information is also relevant: 150,400 20X8 '000 159,000 18,600 (10,200) 24,310 i. ii. In April 20X9, Admiralty Co. had to renegotiate its shipping licences with three major ports in the Caribbean, Hong Kong and Vietnam. These subsequently led to an increase in the prices Admiralty Co. had to pay for the right to operate/dock ships there. The licenses with eight further major ports are due to expire in December 20X9, and Admiralty Co. is currently in negotiation with each of these ports. ii) Admiralty Co. had exactly the same cruise schedule in 20X9 as in 20X8, with the overall number of cruises and destinations being the same in both years. Required: 4.1) Calculate the following ratios for the years ended 31 May 20X8 and 20X9 Net profit margin Asset turnover S Current ratio Interest cover Gearing (Debt/Equity) Note: Ratios should be calculated to 3 significant figures. (10 Marks) 4.2) Using your ratio calculations and the other information above, comment on the financial performance and position of Admiralty Co. for the year ended 30 May 20X9. (10 marks) (Word limit for Q4.2: 750 words) Total 20 marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer 41 Ratios Particulars i Net Profit Margin Revenue Profit from Operatio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started