Answered step by step

Verified Expert Solution

Question

1 Approved Answer

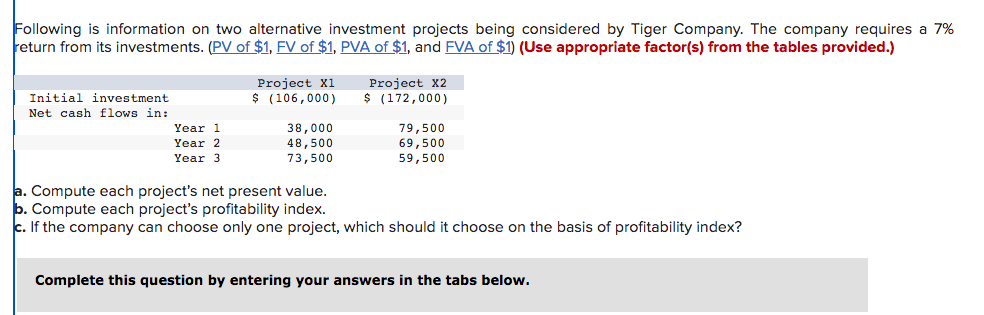

Following is information on two alternative investment projects being considered by Tiger Company. The company requires a 7% return from its investments. (PV of

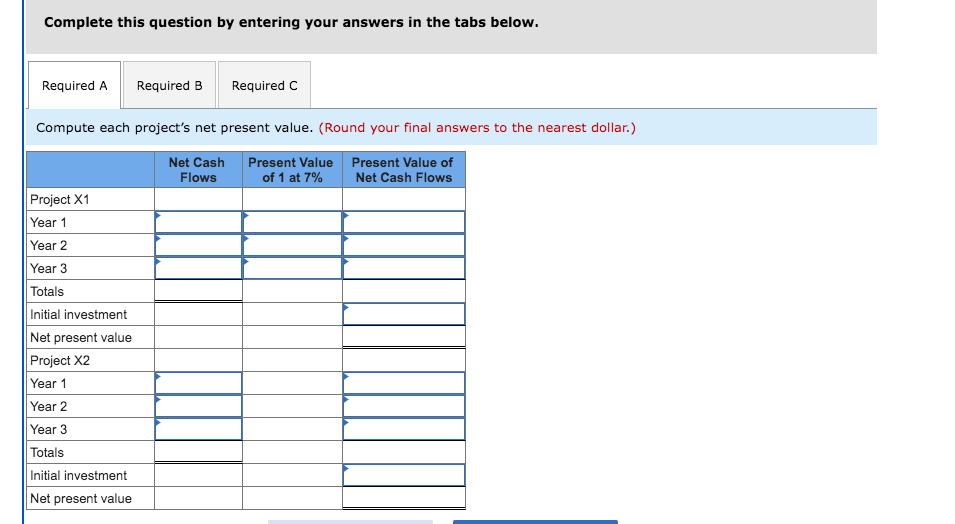

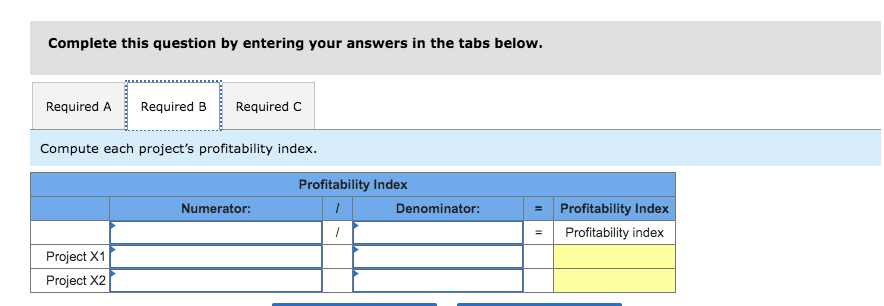

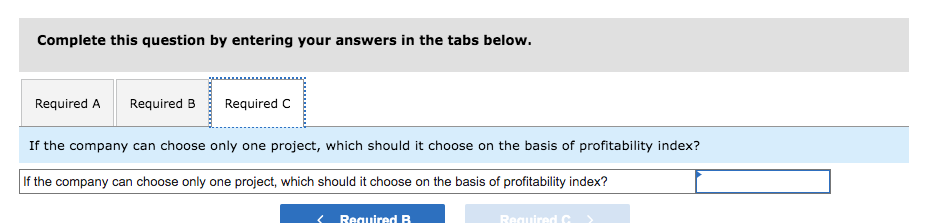

Following is information on two alternative investment projects being considered by Tiger Company. The company requires a 7% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project X1 Project X2 Initial investment $ (106,000) $ (172,000) Net cash flows in: Year 1 38,000 79,500 Year 2 48,500 69,500 Year 3 73,500 59,500 a. Compute each project's net present value. b. Compute each project's profitability index. c. If the company can choose only one project, which should it choose on the basis of profitability index? Complete this question by entering your answers in the tabs below. Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute each project's net present value. (Round your final answers to the nearest dollar.) Net Cash Flows Present Value of 1 at 7% Present Value of Net Cash Flows Project X1 Year 1 Year 2 Year 3 Totals Initial investment Net present value Project X2 Year 1 Year 2 Year 3 Totals Initial investment Net present value Complete this question by entering your answers in the tabs below. Required A Required B Required C Compute each project's profitability index. Project X1 Project X2 Numerator: Profitability Index Denominator: Profitability Index Profitability index Complete this question by entering your answers in the tabs below. Required A Required B Required C If the company can choose only one project, which should it choose on the basis of profitability index? If the company can choose only one project, which should it choose on the basis of profitability index?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Net Present Value Project X1 Year 1 cash flow 38000 PV factor for 1 period at 7 09346 PV of year 1 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started