Answered step by step

Verified Expert Solution

Question

1 Approved Answer

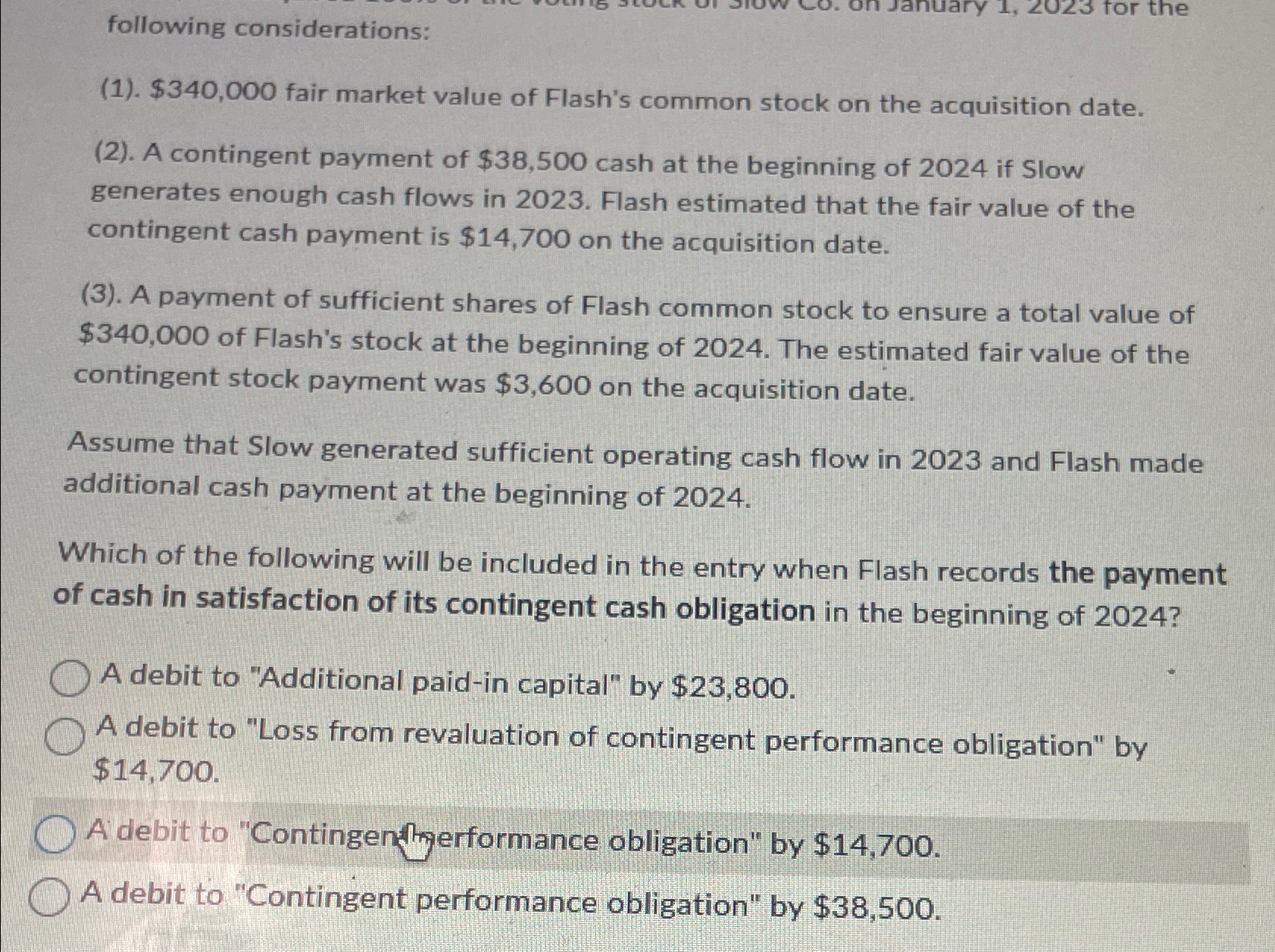

following considerations: ( 1 ) . $ 3 4 0 , 0 0 0 fair market value of Flash's common stock on the acquisition date.

following considerations:

$ fair market value of Flash's common stock on the acquisition date.

A contingent payment of $ cash at the beginning of if Slow generates enough cash flows in Flash estimated that the fair value of the contingent cash payment is $ on the acquisition date.

A payment of sufficient shares of Flash common stock to ensure a total value of $ of Flash's stock at the beginning of The estimated fair value of the contingent stock payment was $ on the acquisition date.

Assume that Slow generated sufficient operating cash flow in and Flash made additional cash payment at the beginning of

Which of the following will be included in the entry when Flash records the payment of cash in satisfaction of its contingent cash obligation in the beginning of

A debit to "Additional paidin capital" by $

A debit to "Loss from revaluation of contingent performance obligation" by $

A debit to "Contingendngerformance obligation" by $

A debit to "Contingent performance obligation" by $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started