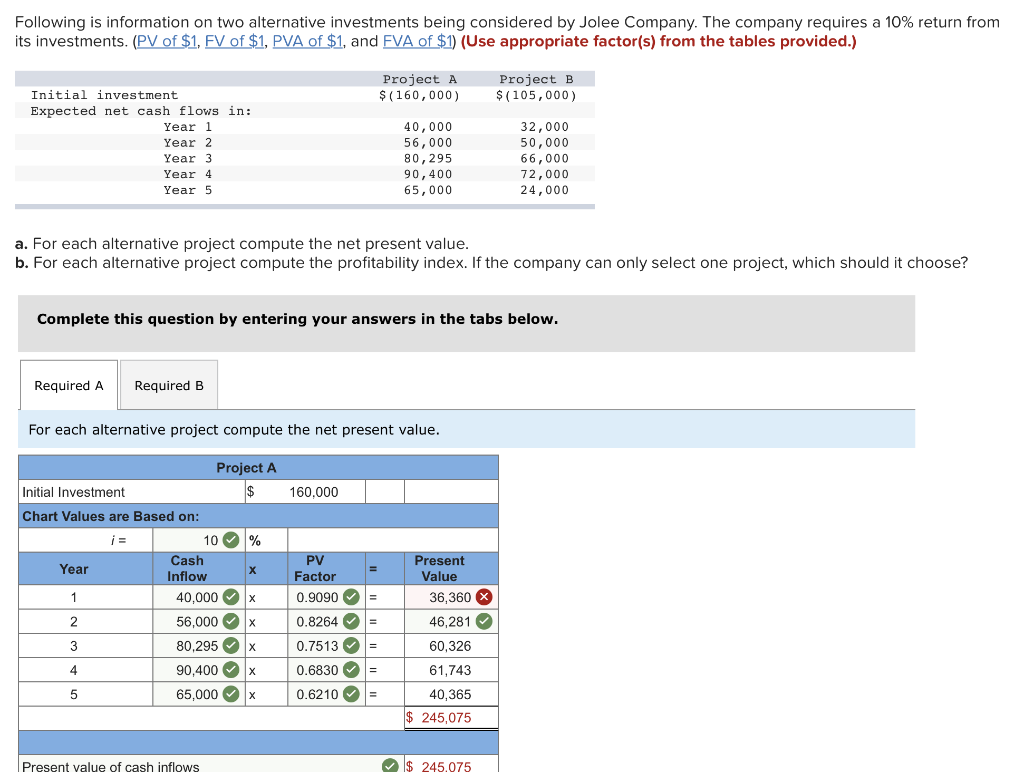

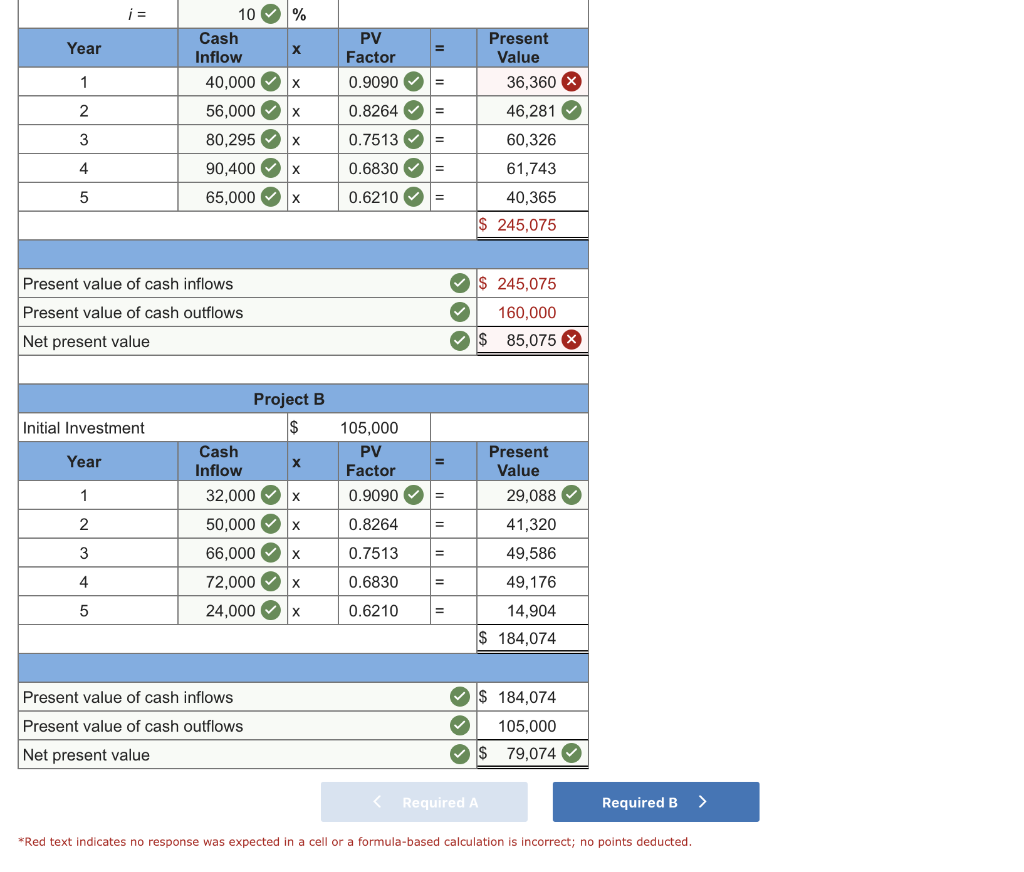

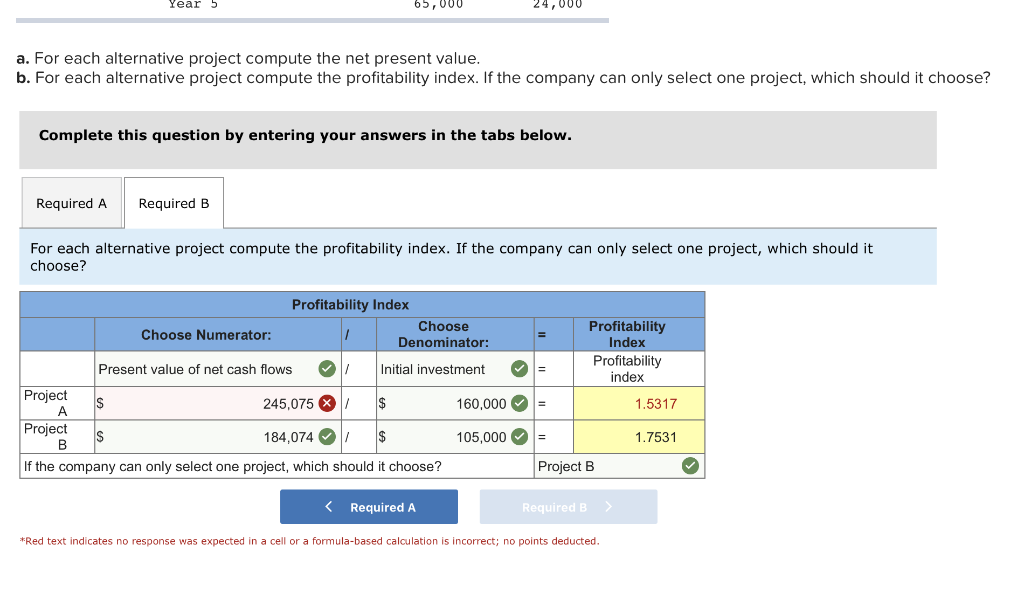

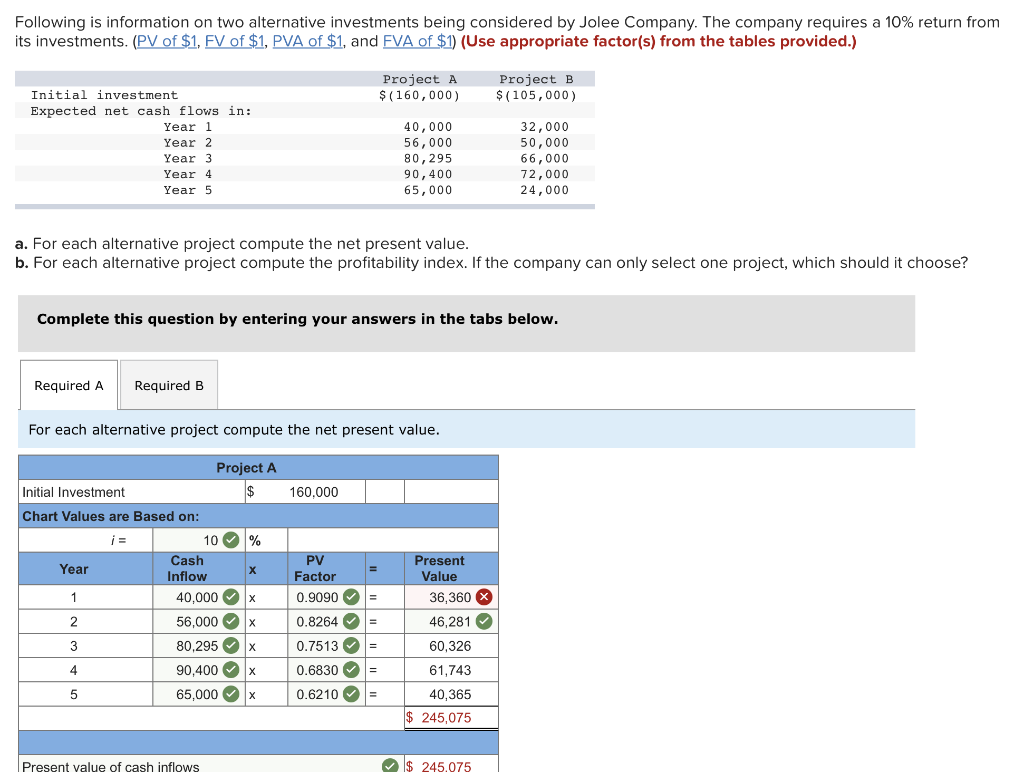

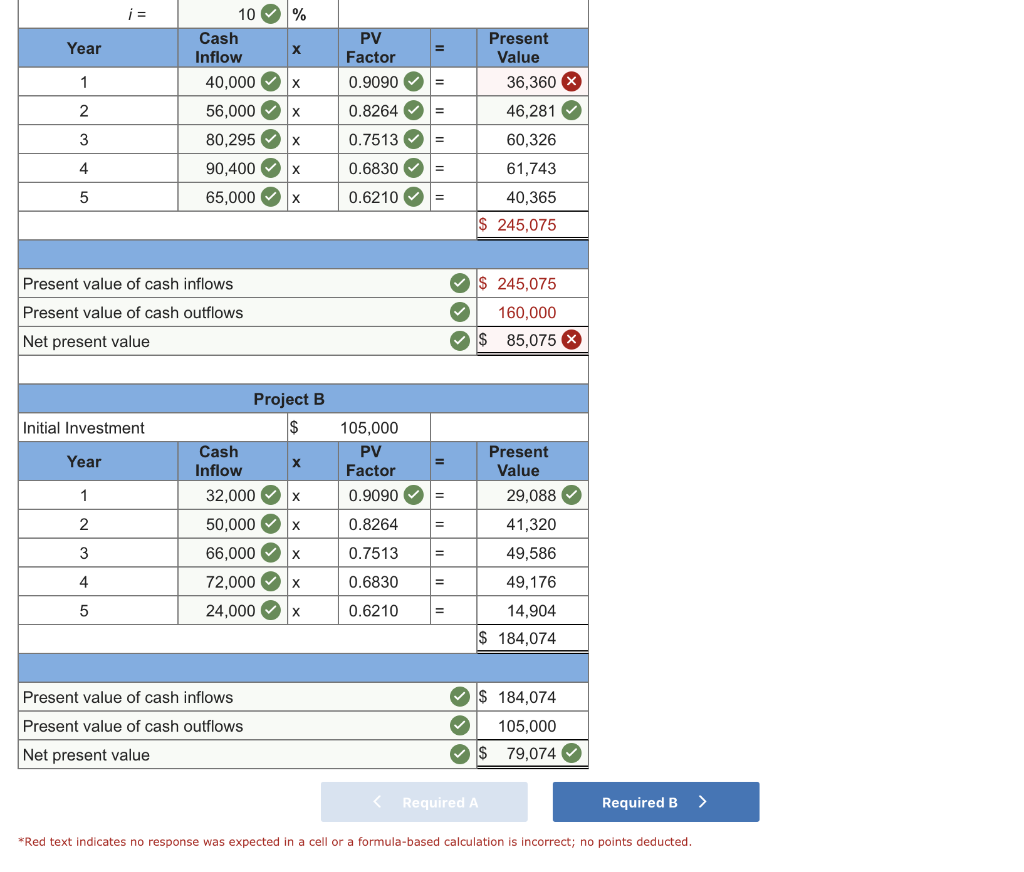

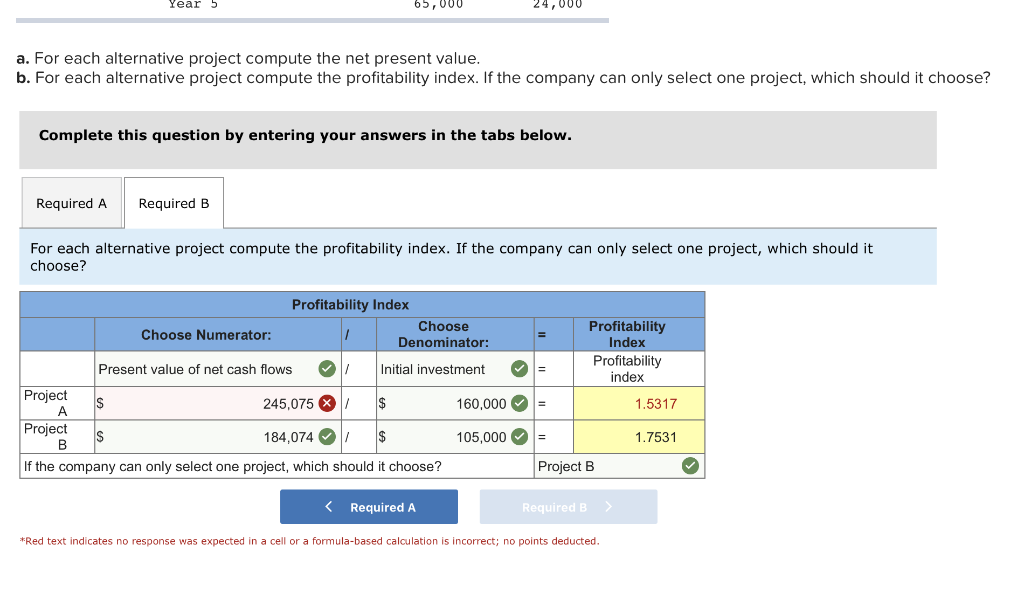

Following is information on two alternative investments being considered by Jolee Company. The company requires a 10% return from its investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Project A $(160,000) Project B $ (105,000) Initial investment Expected net cash flows in: Year 1 Year 2 Year 3 Year 4 Year 5 40,000 56,000 80,295 90, 400 65,000 32,000 50,000 66,000 72,000 24,000 a. For each alternative project compute