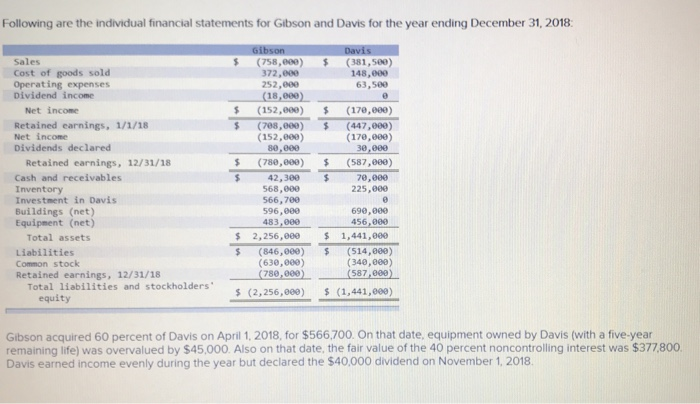

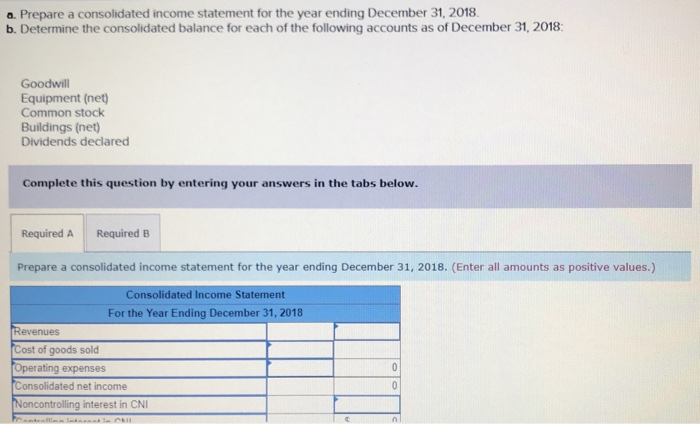

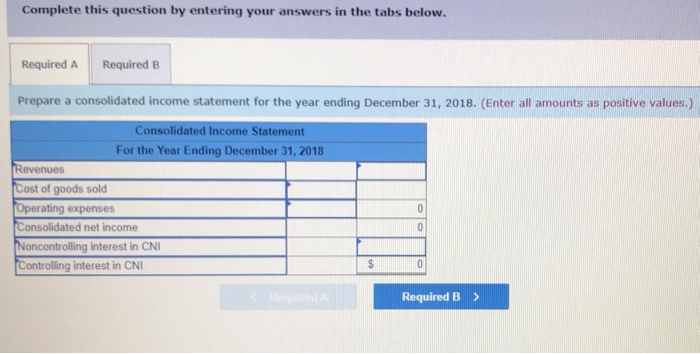

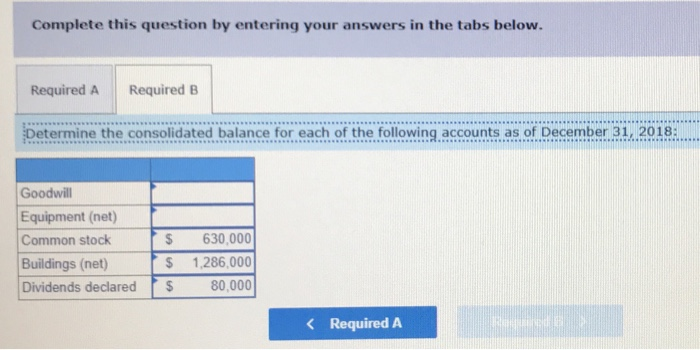

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2018 Sales (758,e00) (381,58e) 148,000 63,500 Cost of goods sold Operating expenses Dividend income 372,000 252,800 18,800) (152,000) (170,000) Net income Retained earnings, 1/1/18 Net income s (708,000) (447,000) (170,000) 30,000 (152,800) Dividends declared 80,009 Retained earnings, 12/31/18 5 (780,000) (587,080) Cash and receivables Inventory Investment in Davis Buildings (net) Equipment (net) $ 42,300 568,000 566, 780 596,088 483,080 70,000 225,880 690,800 456,899 2,256,000 1,441,800 (846,000)(514,000) (630,080) Total assets Liabilities Common stock (340,800) 587,800 Retained earnings, 12/31/18 Total liabilities and stockholders equity (2,256,000 ) (1,441,600) Gibson acquired 60 percent of Davis on April 1, 2018, for $566,700. On that date, equipment owned by Davis (with a five-year remaining life) was overvalued by $45,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $377.800. Davis earned income evenly during the year but declared the $40,000 dividend on November 1, 2018 a. Prepare a consolidated income statement for the year ending December 31, 2018 b. Determine the consolidated balance for each of the following accounts as of December 31, 2018 Goodwil Equipment (net) Common stock Buildings (net) Dividends declared Complete this question by entering your answers in the tabs below. Required A Required B Prepare a consolidated income statement for the year ending December 31, 2018. (Enter all amounts as positive values.) Consolidated Income Statement For the Year Ending December 31, 2018 Revenues ost of goods sold perating expenses onsolidated net income oncontrolling interest in CNI Complete this question by entering your answers in the tabs below. Required A Required B Prepare a consolidated income statement for the year ending December 31, 2018. (Enter all amounts as positive values.) Consolidated Income Statement For the Year Ending December 31, 2018 evenues Cost of goods sold Operating expenses Consolidated net income Noncontrolling interest in CNI Required B > Complete this question by entering your answers in the tabs below. Required A Required B Determine the consolidated balance for each of the following accounts as of December 31 2018: Goodwill Equipment (net) S 630,000 Common stock S 1,286,000 Buildings (net) Dividends declared 80,000 Required A