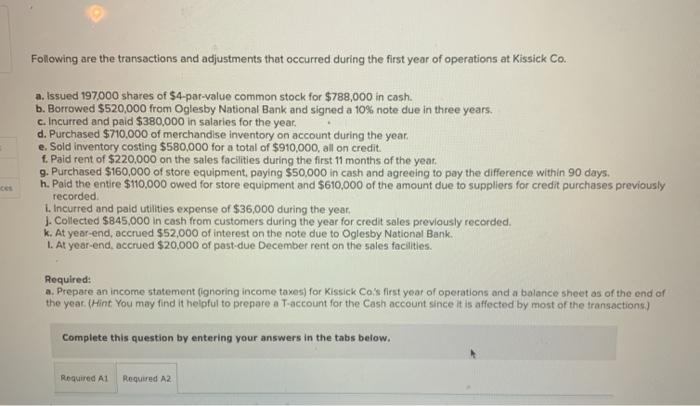

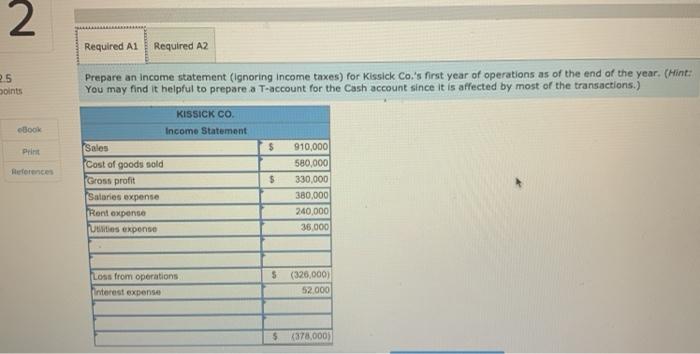

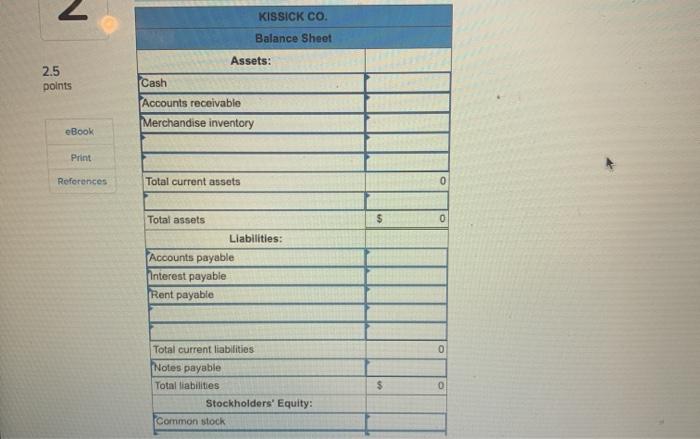

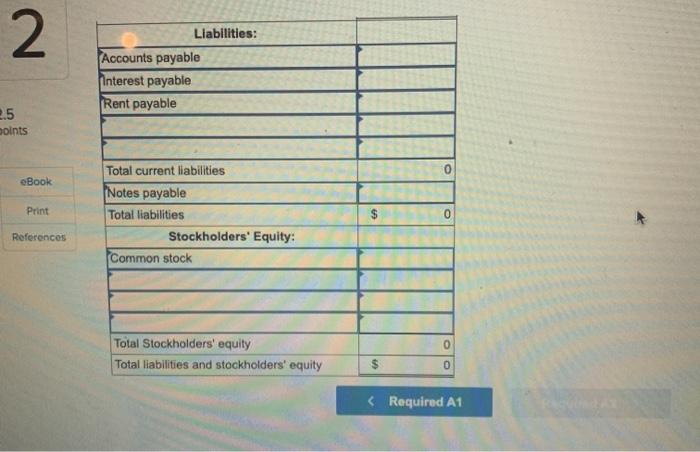

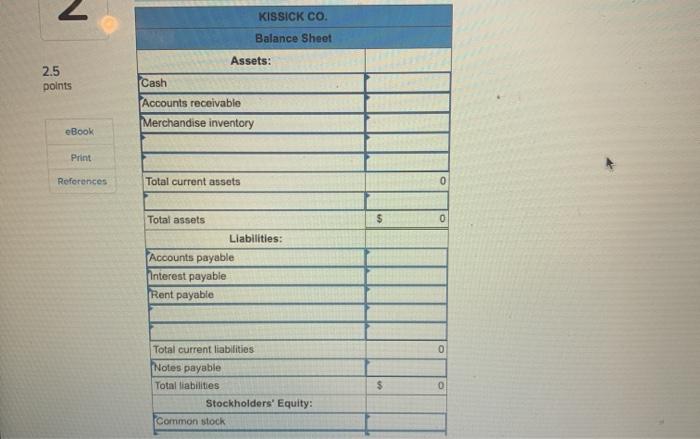

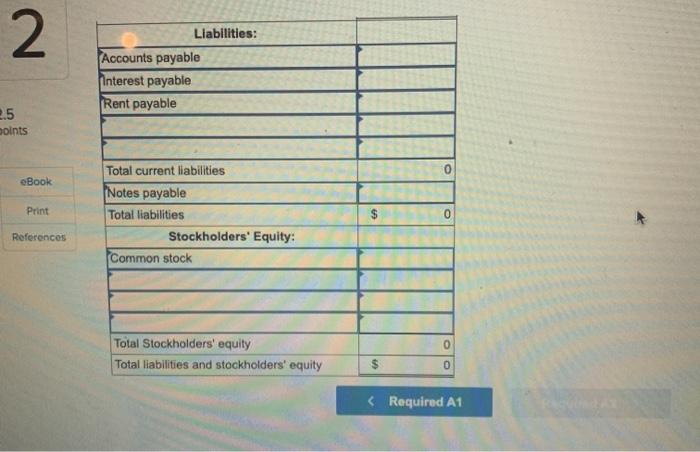

Following are the transactions and adjustments that occurred during the first year of operations at Kissick Co. a. Issued 197,000 shares of $4-par-value common stock for $788,000 in cash. b. Borrowed $520,000 from Oglesby National Bank and signed a 10% note due in three years. c. Incurred and paid $380,000 in salaries for the year. d. Purchased $710,000 of merchandise inventory on account during the year e. Sold inventory costing $580,000 for a total of $910,000, all on credit. f. Paid rent of $220,000 on the sales facilities during the first 11 months of the year, 9. Purchased $160,000 of store equipment, paying $50,000 in cash and agreeing to pay the difference within 90 days. h. Pald the entire $110,000 owed for store equipment and $610,000 of the amount due to suppliers for credit purchases previously recorded 1. Incurred and paid utilities expense of $36,000 during the year, J. Collected $845,000 in cash from customers during the year for credit sales previously recorded k. At year-end, acerued 552,000 of interest on the note due to Oglesby National Bank. 1. At year-end, accrued $20,000 of past-due December rent on the sales facilities Required: