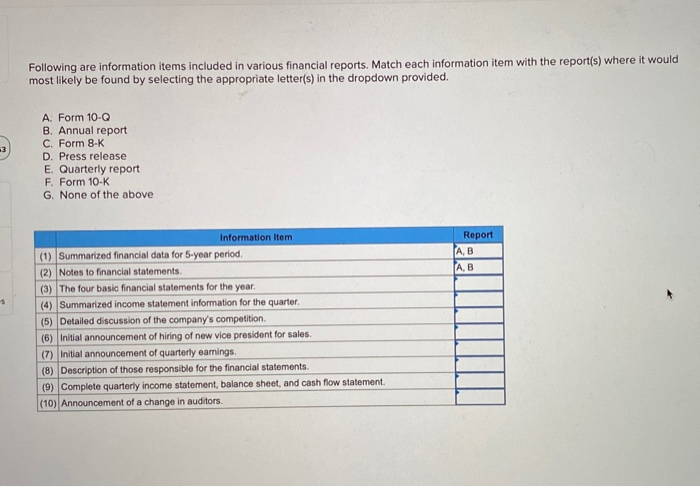

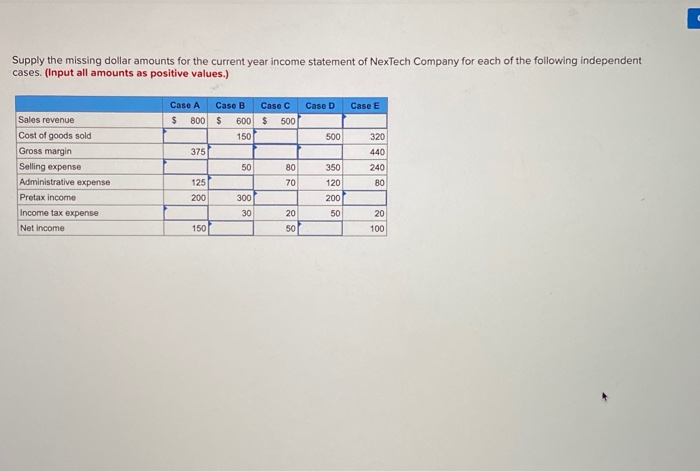

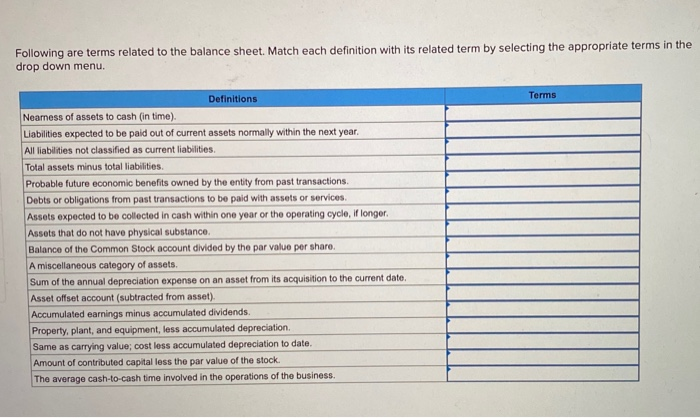

Following are information items included in various financial reports. Match each information item with the report(s) where it would most likely be found by selecting the appropriate letter(s) in the dropdown provided. A. Form 10-Q B. Annual report C. Form 8-K D. Press release E. Quarterly report F. Form 10-K G. None of the above 3 Report Information Item A, B A, B (1) Summarized financial data for 5-year period (2) Notes to financial statements. (3) The four basic financial statements for the year (4) Summarized income statement information for the quarter (5) Detailed discussion of the company's competition. (6) Initial announcement of hiring of new vice president for sales (7) Initial announcement of quarterly eamings. (8) Description of those responsible for the financial statements. (9) Complete quarterly income statement, balance sheet, and cash flow statement. (10) Announcement of a change in auditors. Supply the missing dollar amounts for the current year income statement of NexTech Company for each of the following independent cases. (Input all amounts as positive values.) Case A Case B Case C Case D Case E Sales revenue $ 800 $ 600 500 Cost of goods sold 500 150 320 Gross margin 375 440 Selling expense 80 350 240 Administrative expense 125 70 120 80 Pretax income 200 300 200 Income tax expense 30 20 50 20 Net income 150 50 100 Following are terms related to the balance sheet. Match each definition with its related term by selecting the appropriate terms in the drop down menu. Terms Definitions Neaness of assets to cash (in time). Liabilities expected to be paid out of current assets normally within the next year. All liabilities not classified as current liabilities. Total assets minus total liabilities Probable future economic benefits owned by the entity from past transactions. Debts or obligations from past transactions to be paid with assets or services Assets expected to be collected in cash within one year or the operating cycle, if longer Assets that do not have physical substance. Balance of the Common Stock account divided by the par value per share. A miscellaneous category of assets. Sum of the annual depreciation expense on an asset from its acquisition to the current date. Asset offset account (subtracted from asset). Accumulated earnings minus accumulated dividends. Property, plant, and equipment, less accumulated depreciation. Same as carrying value; cost less accumulated depreciation to date. Amount of contributed capital less the par value of the stock The average cash-to-cash time involved in the operations of the business. Following are information items included in various financial reports. Match each information item with the report(s) where it would most likely be found by selecting the appropriate letter(s) in the dropdown provided. A. Form 10-Q B. Annual report C. Form 8-K D. Press release E. Quarterly report F. Form 10-K G. None of the above 3 Report Information Item A, B A, B (1) Summarized financial data for 5-year period (2) Notes to financial statements. (3) The four basic financial statements for the year (4) Summarized income statement information for the quarter (5) Detailed discussion of the company's competition. (6) Initial announcement of hiring of new vice president for sales (7) Initial announcement of quarterly eamings. (8) Description of those responsible for the financial statements. (9) Complete quarterly income statement, balance sheet, and cash flow statement. (10) Announcement of a change in auditors. Supply the missing dollar amounts for the current year income statement of NexTech Company for each of the following independent cases. (Input all amounts as positive values.) Case A Case B Case C Case D Case E Sales revenue $ 800 $ 600 500 Cost of goods sold 500 150 320 Gross margin 375 440 Selling expense 80 350 240 Administrative expense 125 70 120 80 Pretax income 200 300 200 Income tax expense 30 20 50 20 Net income 150 50 100 Following are terms related to the balance sheet. Match each definition with its related term by selecting the appropriate terms in the drop down menu. Terms Definitions Neaness of assets to cash (in time). Liabilities expected to be paid out of current assets normally within the next year. All liabilities not classified as current liabilities. Total assets minus total liabilities Probable future economic benefits owned by the entity from past transactions. Debts or obligations from past transactions to be paid with assets or services Assets expected to be collected in cash within one year or the operating cycle, if longer Assets that do not have physical substance. Balance of the Common Stock account divided by the par value per share. A miscellaneous category of assets. Sum of the annual depreciation expense on an asset from its acquisition to the current date. Asset offset account (subtracted from asset). Accumulated earnings minus accumulated dividends. Property, plant, and equipment, less accumulated depreciation. Same as carrying value; cost less accumulated depreciation to date. Amount of contributed capital less the par value of the stock The average cash-to-cash time involved in the operations of the business