Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are selected income statement and balance sheet data from two retailers, ANF (clothing retailer in the high-end market) and TJX (clothing retailer in

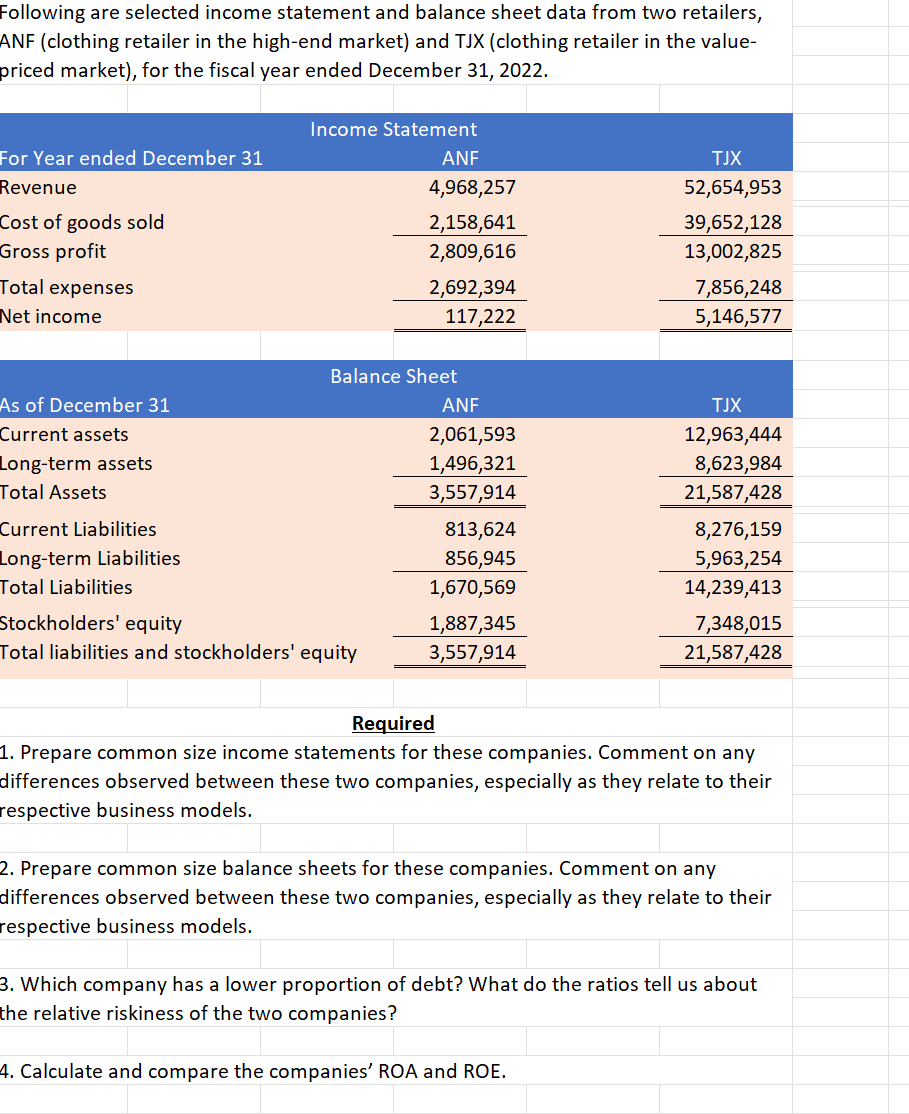

Following are selected income statement and balance sheet data from two retailers, ANF (clothing retailer in the high-end market) and TJX (clothing retailer in the value- priced market), for the fiscal year ended December 31, 2022. For Year ended December 31 Revenue Cost of goods sold Gross profit Total expenses Net income Income Statement ANF TJX 4,968,257 52,654,953 2,158,641 39,652,128 2,809,616 13,002,825 2,692,394 117,222 7,856,248 5,146,577 Balance Sheet As of December 31 ANF TJX Current assets 2,061,593 12,963,444 Long-term assets 1,496,321 8,623,984 Total Assets Current Liabilities 3,557,914 21,587,428 813,624 8,276,159 Long-term Liabilities 856,945 5,963,254 Total Liabilities 1,670,569 14,239,413 Stockholders' equity 1,887,345 7,348,015 Total liabilities and stockholders' equity 3,557,914 21,587,428 Required 1. Prepare common size income statements for these companies. Comment on any differences observed between these two companies, especially as they relate to their respective business models. 2. Prepare common size balance sheets for these companies. Comment on any differences observed between these two companies, especially as they relate to their respective business models. 3. Which company has a lower proportion of debt? What do the ratios tell us about the relative riskiness of the two companies? 4. Calculate and compare the companies' ROA and ROE.

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 Common size income statements ANF Revenue 100 Cost of goods sold 4335 Gross profit 5665 Expenses 5...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started