a. Prepare an income statement (ignoring income taxes) for Kissick Co's first year of operations and a balance sheet os of the end of the year. (Hint You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions) Complete this question by entering your answers in the tabs below. Required A1 Required A2 2 Required A1 Required A2 25 Doints Prepare an income statement (ignoring income taxes) for Kissick Co.'s first year of operations as of the end of the year. (Hint: You may find it helpful to prepare a T-account for the Cash account since it is affected by most of the transactions.) Book $ Print KISSICK CO. Income Statement Sales Cost of goods sold Gross profit Salaries expense Rent expense Us expenso 910,000 580,000 330.000 References $ 380,000 240,000 36,000 Lons from operations interest expense $ (326,000) 52.000 5 (378,000) KISSICK CO. Balance Sheet Assets: 2.5 points Cash Accounts receivable Merchandise inventory eBook Print References Total current assets 0 $ 0 Total assets Liabilities: Accounts payable Interest payable Rent payable 0 Total current liabilities Notes payable Total liabilities Stockholders' Equity: Common stock $ 0 2 Liabilities: Accounts payable Interest payable Rent payable 2.5 points 0 eBook Print Total current liabilities Notes payable Total liabilities Stockholders' Equity: Common stock $ 0 References 0 Total Stockholders' equity Total liabilities and stockholders' equity $ 0