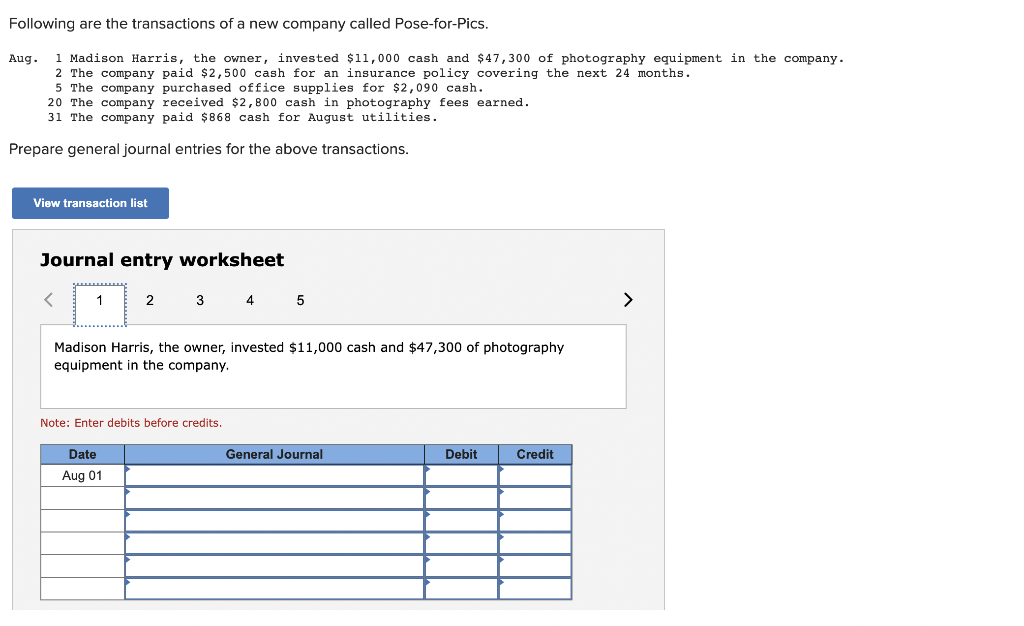

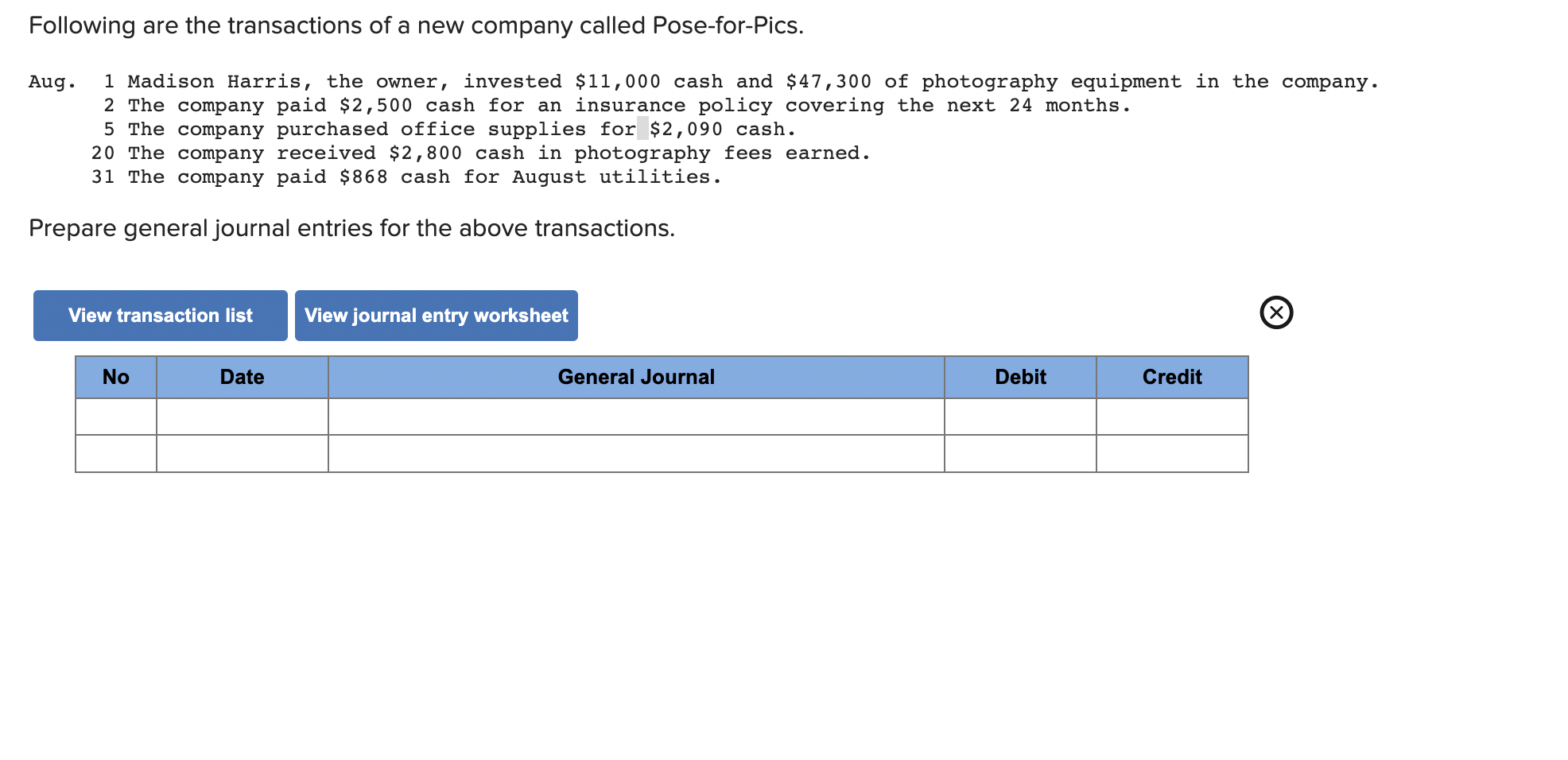

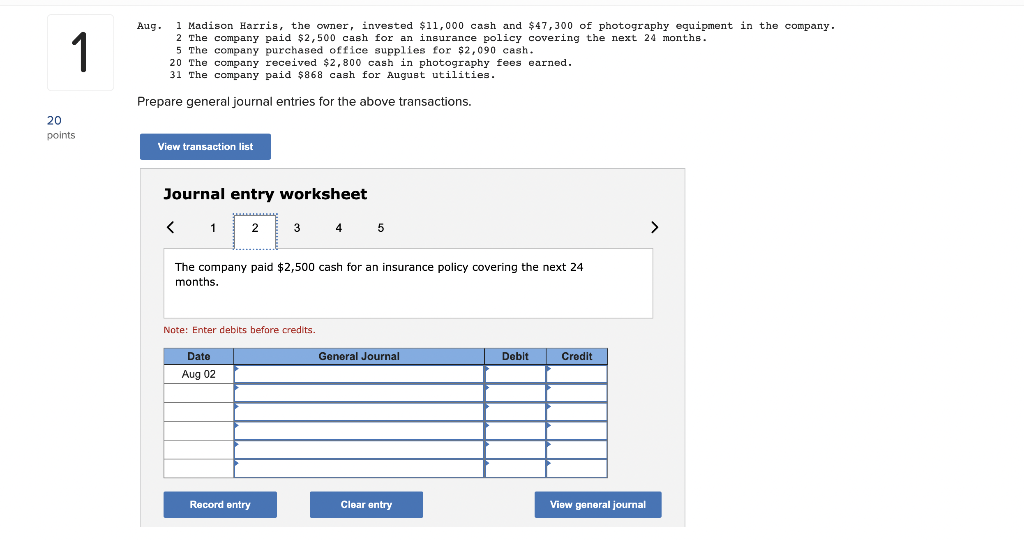

