Question

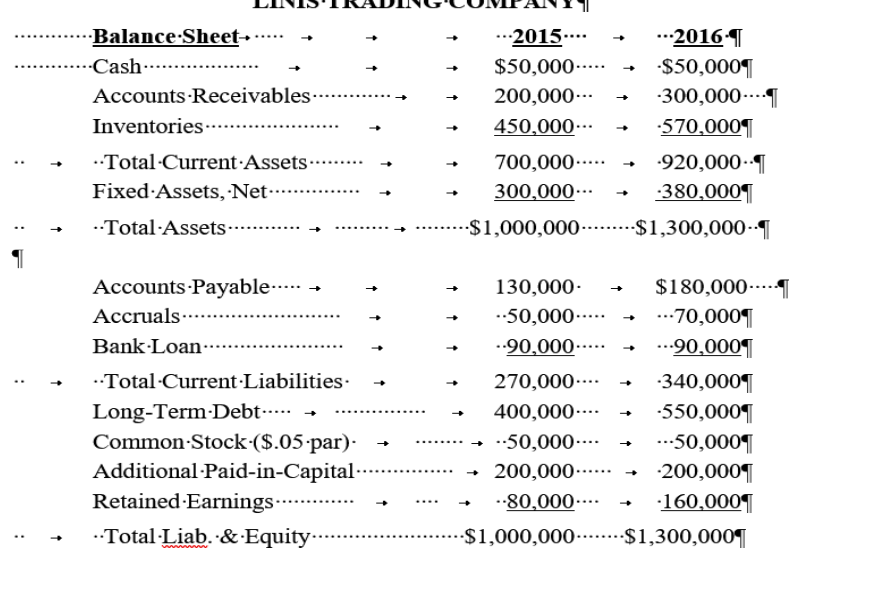

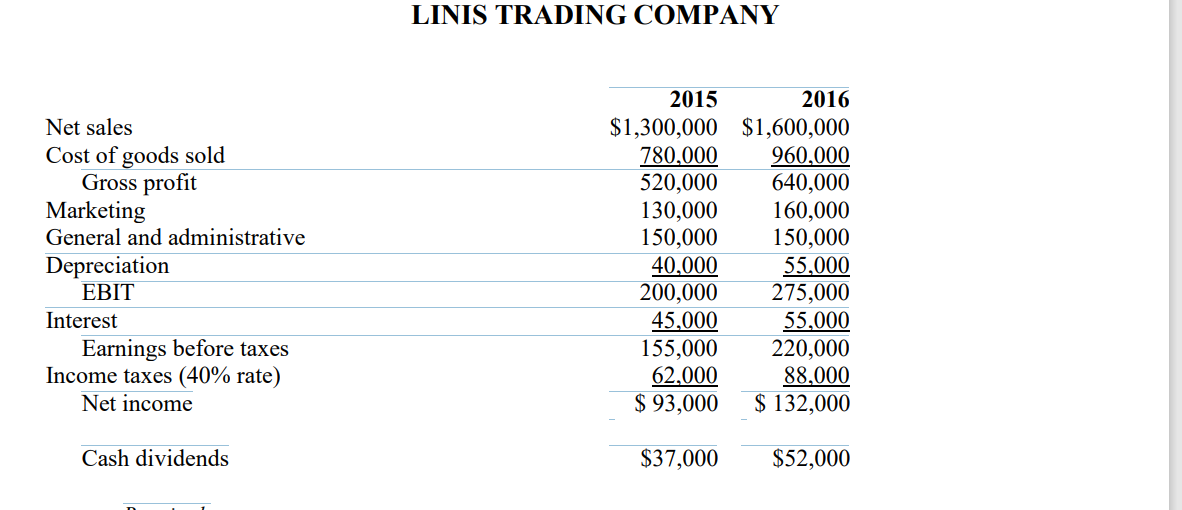

Following are two years of income statements and balance sheets for the Linis Trading Company. a) Linis Trading has a target dividend payout of 40

Following are two years of income statements and balance sheets for the Linis Trading Company.

a) Linis Trading has a target dividend payout of 40 percent of net income. Based on the 2016 financial statements relationships, estimate the sustainable sales growth rate for the company for 2017. (3 marks)

a) Linis Trading has a target dividend payout of 40 percent of net income. Based on the 2016 financial statements relationships, estimate the sustainable sales growth rate for the company for 2017. (3 marks)

b) Show how your answer in part a) of this question would change if Linis Trading decided not to pay any dividends in 2017. (3 marks)

c) Assume Linis Trading wants to grow its sales by 40 percent in 2017 over its 2016 level. Estimate the additional funds needed that will be necessary to support this rapid increase in sales. (4 marks)

d) Sales are forecasted to increase an additional 20 percent in 2018 over 2017. Estimate the two-year additional financing needed (AFN) Linis Trading will need to finance its 2017 and 2018 sales growth plans.

- Balance Sheet -Cash... Accounts Receivables. Inventories..... - 2015.... ...2016-1 $50,000..... -$50,0001 200,000... 300,000....1 450,000... -570,000 700,000..... .920,000.1 300,000 380,000 $1,000,000 .........$1,300,000.- .. - Total Current Assets.... Fixed Assets, Net......... -Total-Assets.. .. 1 - - Accounts Payable.... Accruals. Bank Loan Total Current Liabilities. Long-Term Debt..... Common Stock-($.05.par). Additional Paid-in-Capital Retained Earnings..... Total Liab. & Equity. 130,000- $180,000..... --50,000..... ...70,000 ..90,000..... ...90,0000 270,000.... 340,000 400,000.... -550,000 --50,000.... ...50,000 200,000...... -200,000 --80,000.... 160,0007 $1,000,000......$1,300,000 - LINIS TRADING COMPANY Net sales Cost of goods sold Gross profit Marketing General and administrative Depreciation EBIT Interest Earnings before taxes Income taxes (40% rate) Net income 2015 2016 $1,300,000 $1,600,000 780,000 960,000 520,000 640,000 130,000 160,000 150,000 150,000 40,000 55,000 200,000 275,000 45,000 55,000 155,000 220,000 62,000 88,000 $ 93,000 $ 132,000 Cash dividends $37,000 $52,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started