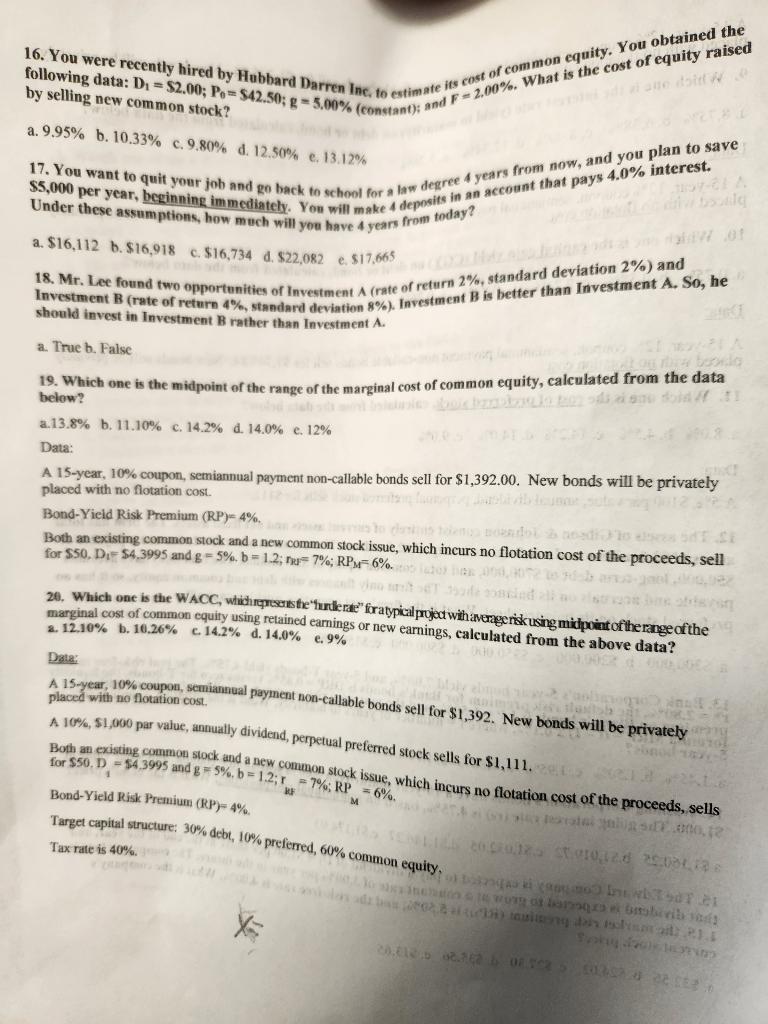

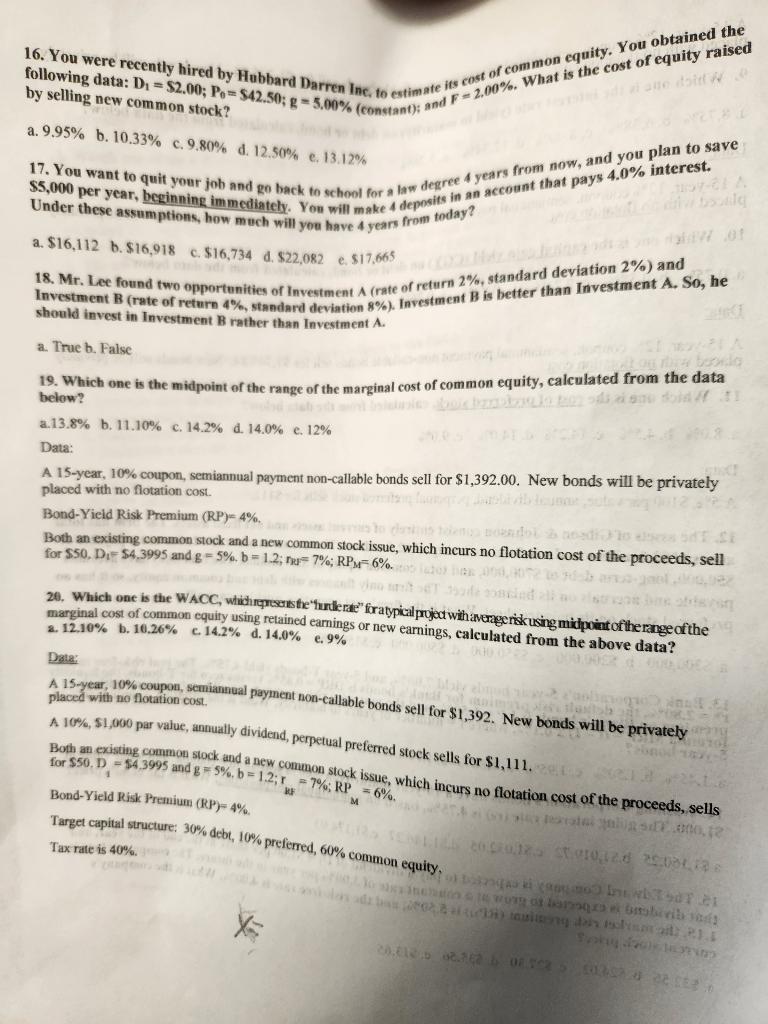

following data: D1=$2.00;P0=$42.50;g=5.00% Inc, to estimate is cost of common equity. You obtained is the cost of equity raised by selling new common stock? a.9.95%b.10.33%c.9.80%d.12.50%e.13.12% 17. You want to quit your job and go back to school for a law degree 4 years from now, and you plan to save a.$16,112b.$16,918c.$16,734d.$22,082e.$17,665 18. Mr. Lee found two opportunities of Investment A (rate of return 2%, standard deviation 2% ) and Investment B (rate of return 4%, standard deviation 8% ). Investment B is better than Investment A. So, he should invest in Investment B rather than Investment A. a. True b. False 19. Which one is the midpoint of the range of the marginal cost of common equity, calculated from the data below? Data: A 15 -year, 10% coupon, semiannual payment non-callable bonds sell for $1,392.00. New bonds will be privately placed with no flotation cost. Bond-Yield Risk Premium (RP) =4%. Both an existing common stock and a new common stock issue, which incurs no flotation cost of the proceeds, sell for $50,D1=$4,3995 and g=5%,b=1.2;rmR=7%;RPM=6%. marginal cost of common equity using retained earnings or new earnings, calculated from the above data? Date: A 15-year, 10% coupon, semianneal payment non-callable bonds sell for $1,392. New bonds will be privately placed with no flotation cost. A 10%,$1,000 par value, annually dividend, perpetual preferred stock sells for $1,111. Both an existing common stock and a new common stock issue, which incurs no flotation cost of the proceeds, sells for $50,D1=$4.3995 and g=$%,b=1.2. Tax rate is 40%. following data: D1=$2.00;P0=$42.50;g=5.00% Inc, to estimate is cost of common equity. You obtained is the cost of equity raised by selling new common stock? a.9.95%b.10.33%c.9.80%d.12.50%e.13.12% 17. You want to quit your job and go back to school for a law degree 4 years from now, and you plan to save a.$16,112b.$16,918c.$16,734d.$22,082e.$17,665 18. Mr. Lee found two opportunities of Investment A (rate of return 2%, standard deviation 2% ) and Investment B (rate of return 4%, standard deviation 8% ). Investment B is better than Investment A. So, he should invest in Investment B rather than Investment A. a. True b. False 19. Which one is the midpoint of the range of the marginal cost of common equity, calculated from the data below? Data: A 15 -year, 10% coupon, semiannual payment non-callable bonds sell for $1,392.00. New bonds will be privately placed with no flotation cost. Bond-Yield Risk Premium (RP) =4%. Both an existing common stock and a new common stock issue, which incurs no flotation cost of the proceeds, sell for $50,D1=$4,3995 and g=5%,b=1.2;rmR=7%;RPM=6%. marginal cost of common equity using retained earnings or new earnings, calculated from the above data? Date: A 15-year, 10% coupon, semianneal payment non-callable bonds sell for $1,392. New bonds will be privately placed with no flotation cost. A 10%,$1,000 par value, annually dividend, perpetual preferred stock sells for $1,111. Both an existing common stock and a new common stock issue, which incurs no flotation cost of the proceeds, sells for $50,D1=$4.3995 and g=$%,b=1.2. Tax rate is 40%