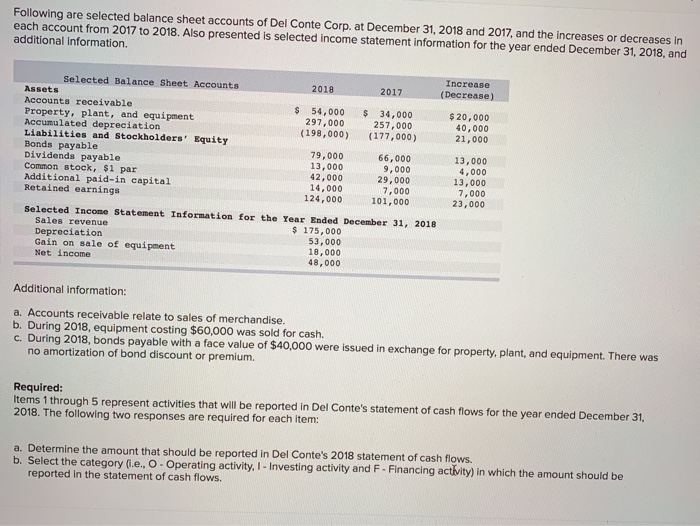

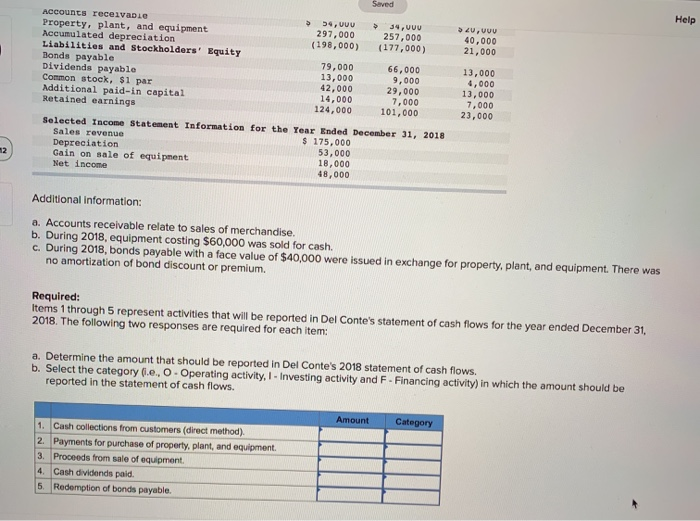

Following are selected balance sheet accounts of Del Conte Corp. at December 31, 2018 and 2017, and the increases or decreases in each account from 2017 to 2018. Also presented is selected income statement information for the year ended December 31, 2018, and additional Information. 2018 Selected Balance Sheet Accounts Increase Assets 2017 (Decrease) Accounts receivable $ 54,000 $ Property, plant, and equipment 34,000 $ 20,000 Accumulated depreciation 297,000 257,000 40,000 Liabilities and Stockholders' Equity (198,000) (177,000) 21,000 Bonds payable Dividends payable 79,000 66,000 13,000 13,000 9,000 Common stock, $1 par 4,000 42,000 Additional paid-in capital 29,000 13,000 14,000 7,000 Retained earnings 7,000 124,000 101,000 23,000 Selected Income Statement Information for the Year Ended December 31, 2018 Sales revenue $ 175,000 Depreciation 53,000 Gain on sale of equipment 18,000 Net income 48,000 Additional information: a. Accounts receivable relate to sales of merchandise. b. During 2018, equipment costing $60,000 was sold for cash. c. During 2018, bonds payable with a face value of $40,000 were issued in exchange for property, plant, and equipment. There was no amortization of bond discount or premium. Required: Items 1 through 5 represent activities that will be reported in Del Conte's statement of cash flows for the year ended December 31, 2018. The following two responses are required for each item: a. Determine the amount that should be reported in Del Conte's 2018 statement of cash flows. b. Select the category (i.e., O - Operating activity, I - Investing activity and F - Financing activity) in which the amount should be reported in the statement of cash flows. Help 20, VUU 40,000 21,000 Seved Accounts receivable 54,UU > 34,VUU Property, plant, and equipment 297,000 257,000 Accumulated depreciation Liabilities and Stockholders' Equity (198,000) (177,000) Bonds payable 79,000 Dividends payable 66,000 13,000 9,000 Common stock, $1 par 42,000 29,000 Additional paid-in capital 14,000 7,000 Retained earnings 124,000 101,000 Selected Income Statement Information for the Year Ended December 31, 2018 Sales revenue $ 175,000 Depreciation 53,000 Gain on sale of equipment 18,000 Net income 48,000 13,000 4,000 13,000 7,000 23,000 12 Additional Information: a. Accounts receivable relate to sales of merchandise. b. During 2018, equipment costing $60,000 was sold for cash. c. During 2018, bonds payable with a face value of $40,000 were issued in exchange for property, plant, and equipment. There was no amortization of bond discount or premium. Required: Items 1 through 5 represent activities that will be reported in Del Conte's statement of cash flows for the year ended December 31, 2018. The following two responses are required for each item: a. Determine the amount that should be reported in Del Conte's 2018 statement of cash flows. b. Select the category (e. oOperating activity, 1 - Investing activity and F - Financing activity) in which the amount should be reported in the statement of cash flows. Amount Category 1. Cash collections from customers (direct method) 2. Payments for purchase of property, plant, and equipment. 3. Proceeds from sale of equipment 4. Cash dividends paid. 5 Redemption of bonds payable