Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2021: Gibson Davis Sales $ (600,000 ) $ (300,000

Following are the individual financial statements for Gibson and Davis for the year ending December 31, 2021:

| Gibson | Davis | ||||||

| Sales | $ | (600,000 | ) | $ | (300,000 | ) | |

| Cost of goods sold | 300,000 | 140,000 | |||||

| Operating expenses | 174,000 | 60,000 | |||||

| Dividend income | (24,000 | ) | 0 | ||||

| Net income | $ | (150,000 | ) | $ | (100,000 | ) | |

| Retained earnings, 1/1/21 | $ | (700,000 | ) | $ | (400,000 | ) | |

| Net income | (150,000 | ) | (100,000 | ) | |||

| Dividends declared | 80,000 | 40,000 | |||||

| Retained earnings, 12/31/21 | $ | (770,000 | ) | $ | (460,000 | ) | |

| Cash and receivables | $ | 248,000 | $ | 100,000 | |||

| Inventory | 500,000 | 190,000 | |||||

| Investment in Davis | 528,000 | 0 | |||||

| Buildings (net) | 524,000 | 600,000 | |||||

| Equipment (net) | 400,000 | 400,000 | |||||

| Total assets | $ | 2,200,000 | $ | 1,290,000 | |||

| Liabilities | $ | (800,000 | ) | $ | (490,000 | ) | |

| Common stock | (630,000 | ) | (340,000 | ) | |||

| Retained earnings, 12/31/21 | (770,000 | ) | (460,000 | ) | |||

| Total liabilities and stockholders' equity | $ | (2,200,000 | ) | $ | (1,290,000 | ) | |

Gibson acquired 60 percent of Davis on April 1, 2021, for $528,000. On that date, equipment owned by Davis (with a five-year remaining life) was overvalued by $30,000. Also on that date, the fair value of the 40 percent noncontrolling interest was $352,000. Davis earned income evenly during the year but declared the $40,000 dividend on November 1, 2021.

What did I do wrong? Can you tell me the correct #?

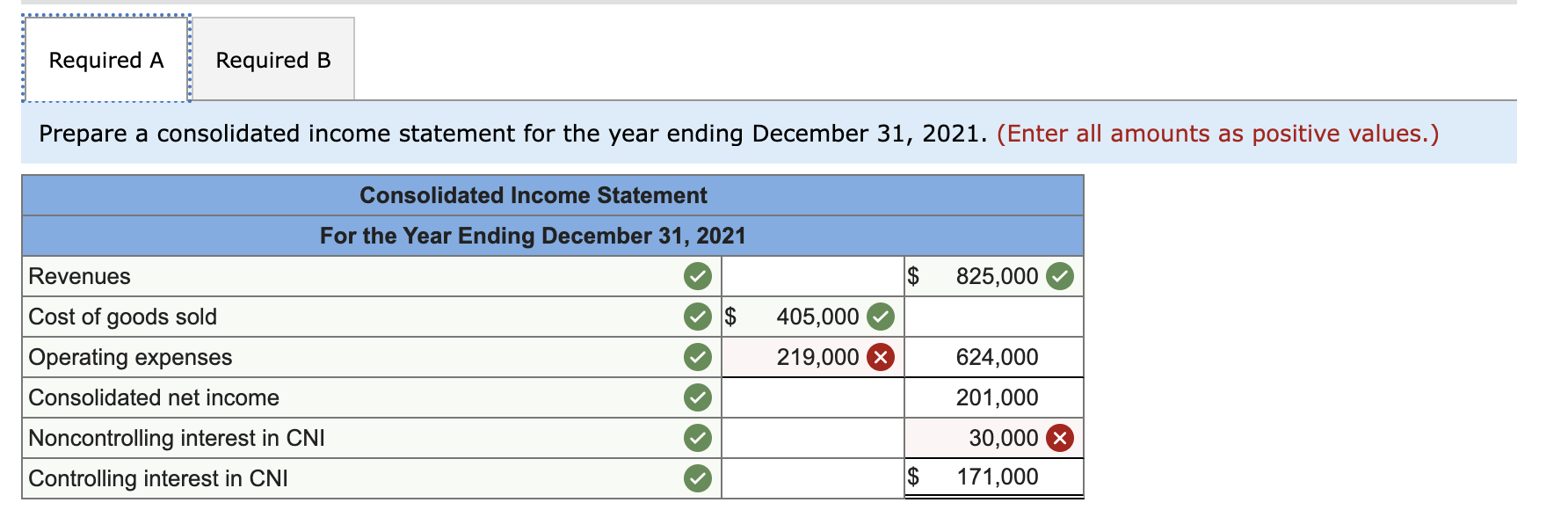

Required A Required B Prepare a consolidated income statement for the year ending December 31, 2021. (Enter all amounts as positive values.) Consolidated Income Statement For the Year Ending December 31, 2021 \begin{tabular}{|l|c|c|c|} \hline Revenues & & & $25,000 \\ \hline Cost of goods sold & & $405,000 & \\ \hline Operating expenses & & 219,000 & 624,000 \\ \hline Consolidated net income & & & 201,000 \\ \hline Noncontrolling interest in CNI & & & 30,000 \\ \hline Controlling interest in CNI & & & $171,000 \\ \hline \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the corrected consolidated income statement for Gibson and Davis for the year ending Dece...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started