Answered step by step

Verified Expert Solution

Question

1 Approved Answer

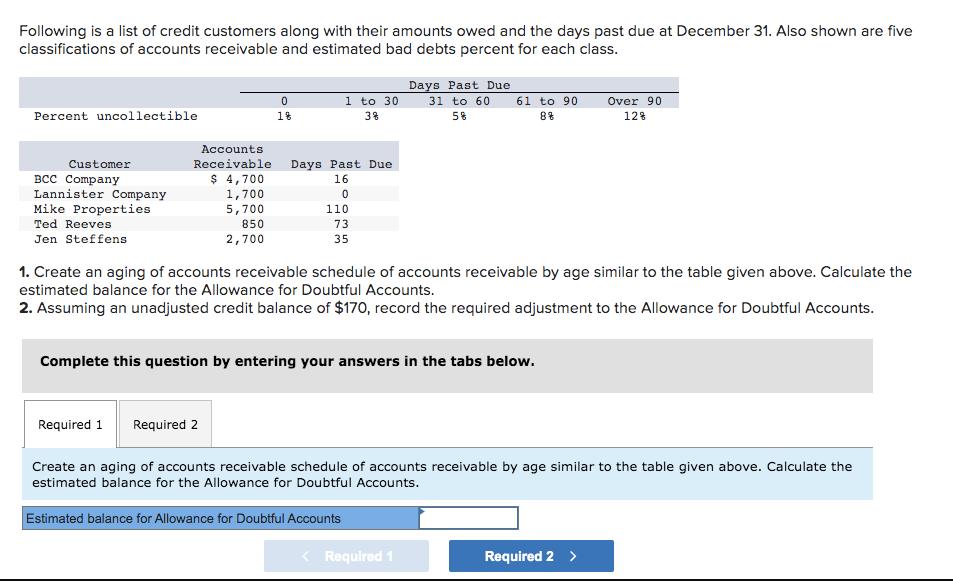

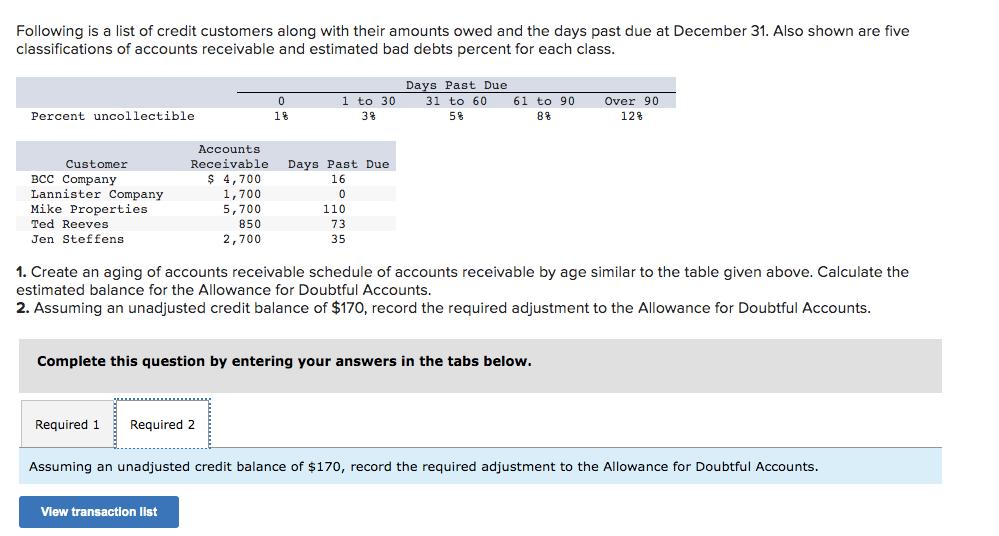

Following is a list of credit customers along with their amounts owed and the days past due at December 31. Also shown are five

Following is a list of credit customers along with their amounts owed and the days past due at December 31. Also shown are five classifications of accounts receivable and estimated bad debts percent for each class. Percent uncollectible Customer BCC Company Lannister Company Mike Properties Ted Reeves Jen Steffens 0 1% Accounts Receivable Days Past Due 16 $ 4,700 1,700 5,700 850 2,700 1 to 30 3% Required 1 Required 2 0 110 73 35 Days Past Due 31 to 60 61 to 90 58 8% 1. Create an aging of accounts receivable schedule of accounts receivable by age similar to the table given above. Calculate the estimated balance for the Allowance for Doubtful Accounts. 2. Assuming an unadjusted credit balance of $170, record the required adjustment to the Allowance for Doubtful Accounts. Complete this question by entering your answers in the tabs below. Required 1 Over 90 12% Create an aging of accounts receivable schedule of accounts receivable by age similar to the table given above. Calculate the estimated balance for the Allowance for Doubtful Accounts. Estimated balance for Allowance for Doubtful Accounts Required 2 > Following is a list of credit customers along with their amounts owed and the days past due at December 31. Also shown are five classifications of accounts receivable and estimated bad debts percent for each class. Percent uncollectible. Customer BCC Company Lannister Company Mike Properties Ted Reeves Jen Steffens 0 Accounts. Receivable Days Past Due 16 $ 4,700 1,700 5,700 850 2,700 Required 1 Required 2 1 to 30 3% View transaction list 0 110 73 35 Days Past Due 31 to 60 61 to 90 5% 8% 1. Create an aging of accounts receivable schedule of accounts receivable by age similar to the table given above. Calculate the estimated balance for the Allowance for Doubtful Accounts. 2. Assuming an unadjusted credit balance of $170, record the required adjustment to the Allowance for Doubtful Accounts. Complete this question by entering your answers in the tabs below. Over 90 12% Assuming an unadjusted credit balance of $170, record the required adjustment to the Allowance for Doubtful Accounts.

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Answer Working 1 Aging analysis schedule for Requirement 1 0 not due 1 to 30 31 to 60 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started