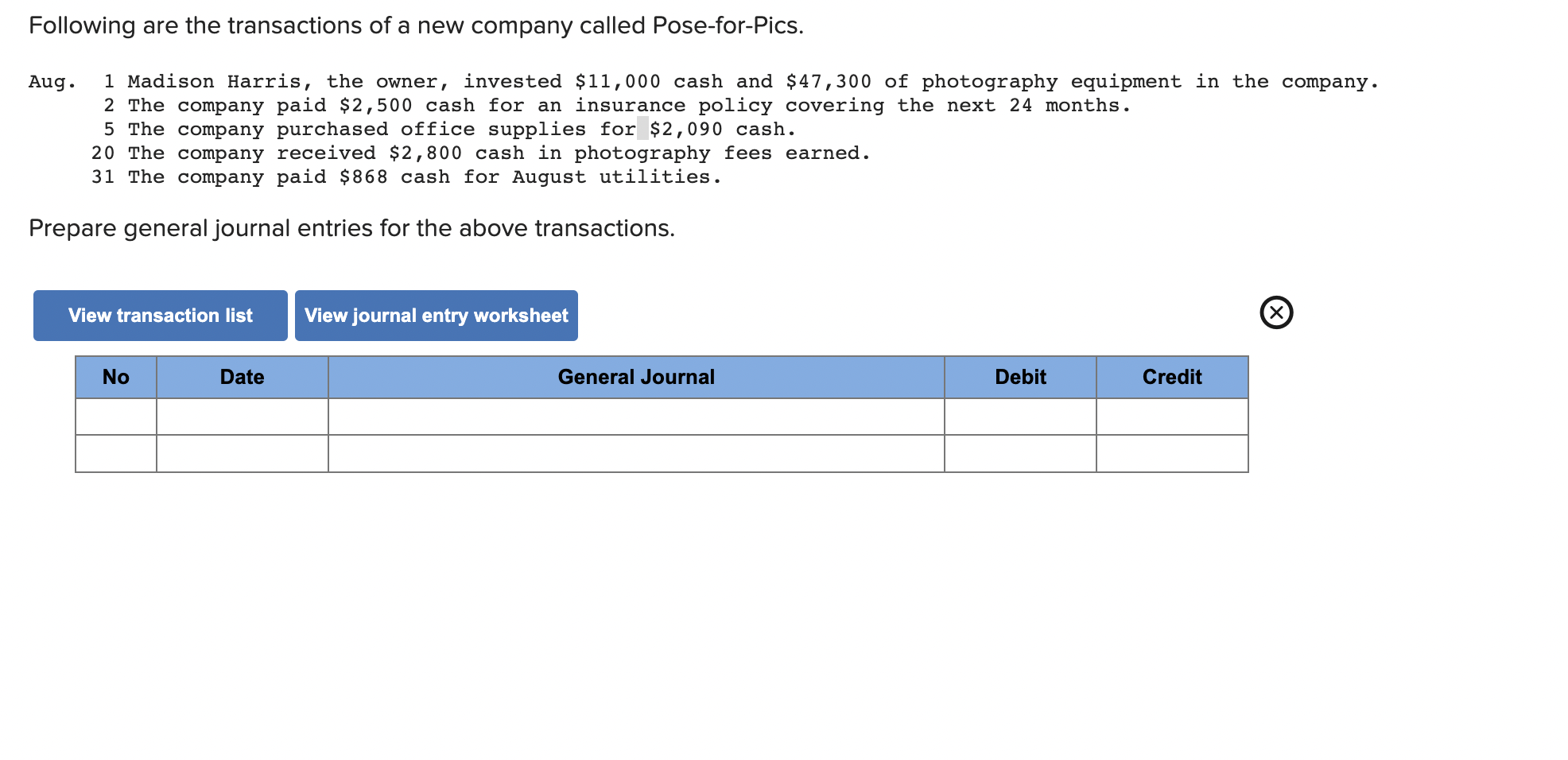

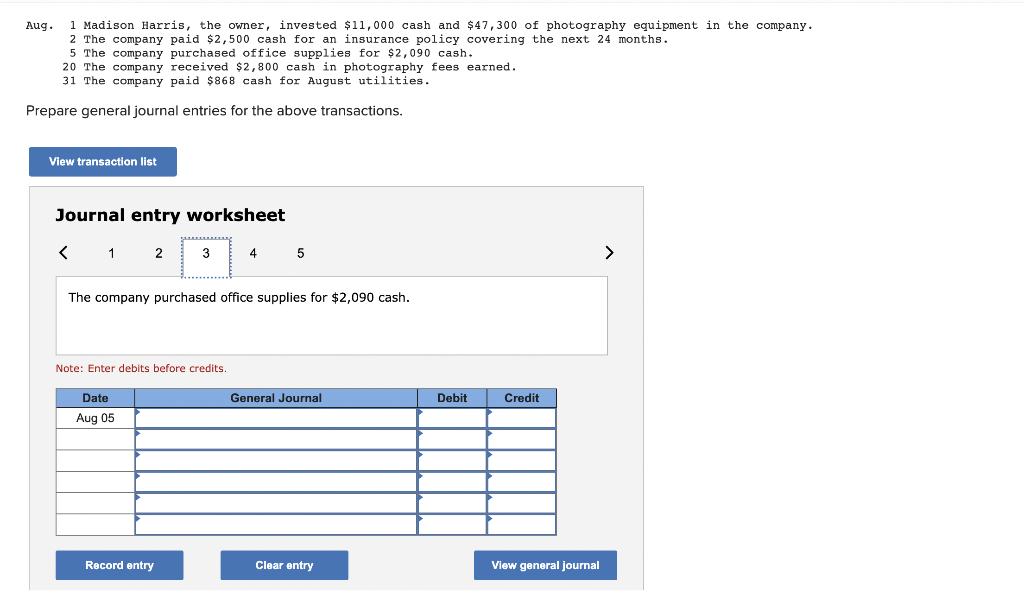

