Question

Following Costs-Benefits Analysis example (Figure 5-6) on page 126, perform the costs-benefits analyses for the problems stated below. 1) As a systems analyst, you are

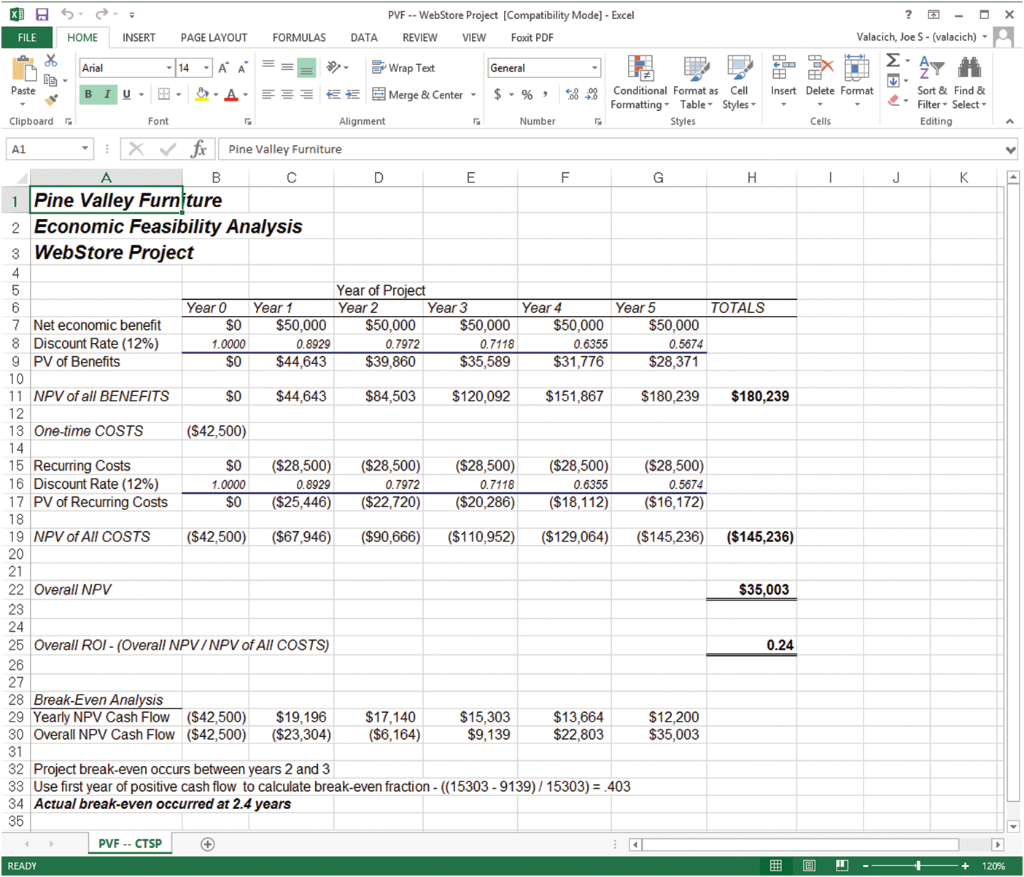

Following Costs-Benefits Analysis example (Figure 5-6) on page 126, perform the costs-benefits analyses for the problems stated below.  1) As a systems analyst, you are preparing a new information system project proposal for management that requires you to create a costs-benefits analysis prior to project presentation. Assume that the project is expected to return monetary benefits of $55,000 per year, one-time costs of $75,000, and recurring costs of $15,000 per year. The project has a discount rate of 8% and a five-year time horizon. a) Create a costs-benefits analysis spreadsheet similar to the one on page 126 in Chapter 5. (10 points)

1) As a systems analyst, you are preparing a new information system project proposal for management that requires you to create a costs-benefits analysis prior to project presentation. Assume that the project is expected to return monetary benefits of $55,000 per year, one-time costs of $75,000, and recurring costs of $15,000 per year. The project has a discount rate of 8% and a five-year time horizon. a) Create a costs-benefits analysis spreadsheet similar to the one on page 126 in Chapter 5. (10 points)

b) Calculate net present value (NPV) of benefits for each year. (10 points)

c) Calculate net present value (NPV) of costs for each year. (10 points)

d) Calculate overall net present value (NPV) at the end of project life. (5 points)

e) Calculate overall return on investment (ROI) at the end of project life. (5 points)

f) Perform break-even analysis (BEA) for the project. (5 points)

g) Calculate break-even point for this project. (5 points) 2) You are also proposing a second project with variable costs and returns. Assume that the project is expected to return monetary benefits of $50,000 the first year, and increasing benefits of $10,000 until the end of project life (year 1 = $50,000, year 2 = $60,000, year 3 = $70,000, year 4 = $80,000, year 5 = $90,000). The project also has one-time costs of $35,000, and variable recurring costs of (year 1 = $25,000, year 2 = $30,000, year 3 = $35,000, year 4 = $40,000, year 5 = $45,000) until the end of project life. The project has a discount rate of 10% and a five-year time horizon. a) Create a costs-benefits analysis spreadsheet similar to the one on page 126 in Chapter 5. (10 points)

b) Calculate net present value (NPV) of benefits for each year. (10 points)

c) Calculate net present value (NPV) of costs for each year. (10 points)

d) Calculate overall net present value (NPV) at the end of project life. (5 points)

e) Calculate overall return on investment (ROI) at the end of project life. (5 points)

f) Perform break-even analysis (BEA) for the project. (5 points)

g) Calculate break-even point for this project. (5 points)

