Answered step by step

Verified Expert Solution

Question

1 Approved Answer

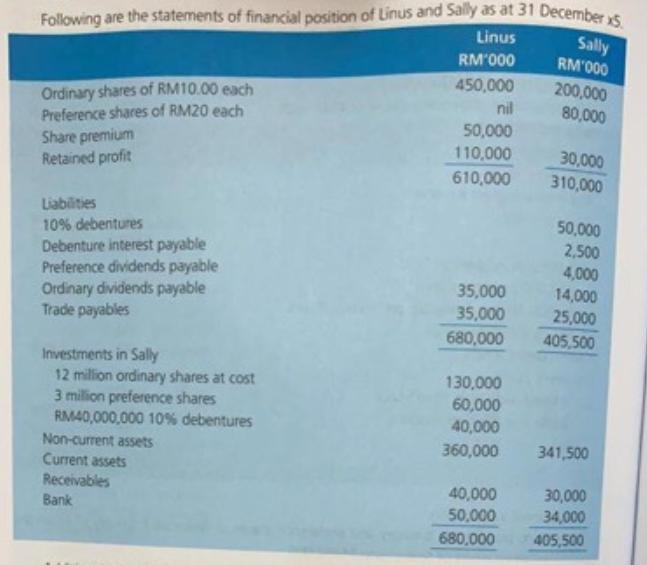

Following are the statements of financial position of Linus and Sally as at 31 December 5. Linus RM'000 450,000 nil 50,000 110,000 610,000 Ordinary

Following are the statements of financial position of Linus and Sally as at 31 December 5. Linus RM'000 450,000 nil 50,000 110,000 610,000 Ordinary shares of RM10.00 each Preference shares of RM20 each Share premium Retained profit Liabilities 10% debentures Debenture interest payable Preference dividends payable Ordinary dividends payable Trade payables Investments in Sally 12 million ordinary shares at cost 3 million preference shares RM40,000,000 10% debentures Non-current assets Current assets Receivables Bank 35,000 35,000 680,000 130,000 60,000 40,000 360,000 40,000 50,000 680,000 Sally RM'000 200,000 80,000 30,000 310,000 50,000 2,500 4,000 14,000 25,000 405,500 341,500 30,000 34,000 405,500 Additional information: (a) When Linus acquired the investments in Sally, the retained profit of Sally had a credit balance of RM10,000,000. (b) Sally has provided for the second half-year's debenture interest and final ordinary and preference dividends. However, Linus has not recognised its share of debenture interest and dividends from Sally (c) The receivables of Linus include an amount of RM10,000,000 due from Sally. However on 30 December x5, Sally had remitted RM2,000,000 which was received by Linus on 2 January x6. Required: Prepare the consolidated statement of financial position as at 31 December x5.

Step by Step Solution

★★★★★

3.42 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated statement of financial Position As at 31st December s Equity 45000000 ordinery share...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started