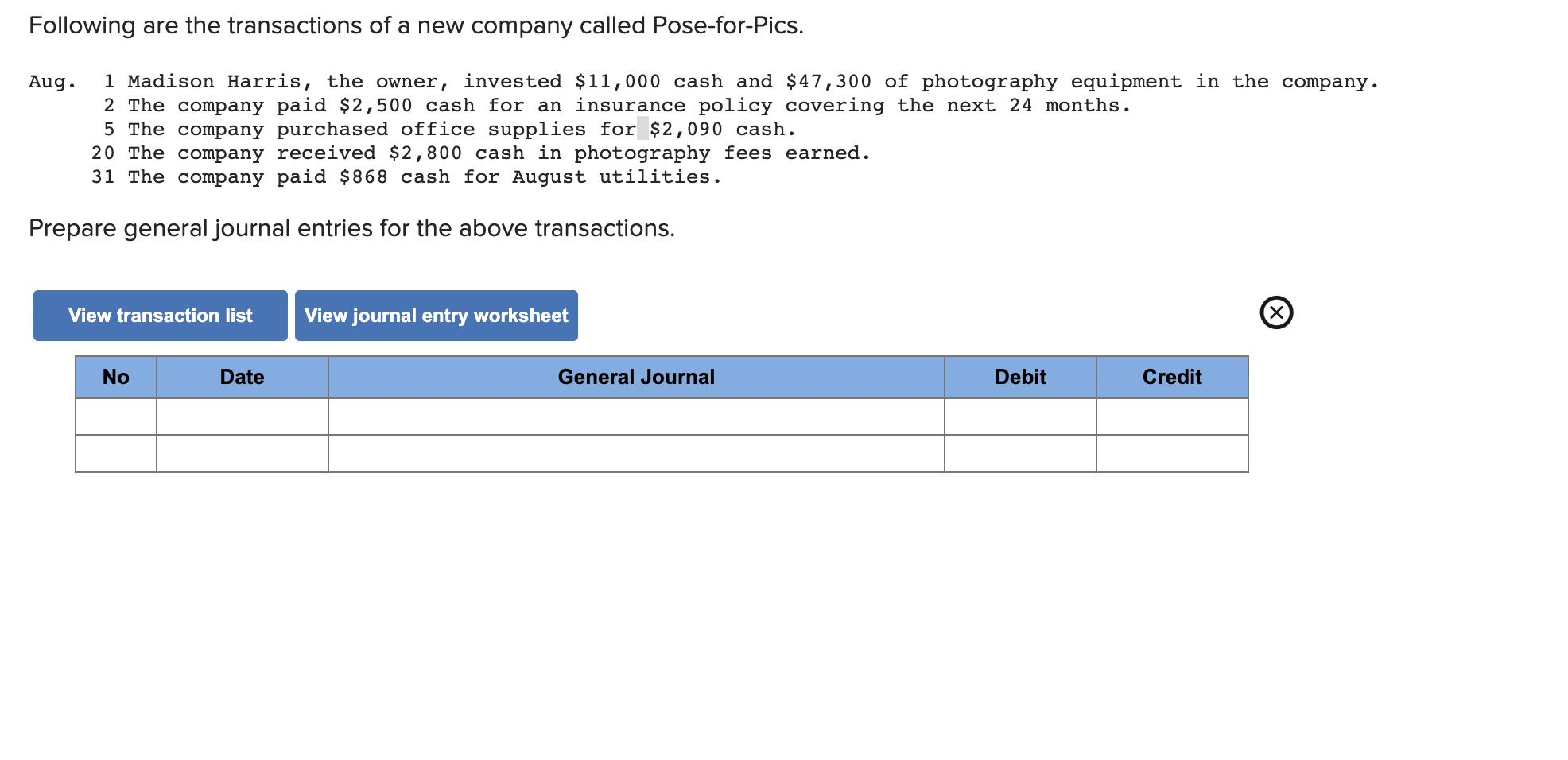

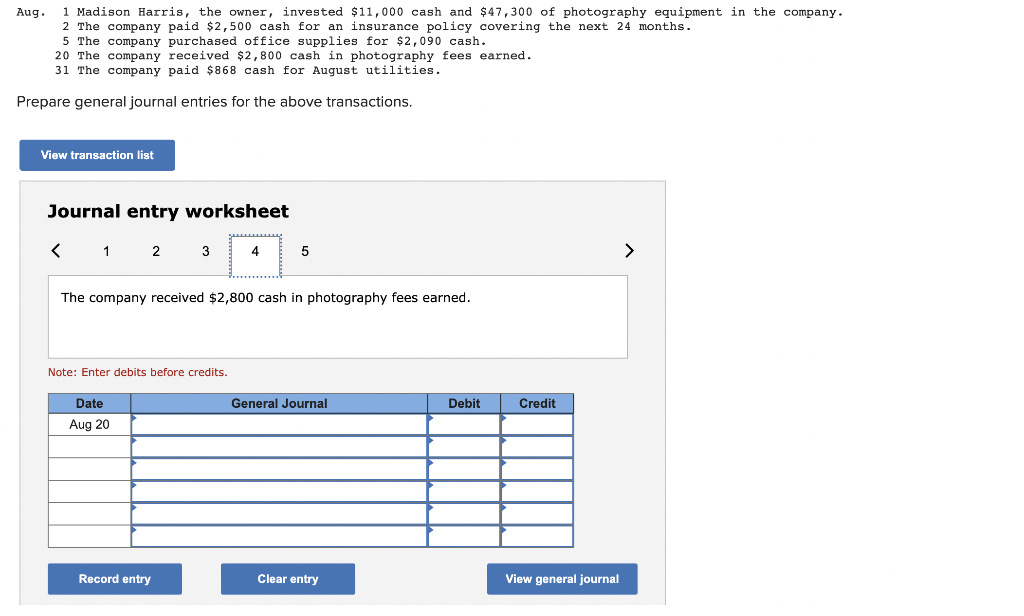

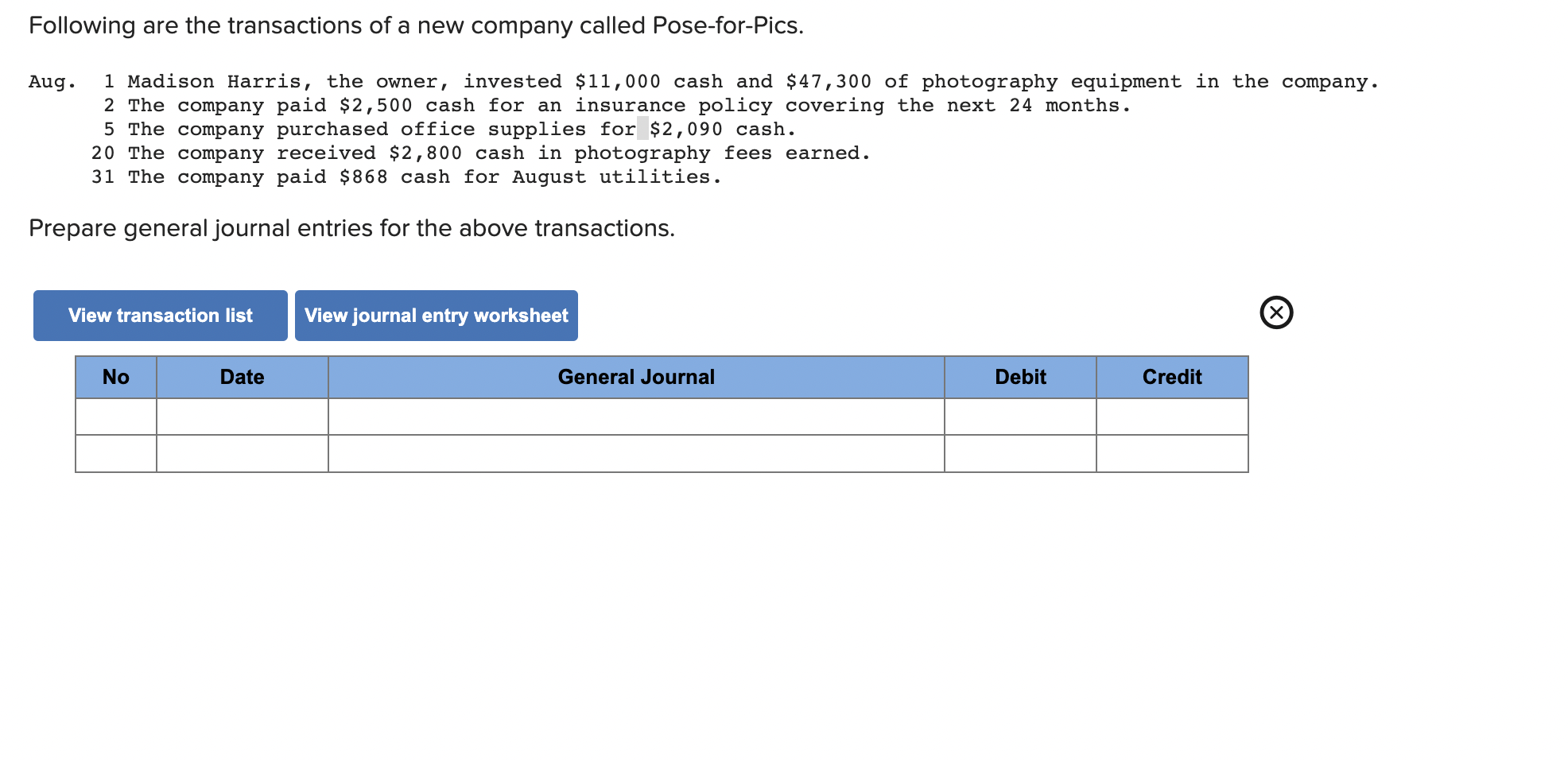

