Question

Following is a list of information for Peter and Amy Jones for the current tax year. Peter and Amy are married and have three children,

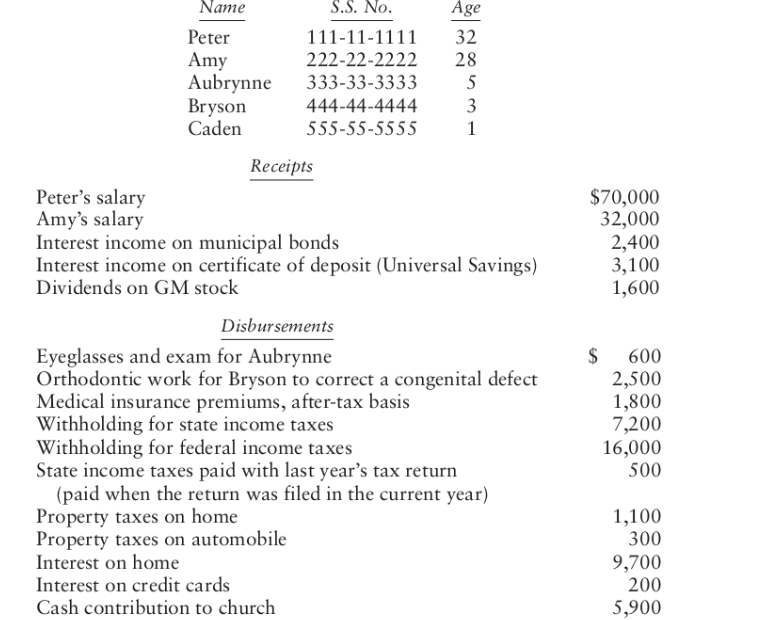

Following is a list of information for Peter and Amy Jones for the current tax year. Peter and Amy are married and have three children, Aubrynne, Bryson, and Caden. They live at 100 Main Street, Anytown, USA 00000. Peter is a lawyer working for a Native American law firm. Amy works part-time in a genetic research lab. The Jones Social Security numbers are ages are as follows: In addition to the above, on September 17, Peter and Amy donate some Beta Trader, Inc. stock to Lakeville Community College. Beta Trader, Inc. is publicly traded. The Fair Market Value (FMV) of the stock on the date of the contribution is $700. Peter and Amy had purchased the stock on November 7, 2004 for $300.

Compute Peter and Amys income tax liability for 2018 using Form 1040, Schedules A and B, and Form 8283, if necessary.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started