Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are the adjusted current funds trial balances of Community Association for Children With Disabilities, a voluntary health and welfare organization, on June 30, 20X4:

Following are the adjusted current funds trial balances of Community Association for Children With Disabilities, a voluntary health and welfare organization, on June 30, 20X4:

| COMMUNITY ASSOCIATION FOR CHILDREN WITH DISABILITIES | |||||||||||||||||||

| Adjusted Current Funds Trial Balances | |||||||||||||||||||

| June 30, 20X4 | |||||||||||||||||||

| Without Donor Restrictions | With Donor Restrictions | ||||||||||||||||||

| Debit | Credit | Debit | Credit | ||||||||||||||||

| Cash | $ | 41,600 | $ | 9,700 | |||||||||||||||

| Bequest Receivable | 5,200 | ||||||||||||||||||

| Pledges Receivable | 13,400 | ||||||||||||||||||

| Accrued Interest Receivable | 1,800 | ||||||||||||||||||

| Investments (at market) | 101,100 | ||||||||||||||||||

| Accounts Payable & Accrued Expenses | $ | 50,500 | $ | 2,200 | |||||||||||||||

| Deferred Revenue | 2,700 | ||||||||||||||||||

| Allowance for Uncollectible Pledges | 4,000 | ||||||||||||||||||

| Fund Balances, July 1, 20X3: | |||||||||||||||||||

| Designated | 13,500 | ||||||||||||||||||

| Undesignated | 27,800 | ||||||||||||||||||

| With Donor Restrictions | 23,600 | ||||||||||||||||||

| Transfers of Expired Endowment Fund Principal | 20,800 | 20,800 | |||||||||||||||||

| Contributions | 301,600 | 18,500 | |||||||||||||||||

| Membership Dues | 26,200 | ||||||||||||||||||

| Program Service Fees | 30,500 | ||||||||||||||||||

| Investment Income | 11,300 | ||||||||||||||||||

| Deaf Childrens Program Expenses | 120,700 | ||||||||||||||||||

| Blind Childrens Program Expenses | 150,500 | ||||||||||||||||||

| Management and General Services | 46,200 | 6,000 | |||||||||||||||||

| Fund-raising Services | 9,600 | 2,600 | |||||||||||||||||

| Provision for Uncollectible Pledges | 4,000 | ||||||||||||||||||

| Total | $ | 488,900 | $ | 488,900 | $ | 44,300 | $ | 44,300 | |||||||||||

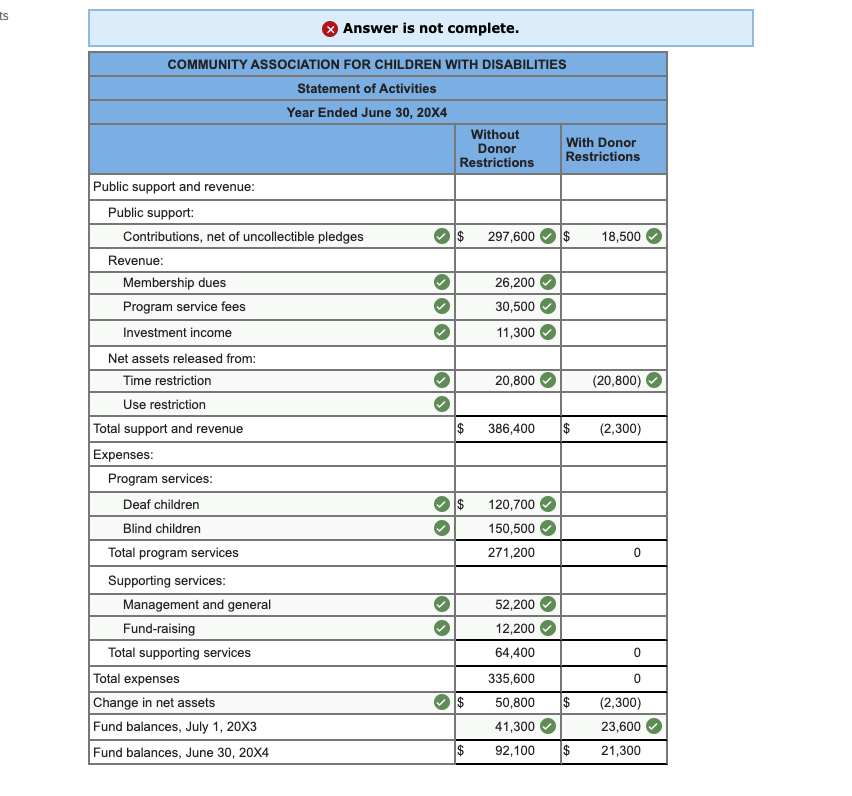

a. Prepare a statement of activities for the year ended June 30, 20X4. (Amounts to be deducted should be indicated by a minus sign.)

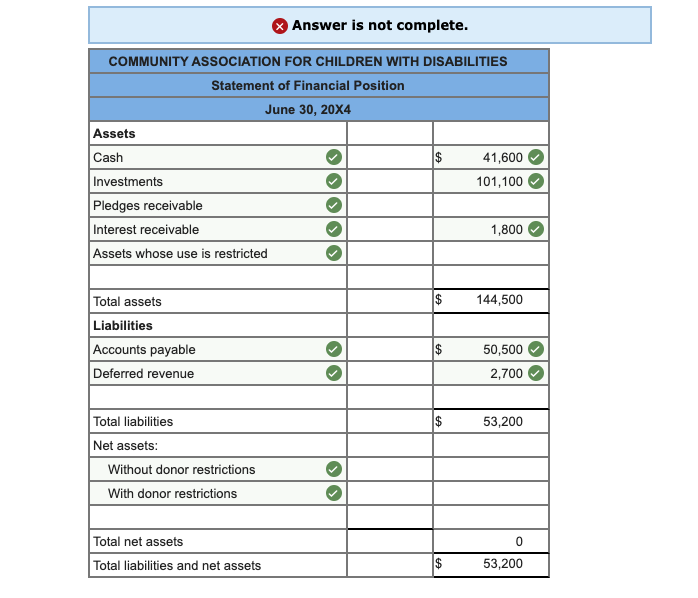

b. Prepare a statement of financial position as of June 30, 20X4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started