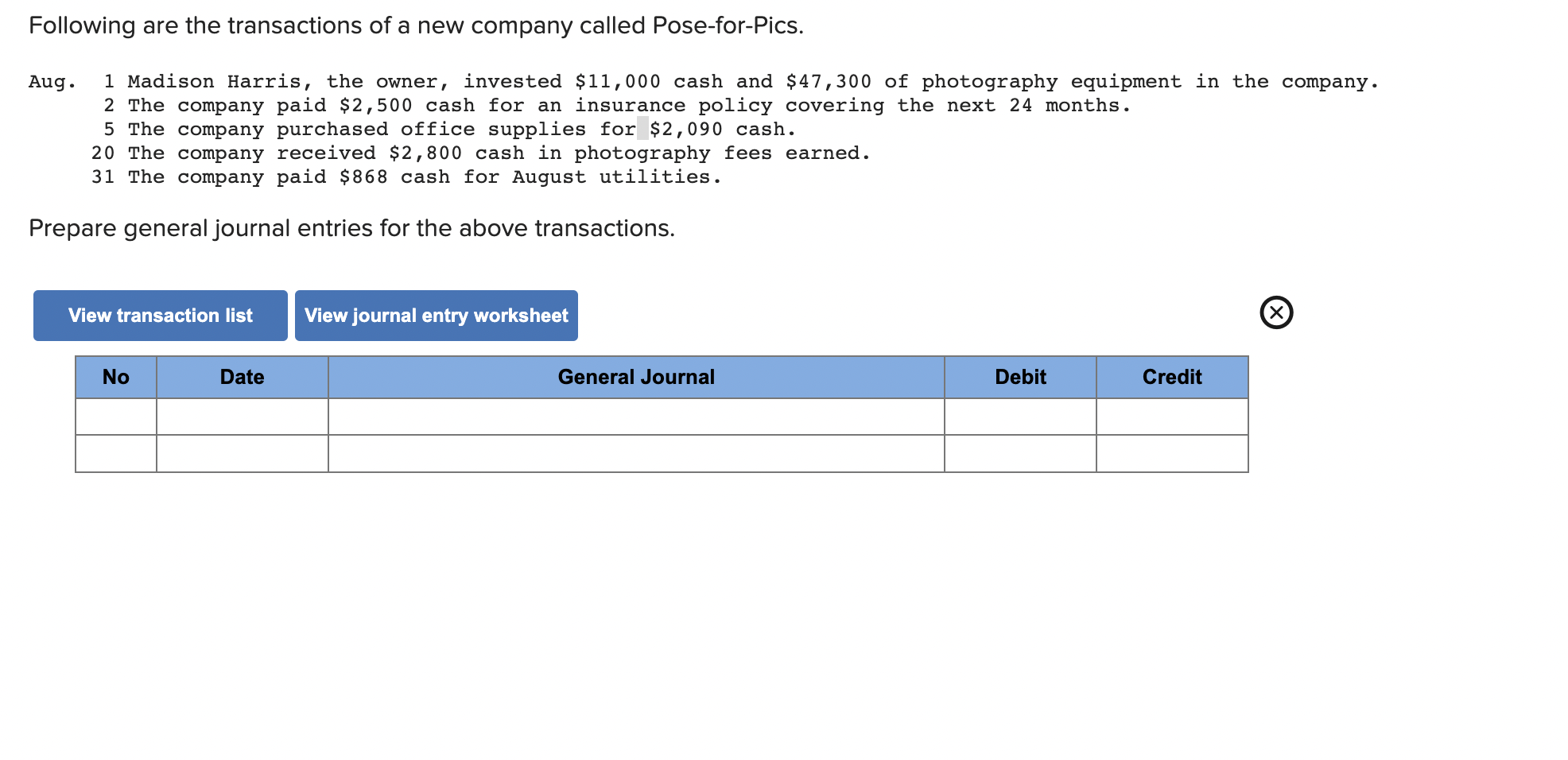

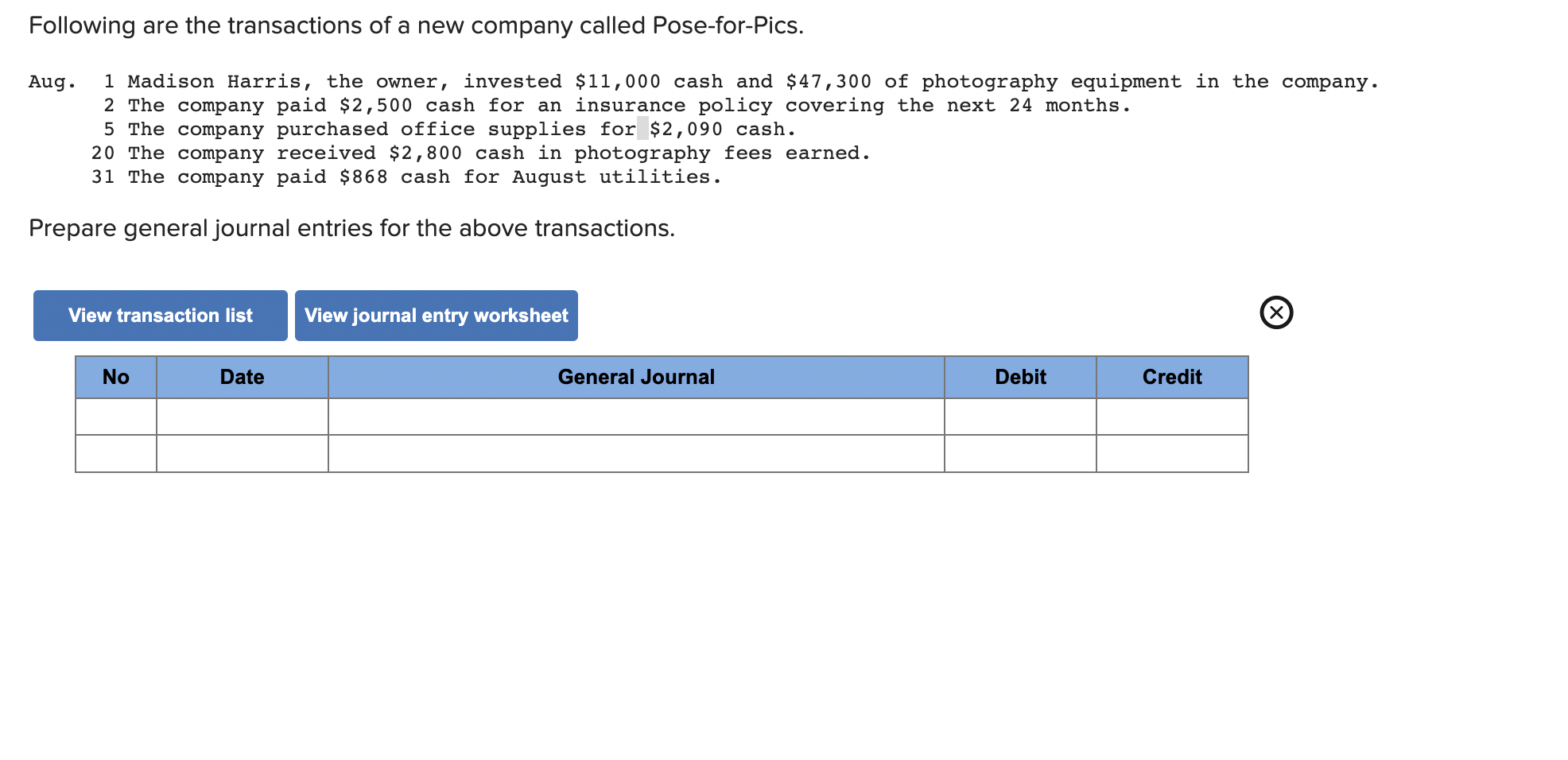