the net present value. b. For each alternative project compute the profitability index. If the company can only select one project, which should it choose? Complete this question by entering your answers in the tabs below. Required A Required B For each alternative project compute the net present value. 160,000 Project A Initial Investment $ Chart Values are Based on: 10 % X PV Year Inflow X Factor - 2 40,000 56,000 80,295 90,400 65,000 X 0.9090 0.8264 0.7513 0.6830 0.6210 = = = = = Present Value 36,360 46,281 60,326 61,743 40,365 $ 245,075 Present value of cash inflows $ 245,075 Year 1 - 2 3 4 10 Cash Inflow 40,000 56,000 80,295 90,400 65,000 PV Factor 0.9090 0.8264 0.7513 0.6830 0.6210 = = Present Value 36,360 46,281 60,326 61,743 - 5 x = 40,365 $ 245,075 Present value of cash outflows Net present value $ 245,075 160,000 $ 85,075 X Project B Initial Investment Year X W 1 105,000 PV Factor 0.9090 0.8264 0.7513 Cash Inflow 32,000 50,000 66,000 72,000 24,000 2 3 - Present Value 29,088 41,320 49,586 49,176 14,904 $ 184,074 0.6830 5 0.6210 Present value of cash inflows Present value of cash outflows Net present value $ 184,074 105,000 $ 79,074 - Required A Required . *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. Year 5 65,000 24,000 a. For each alternative project compute the net present value. b. For each alternative project compute the profitability index. If the company can only select one project, which should it choose? Complete this question by entering your answers in the tabs below. Required A Required B For each alternative project compute the profitability index. If the company can only select one project, which should it choose? Profitability Index Choose Choose Numerator: Denominator: Present value of net cash flows I Initial investment Project 245,075 1 $ 160,000 Project 184,074 $ 105,000 If the company can only select one project, which should it choose? Profitability Index = Profitability index = 1.5317 = 1.7531 Project B A *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted