Answered step by step

Verified Expert Solution

Question

1 Approved Answer

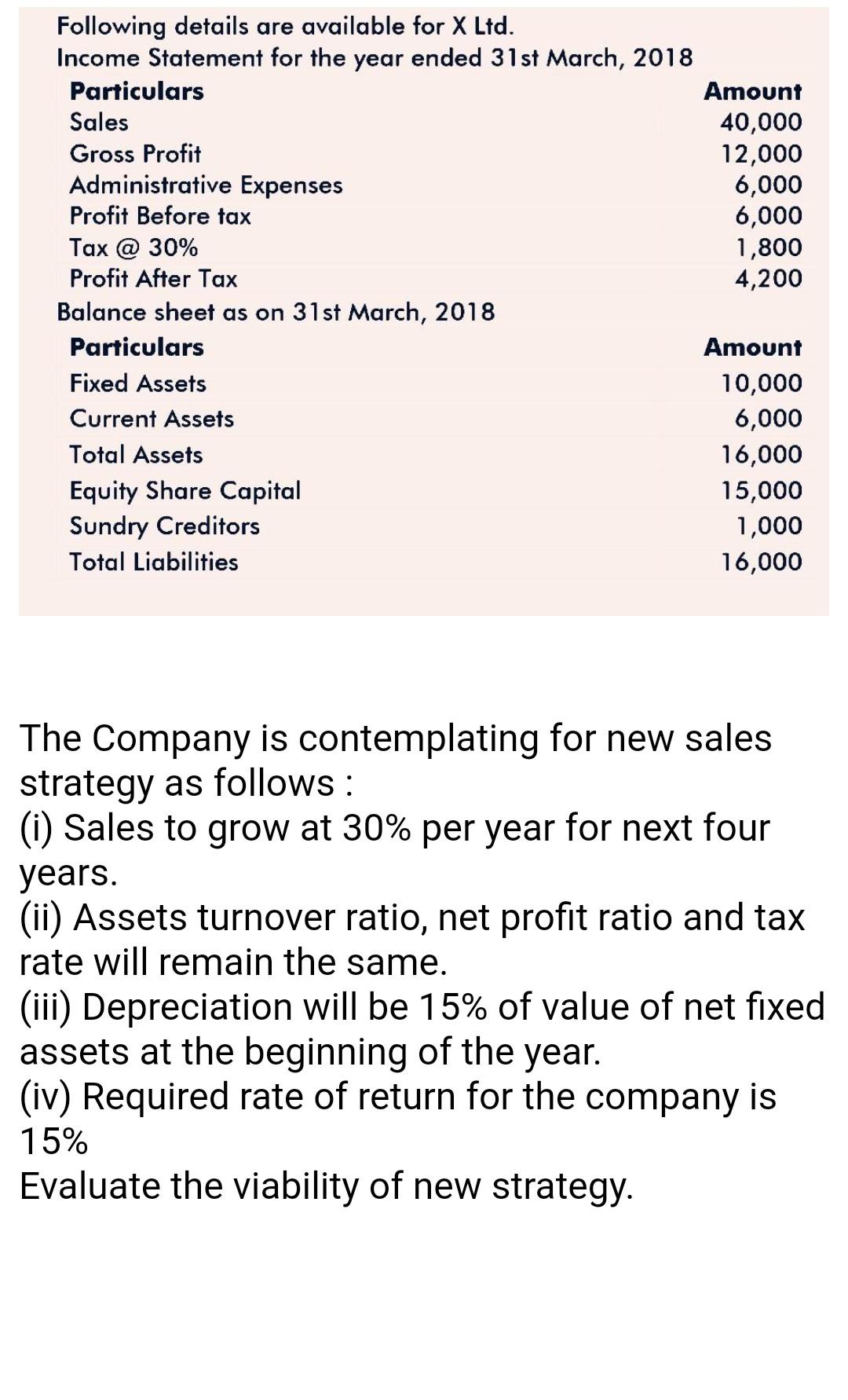

Following details are available for X Ltd. Income Statement for the year ended 31 st March, 2018 Particulars Amount Sales 40,000 Gross Profit 12,000 Administrative

Following details are available for X Ltd. Income Statement for the year ended 31 st March, 2018 Particulars Amount Sales 40,000 Gross Profit 12,000 Administrative Expenses 6,000 Profit Before tax 6,000 Tax @ 30% 1,800 Profit After Tax 4,200 Balance sheet as on 31st March, 2018 Particulars Amount Fixed Assets 10,000 Current Assets 6,000 Total Assets 16,000 Equity Share Capital 15,000 Sundry Creditors 1,000 Total Liabilities 16,000 The Company is contemplating for new sales strategy as follows: (i) Sales to grow at 30% per year for next four years. (ii) Assets turnover ratio, net profit ratio and tax rate will remain the same. (iii) Depreciation will be 15% of value of net fixed assets at the beginning of the year. (iv) Required rate of return for the company is 15% Evaluate the viability of new strategy

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started