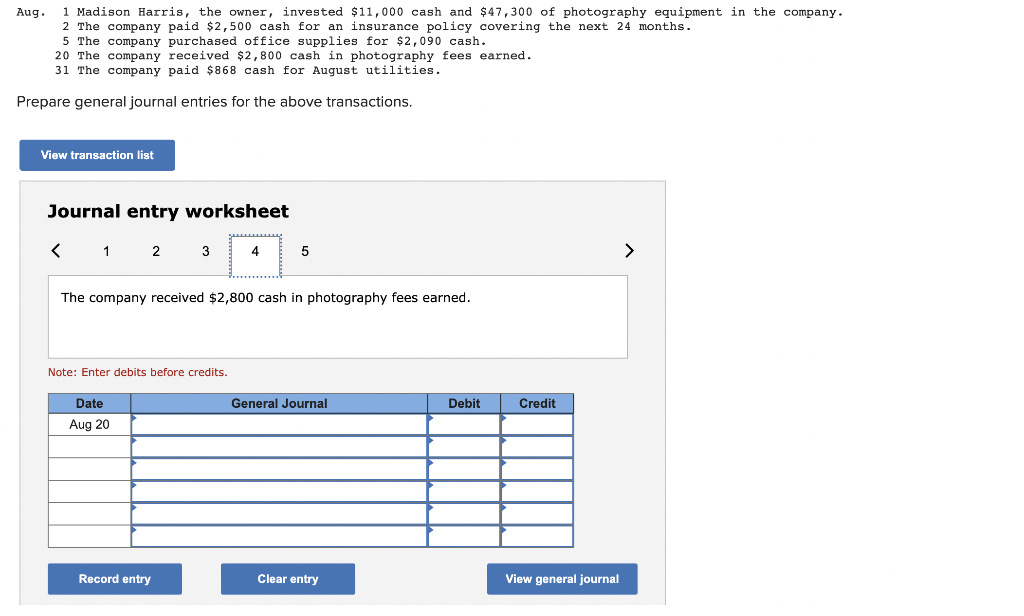

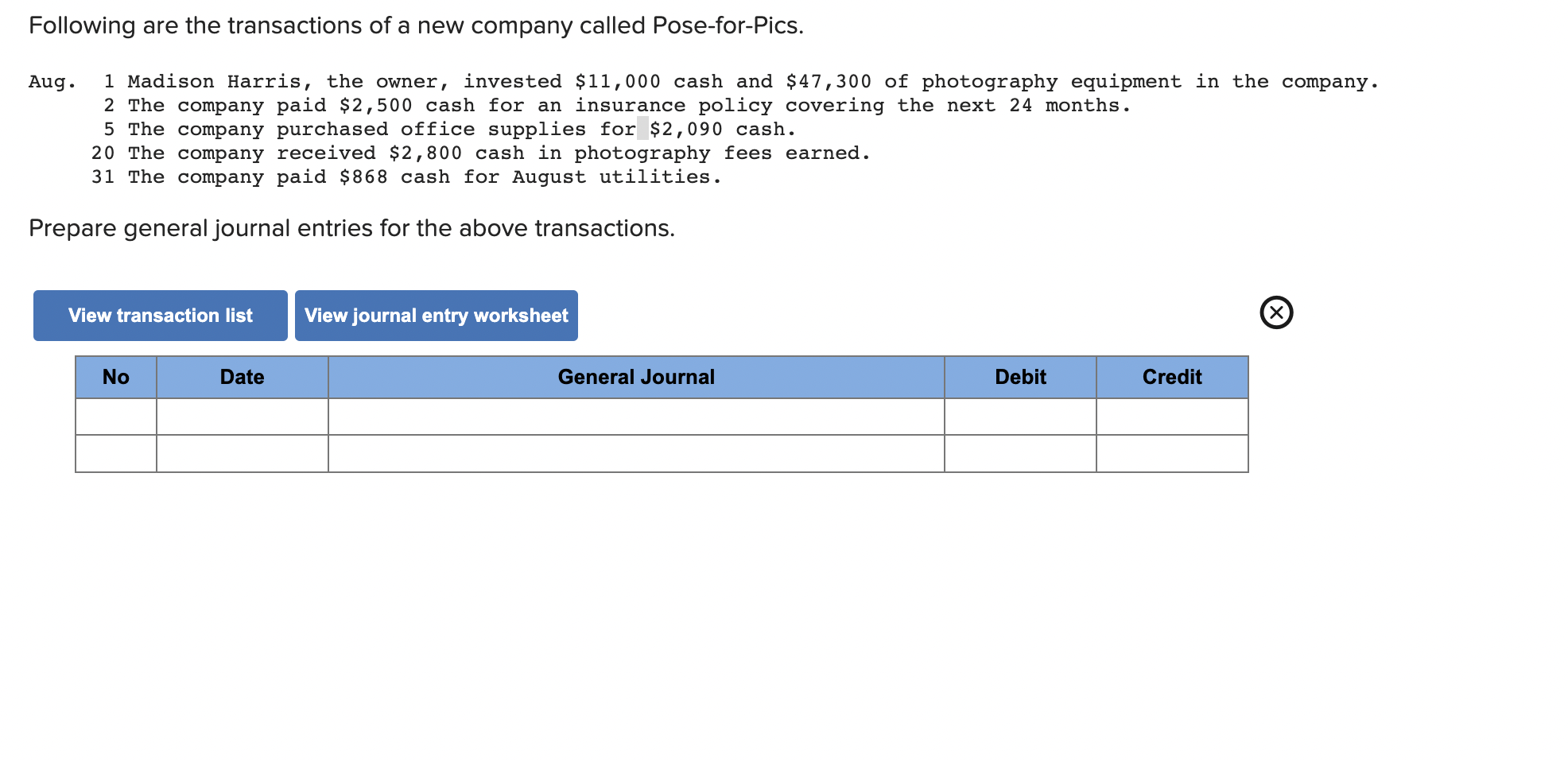

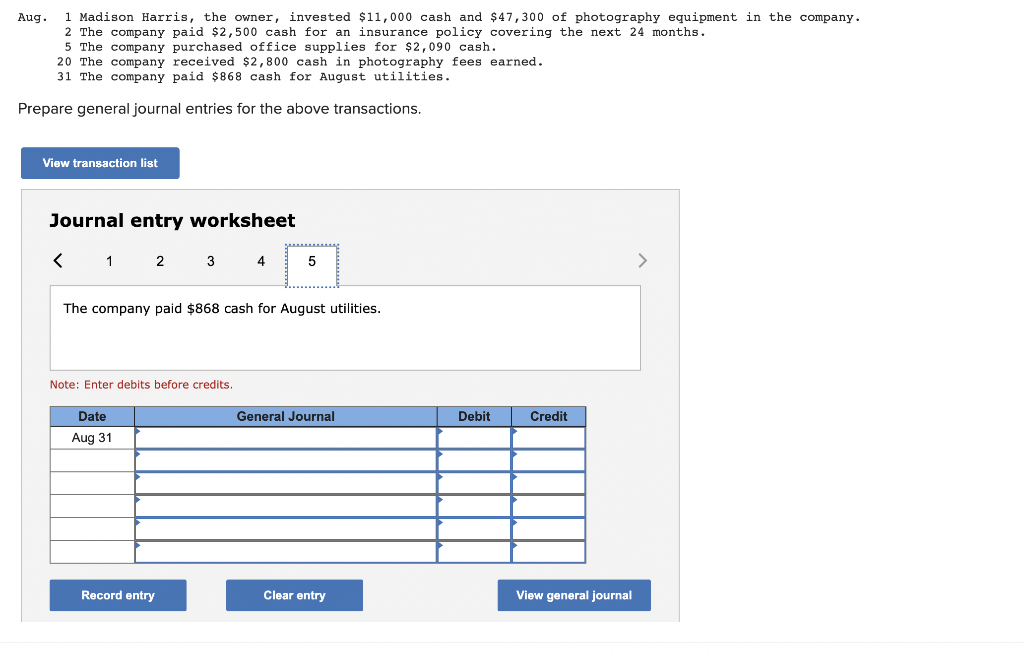