PVF-WebStore Project [Compatibility Mode] - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATAREVIEW VIEW Foxit PD Valacich, Joe S-(valacich) 14A A Wrap Tet General Conditional Format as Cell Formatting Table Styles Paste r" u B- 2. fEMerge & Center . $ . % , Insert Delete Format Sort & Find & . -Filter Select Clipboard Font Alignment Number Cells Editing A1 XJfx Pine Valley Furniture 1 Pine Valley Furniture 2 Economic Feasibility Analysis 3 WebStore Project Year of FP Year 2 Year0 Year 1 Year 3 Year 4 Year 5 TOTALS 7 Net economic benefit 8 Discount Rate (12%) 9PV of Benefits S0 $50,000 $O $44,643$39,860 SO $44,643$84,503 $120,092 $151,867 $180,239 $180,239 $50,000 0.7972 $50,000 0.7118 $35,589 $50,000 0.6355 $31,776 $50,000 0.5674 $28,371 1.0000 0.8929 11 NPV of all BENEFITS 13 One-time COSTS ($42,500) 15 Recurring Costs 16 Discount Rate (12%) 17 PV of Recurring Costs S0 ($28,500) ($28,500)($28,500) ($28,500) ($28,500) 0.5674 S0 ($25,446) $22,720($20,286) ($18,112($16,172) 1.0000 0.8929 0.7972 0.7118 0.6355 19 NPV of AIl COSTS ($42,500) ($67,946 0,666 20 21 22 Overall NPV 23 24 25 Overall ROl-(Overall NPVINPV of AIl COSTS) 26 27 28 Break-Even Analysis 29 Yearly NPV Cash Flow ($42,500 $19,196 $17,140 ($110,952) ($129064) (145,236 ($145,236) $35,003 0.24 $15,303 $9,139 $13,664 $22,803 $12,200 $35,003 0 Overall NPV Cash Flow ($42,500) ($23,304)($6,164) 31 32 Project break-even occurs between years 2 and 3 33 Use first year of positive cash flow to calculate break-even fraction- ((15303-9139)/15303)403 34 Actual break-even occurred at 2.4 years 35 PVF-- CTSP READY 120% PVF-WebStore Project [Compatibility Mode] - Excel FILE HOME INSERT PAGE LAYOUT FORMULAS DATAREVIEW VIEW Foxit PD Valacich, Joe S-(valacich) 14A A Wrap Tet General Conditional Format as Cell Formatting Table Styles Paste r" u B- 2. fEMerge & Center . $ . % , Insert Delete Format Sort & Find & . -Filter Select Clipboard Font Alignment Number Cells Editing A1 XJfx Pine Valley Furniture 1 Pine Valley Furniture 2 Economic Feasibility Analysis 3 WebStore Project Year of FP Year 2 Year0 Year 1 Year 3 Year 4 Year 5 TOTALS 7 Net economic benefit 8 Discount Rate (12%) 9PV of Benefits S0 $50,000 $O $44,643$39,860 SO $44,643$84,503 $120,092 $151,867 $180,239 $180,239 $50,000 0.7972 $50,000 0.7118 $35,589 $50,000 0.6355 $31,776 $50,000 0.5674 $28,371 1.0000 0.8929 11 NPV of all BENEFITS 13 One-time COSTS ($42,500) 15 Recurring Costs 16 Discount Rate (12%) 17 PV of Recurring Costs S0 ($28,500) ($28,500)($28,500) ($28,500) ($28,500) 0.5674 S0 ($25,446) $22,720($20,286) ($18,112($16,172) 1.0000 0.8929 0.7972 0.7118 0.6355 19 NPV of AIl COSTS ($42,500) ($67,946 0,666 20 21 22 Overall NPV 23 24 25 Overall ROl-(Overall NPVINPV of AIl COSTS) 26 27 28 Break-Even Analysis 29 Yearly NPV Cash Flow ($42,500 $19,196 $17,140 ($110,952) ($129064) (145,236 ($145,236) $35,003 0.24 $15,303 $9,139 $13,664 $22,803 $12,200 $35,003 0 Overall NPV Cash Flow ($42,500) ($23,304)($6,164) 31 32 Project break-even occurs between years 2 and 3 33 Use first year of positive cash flow to calculate break-even fraction- ((15303-9139)/15303)403 34 Actual break-even occurred at 2.4 years 35 PVF-- CTSP READY 120%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started