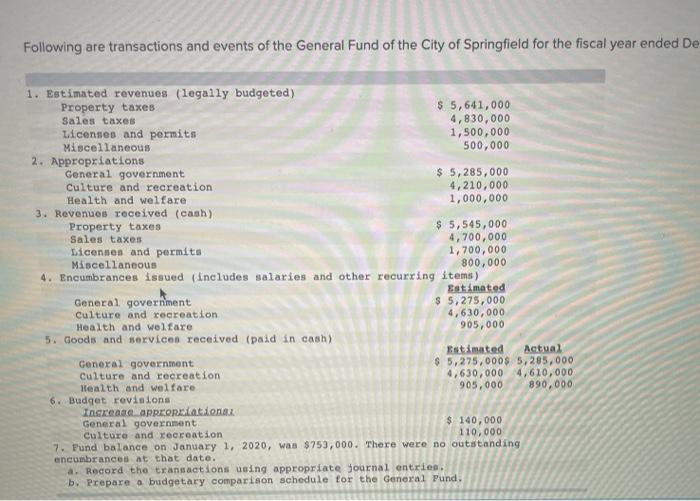

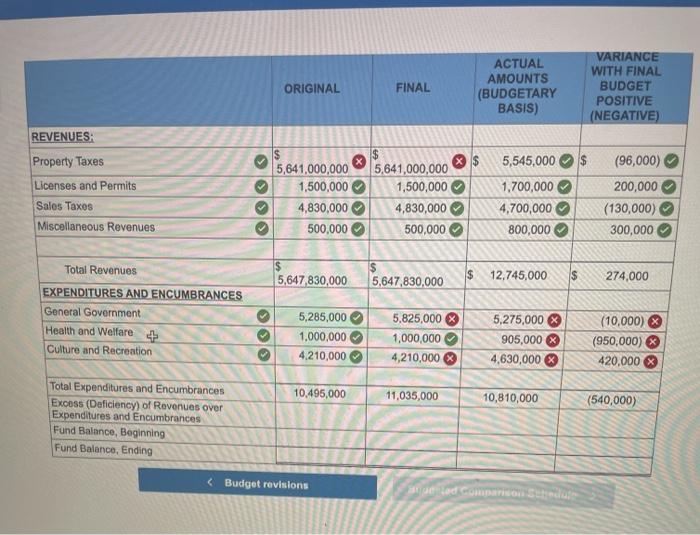

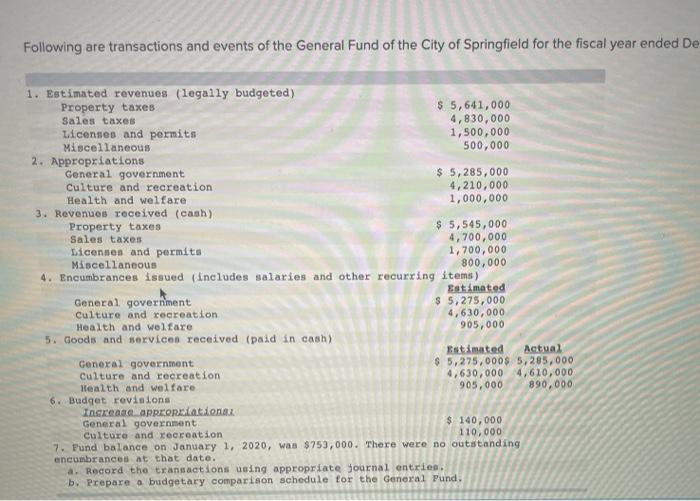

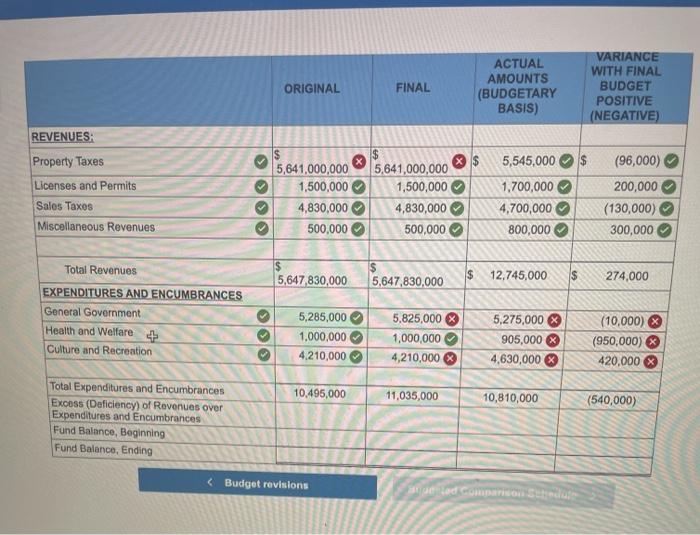

Following are transactions and events of the General Fund of the City of Springfield for the fiscal year ended De 1. Estimated revenues (legally budgeted) Property taxes $ 5,641,000 Sales taxes 4,830,000 Licenses and permits 1,500,000 Miscellaneous 500,000 2. Appropriations General government $ 5,285,000 Culture and recreation 4,210,000 Health and welfare 1,000,000 3. Revenues received (cash) Property taxes $ 5,545,000 Sales taxes 4,700,000 Licenses and permits 1,700,000 Miscellaneous 800,000 4. Encumbrances issued (includes salaries and other recurring items) Estimated General government $ 5,275,000 Culture and recreation 4,630,000 Health and welfare 905,000 5. Goods and servicen received (paid in cash) Estimated Actual General government $ 5,275,000$ 5,285,000 Culture and recreation 4,630,000 4,610,000 Health and welfare 905,000 890,000 6. Budget revisions Increase appropriationez General government $ 140,000 Culture and recreation 110,000 7. Pund balance on January 1, 2020, was $750,000. There were no outstanding encumbrances at that date. a. Record the transactions using appropriate yournal entries. b. Prepare a budgetary comparison schedule for the General Pund. ORIGINAL FINAL ACTUAL AMOUNTS (BUDGETARY BASIS) VARIANCE WITH FINAL BUDGET POSITIVE (NEGATIVE) > $ REVENUES: Property Taxes Licenses and Permits Sales Taxos $ 5,641,000,000 1,500,000 4,830,000 500,000 5,641,000,000 1,500,000 4,830,000 500,000 5,545,000 1,700,000 4,700,000 800,000 (96,000) 200,000 (130,000) 300,000 Miscellaneous Revenues > > Total Revenues $ 5,647,830,000 5,647,830,000 12,745,000 $ 274,000 EXPENDITURES AND ENCUMBRANCES General Government Health and Welfare Culture and Recreation 5,285,000 1,000,000 4.210,000 5,825,000 1,000,000 4,210,000 XIX 5,275,000 $ 905,000 4,630,000 (10,000) (950,000) 420,000 10.495,000 11,035,000 10,810,000 (540,000) Total Expenditures and Encumbrances Excess (Deficiency) of Revenues over Expenditures and Encumbrances Fund Balance, Beginning Fund Balance, Ending $ REVENUES: Property Taxes Licenses and Permits Sales Taxos $ 5,641,000,000 1,500,000 4,830,000 500,000 5,641,000,000 1,500,000 4,830,000 500,000 5,545,000 1,700,000 4,700,000 800,000 (96,000) 200,000 (130,000) 300,000 Miscellaneous Revenues > > Total Revenues $ 5,647,830,000 5,647,830,000 12,745,000 $ 274,000 EXPENDITURES AND ENCUMBRANCES General Government Health and Welfare Culture and Recreation 5,285,000 1,000,000 4.210,000 5,825,000 1,000,000 4,210,000 XIX 5,275,000 $ 905,000 4,630,000 (10,000) (950,000) 420,000 10.495,000 11,035,000 10,810,000 (540,000) Total Expenditures and Encumbrances Excess (Deficiency) of Revenues over Expenditures and Encumbrances Fund Balance, Beginning Fund Balance, Ending