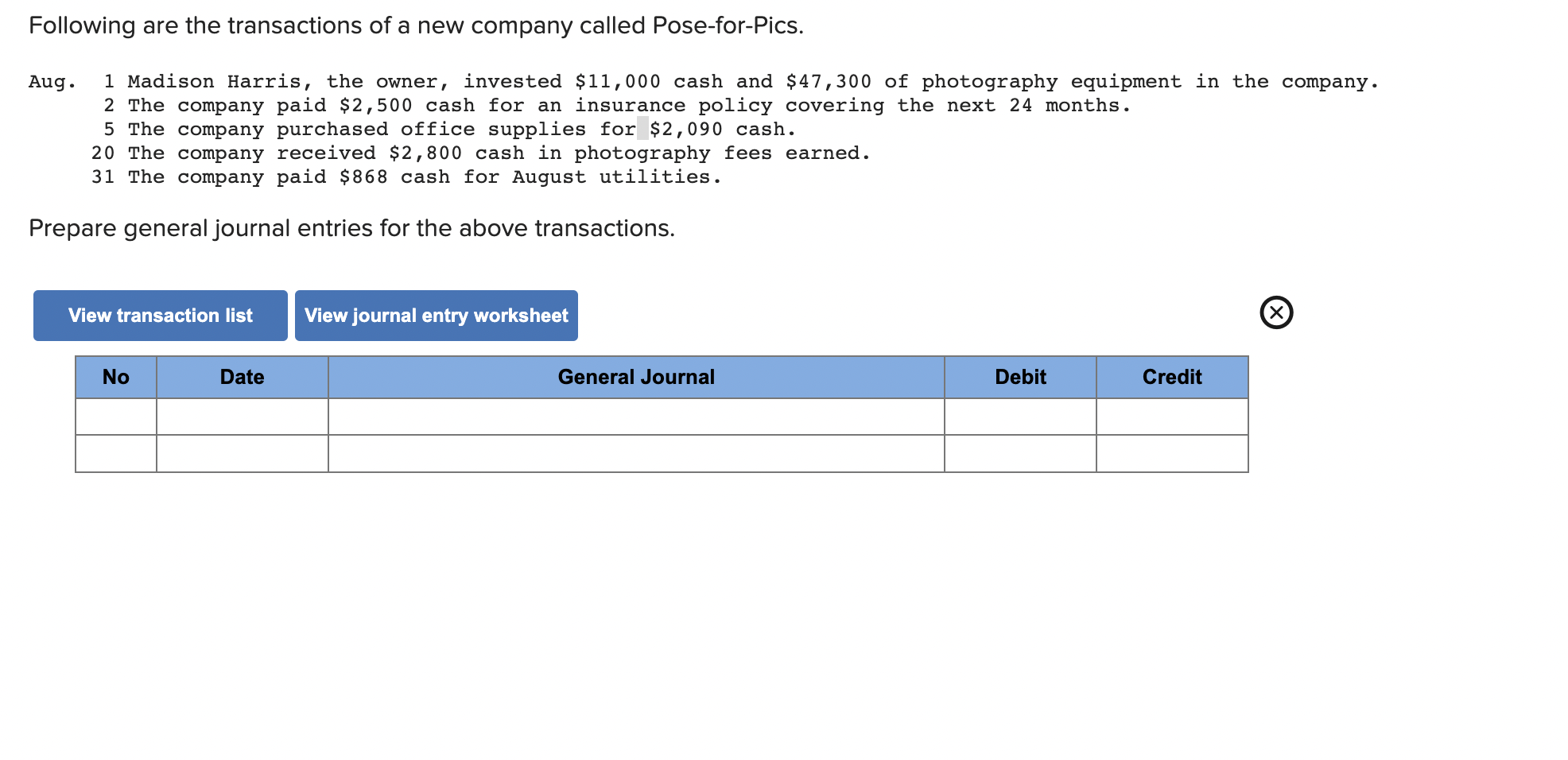

Following are the transactions of a new company called Pose-for-Pics.

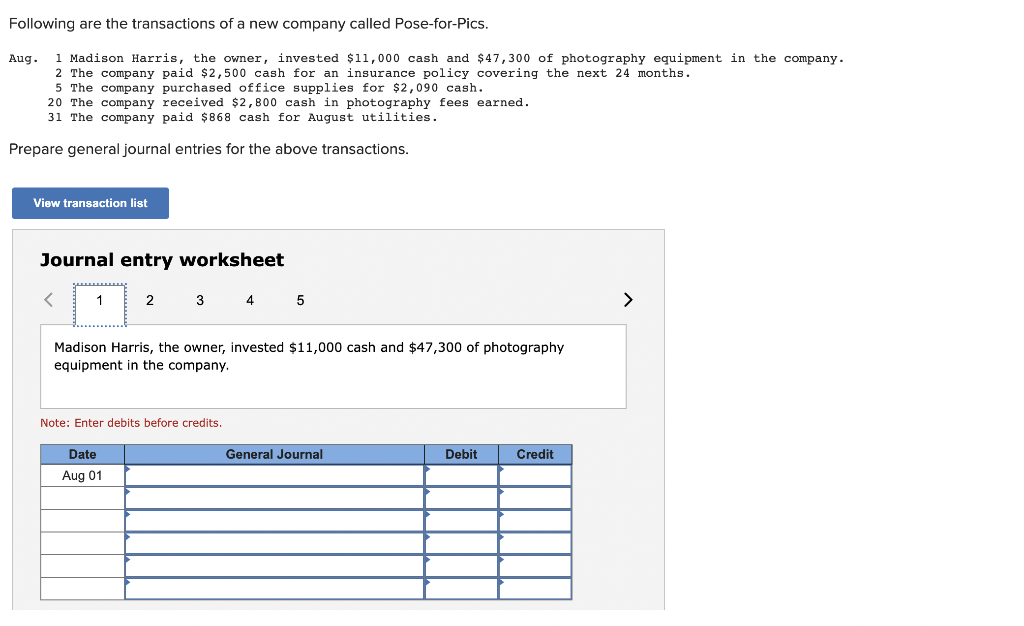

| Aug. | | 1 | | Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. |

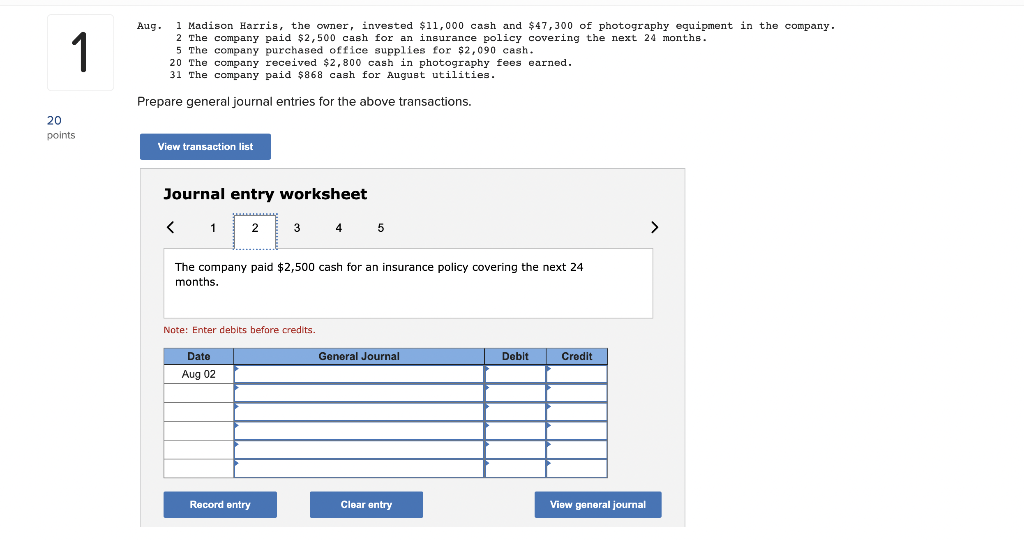

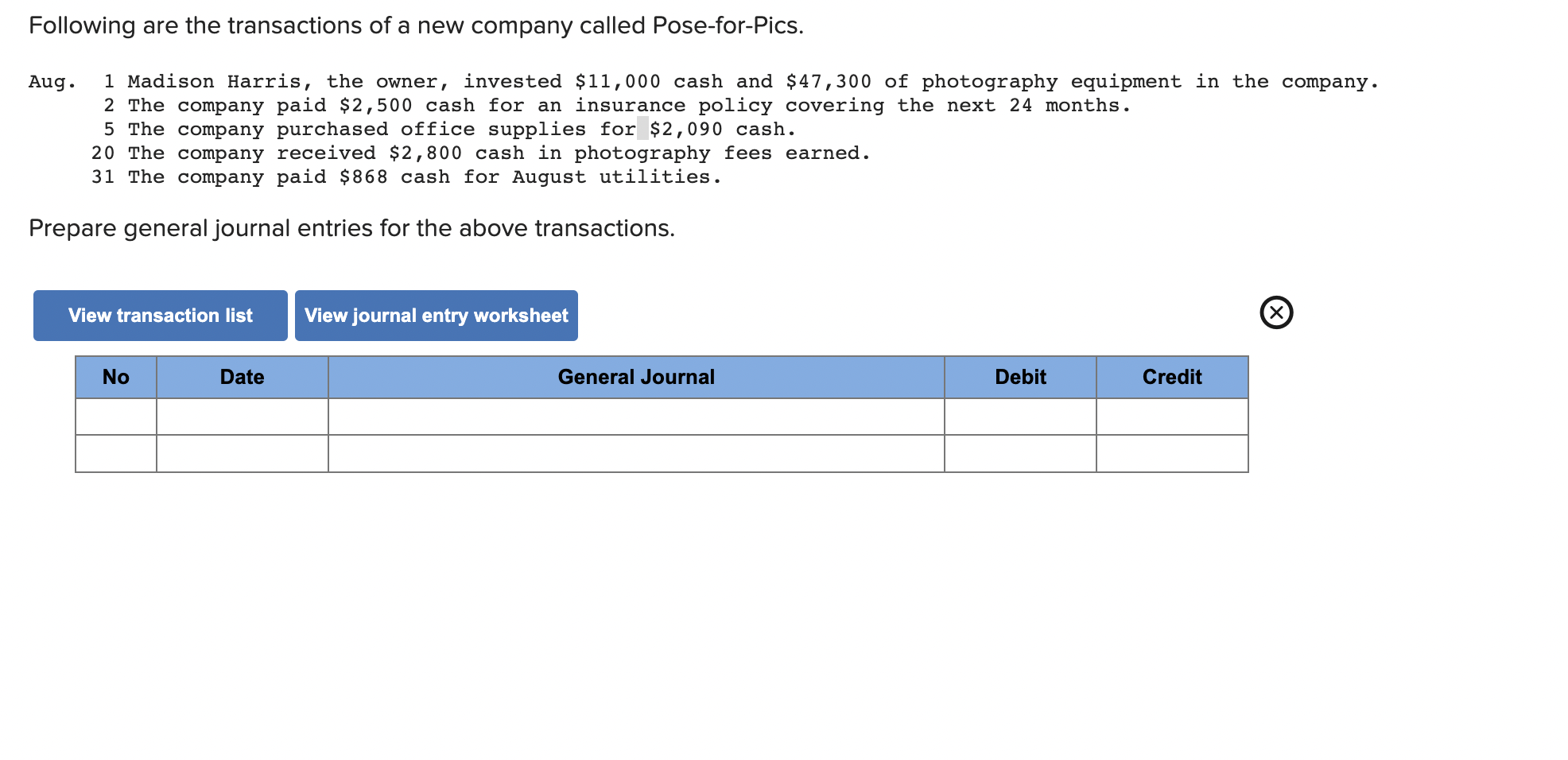

| | | 2 | | The company paid $2,500 cash for an insurance policy covering the next 24 months. |

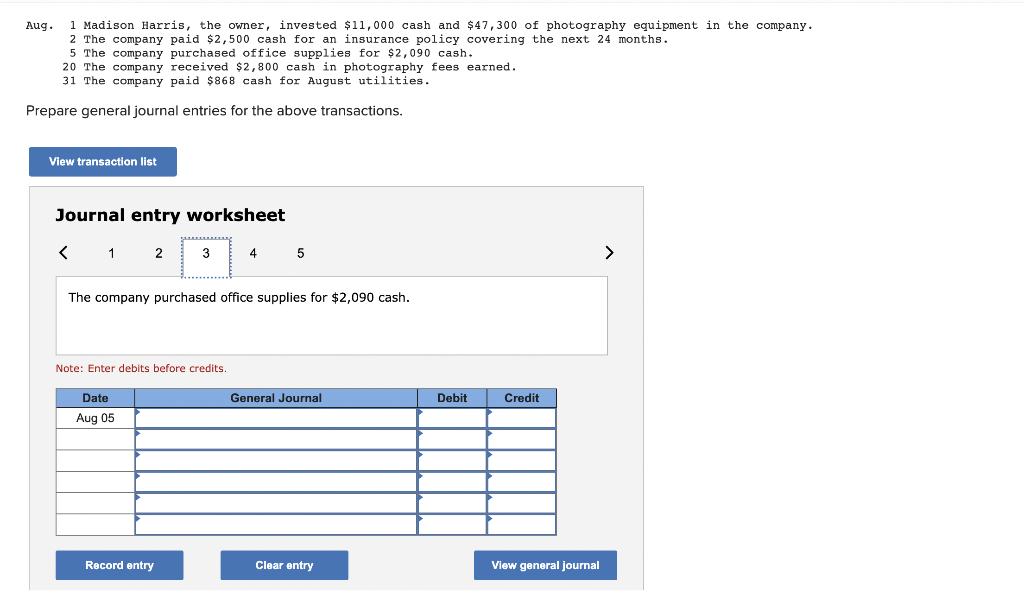

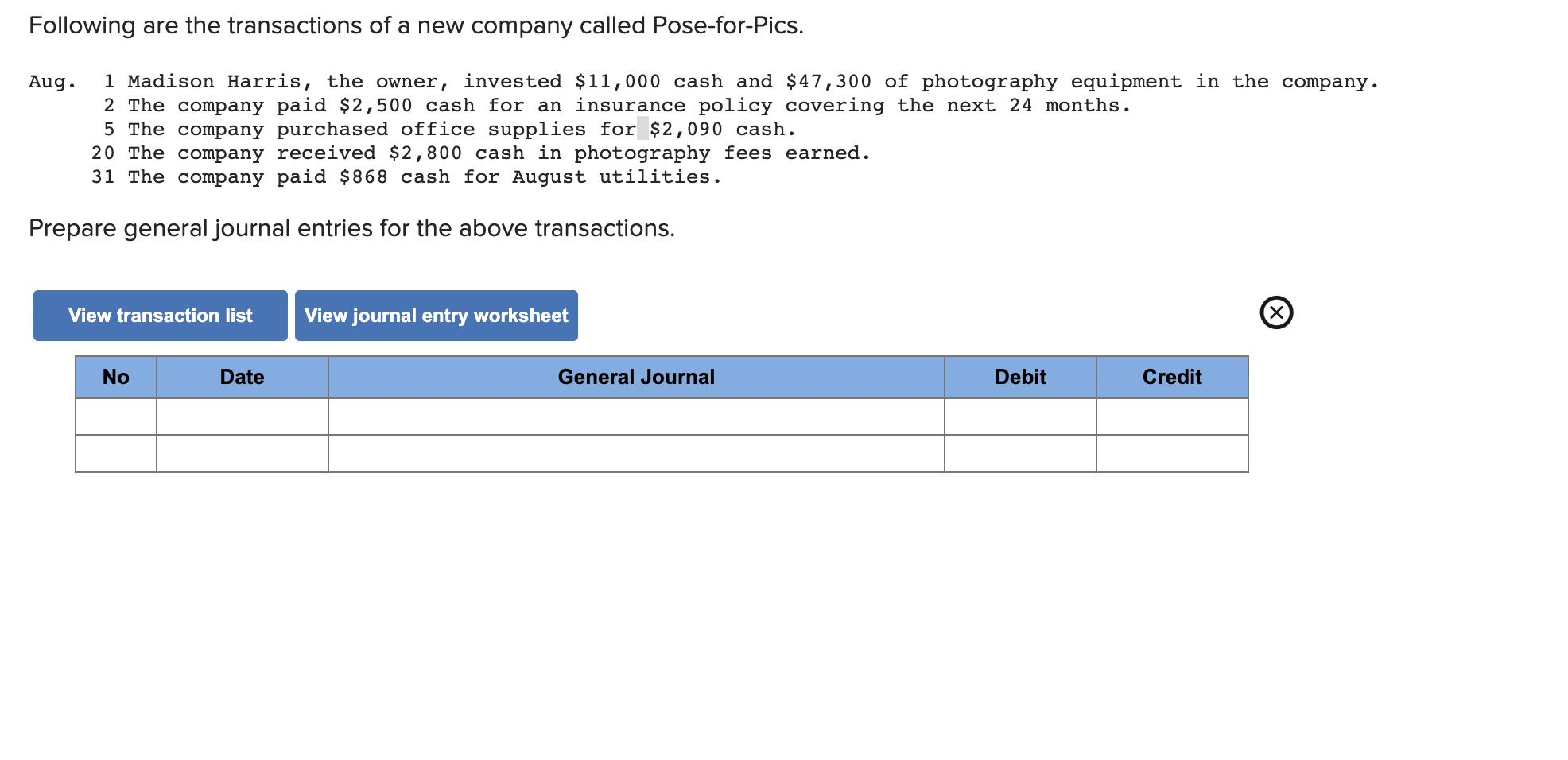

| | | 5 | | The company purchased office supplies for $2,090 cash. |

| | | 20 | | The company received $2,800 cash in photography fees earned. |

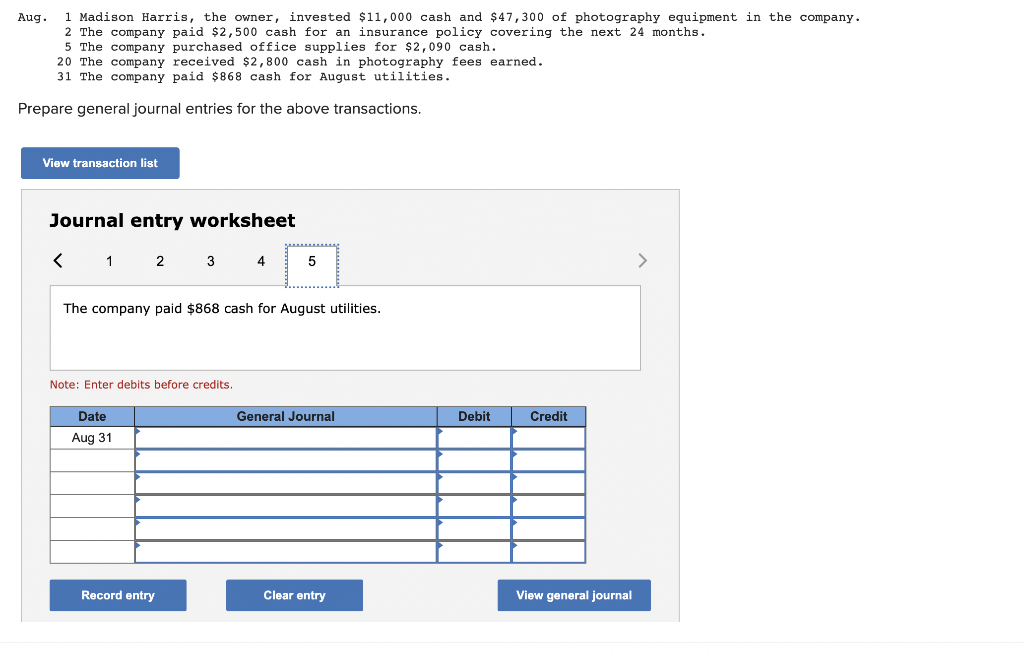

| | | 31 | | The company paid $868 cash for August utilities. |

Prepare general journal entries for the above transactions.

Following are the transactions of a new company called Pose-for-Pics. Aug. I Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Journal entry worksheet Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. Note: Enter debits before credits. Following are the transactions of a new company called Pose-for-Pics. Aug. 1 Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Aug. I Madison Harris, the owner, invested $11s000 cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Journal entry worksheet The company paid $2,500 cash for an insurance policy covering the next 24 months. Note: Enter debits before credits. Following are the transactions of a new company called Pose-for-Pics. Aug. 1 Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Aug. 1 Madison Harris, the owner, invested $11,000cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Journal entry worksheet The company purchased office supplies for $2,090 cash. Note: Enter debits before credits. Following are the transactions of a new company called Pose-for-Pics. Aug. 1 Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Aug. 1 Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Journal entry worksheet Following are the transactions of a new company called Pose-for-Pics. Aug. 1 Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Aug. 1 Madison Harris, the owner, invested $11,000cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions. Journal entry worksheet The company paid $868 cash for August utilities. Note: Enter debits before credits. Following are the transactions of a new company called Pose-for-Pics. Aug. 1 Madison Harris, the owner, invested $11,000 cash and $47,300 of photography equipment in the company. 2 The company paid $2,500 cash for an insurance policy covering the next 24 months. 5 The company purchased office supplies for $2,090cash. 20 The company received $2,800 cash in photography fees earned. 31 The company paid $868 cash for August utilities. Prepare general journal entries for the above transactions