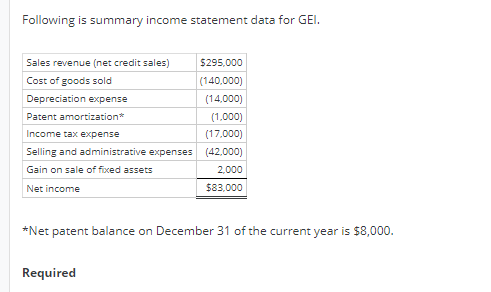

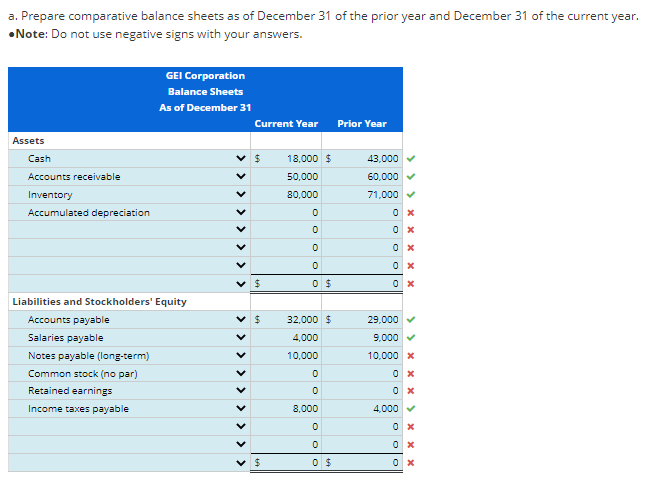

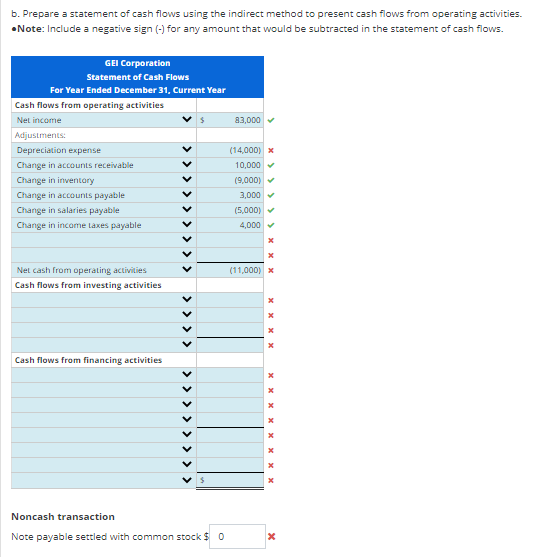

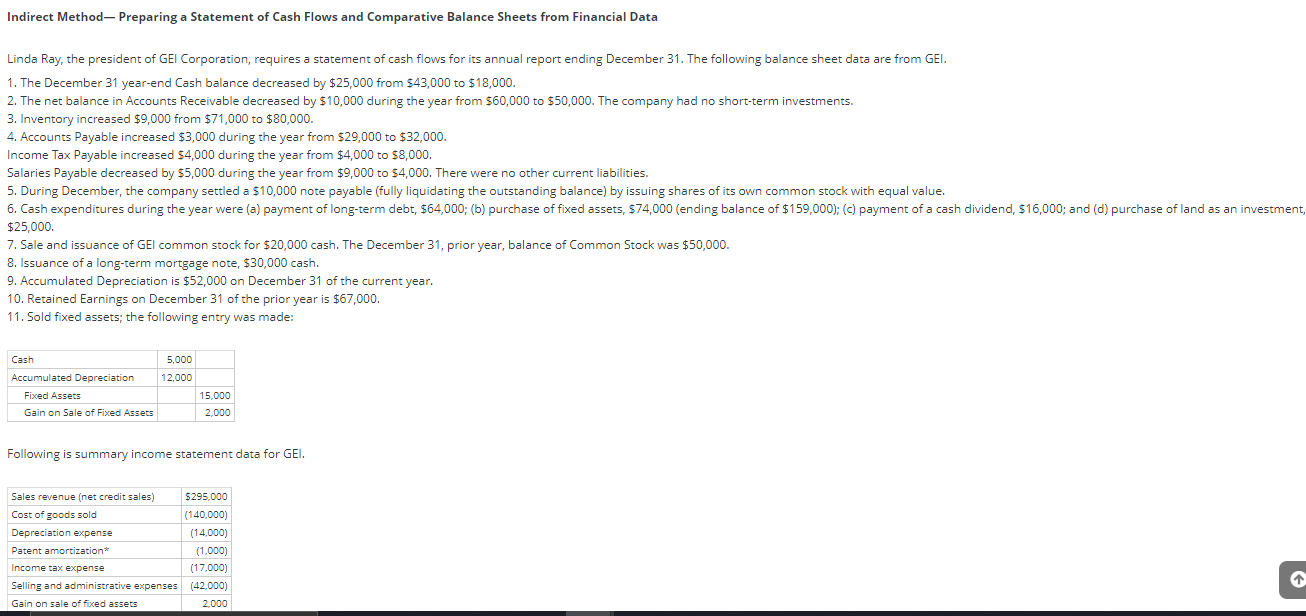

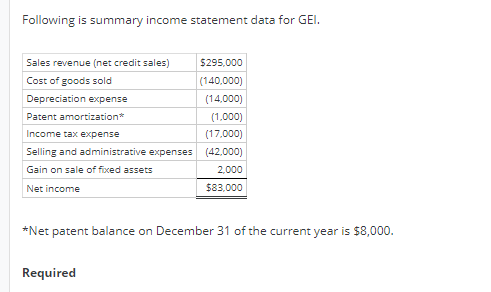

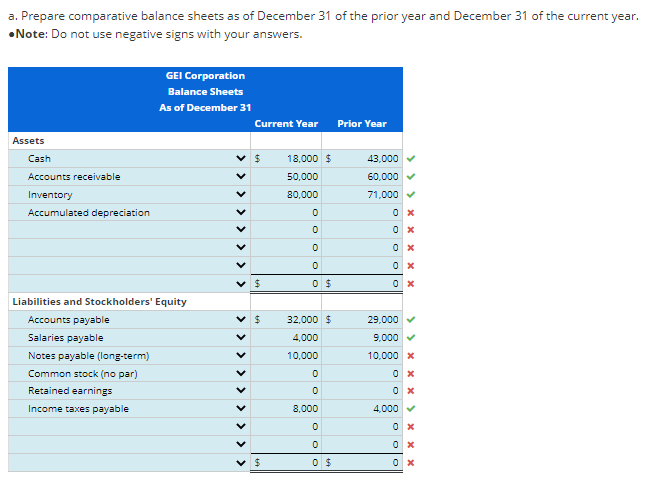

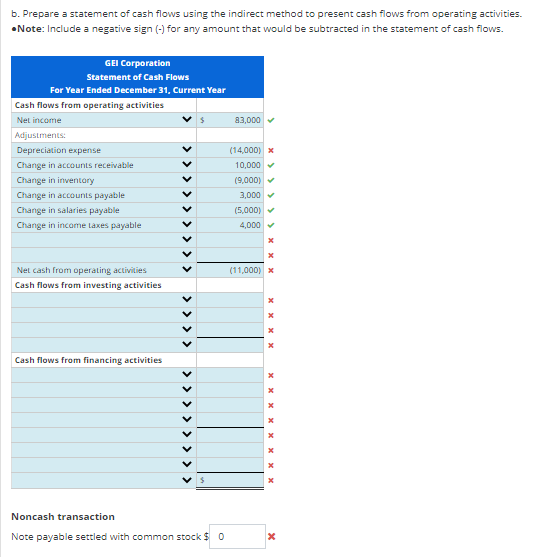

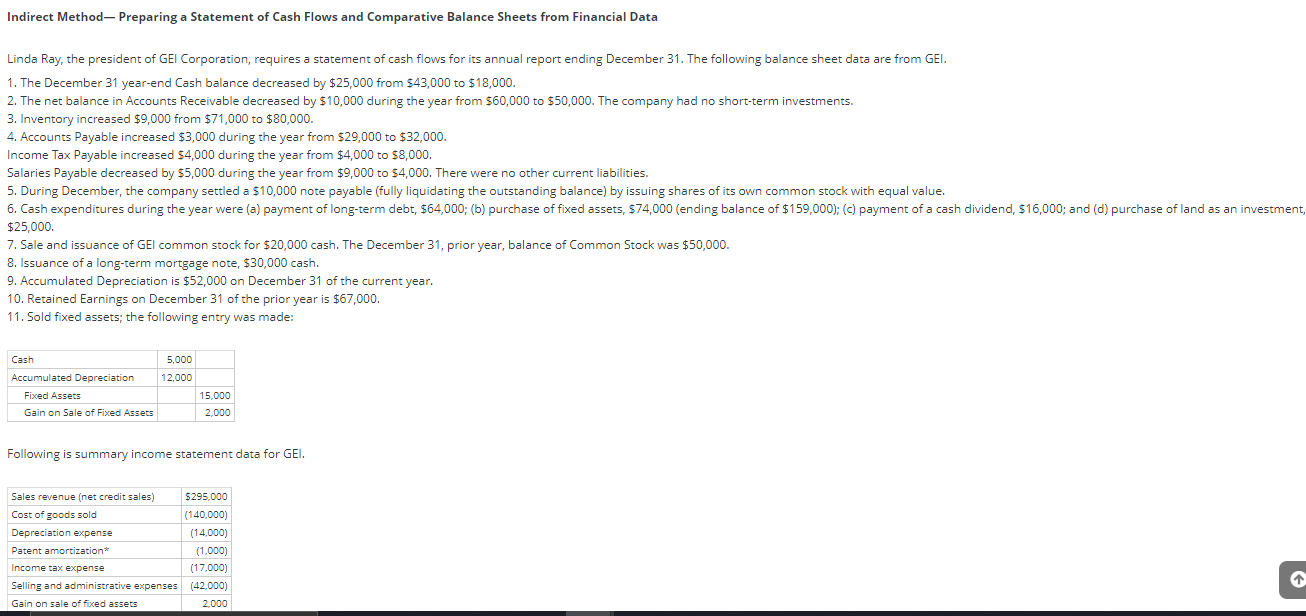

Following is summary income statement data for GEl. Net patent balance on December 31 of the current year is $8,000. a. Prepare comparative balance sheets as of December 31 of the prior year and December 31 of the current year. - Note: Do not use negative signs with your answers. b. Prepare a statement of cash flows using the indirect method to present cash flows from operating activities. - Note: Include a negative sign (-) for any amount that would be subtracted in the statement of cash flows. Note payable settled with common stock $ Indirect Method- Preparing a Statement of Cash Flows and Comparative Balance Sheets from Financial Data Linda Ray, the president of GEl Corporation, requires a statement of cash flows for its annual report ending December 31 . The following balance sheet data are from GEl. 1. The December 31 year-end Cash balance decreased by $25,000 from $43,000 to $18,000. 2. The net balance in Accounts Receivable decreased by $10,000 during the year from $60,000 to $50,000. The company had no short-term investments. 3. Inventory increased $9,000 from $71,000 to $80,000. 4. Accounts Payable increased $3,000 during the year from $29,000 to $32,000. Income Tax Payable increased $4,000 during the year from $4,000 to $8,000. Salaries Payable decreased by $5,000 during the year from $9,000 to $4,000. There were no other current liabilities. 5. During December, the company settled a $10,000 note payable (fully liquidating the outstanding balance) by issuing shares of its own common stock with equal value. $25,000. 7. Sale and issuance of GEI common stock for $20,000 cash. The December 31 , prior year, balance of Common Stock was $50,000. 8. Issuance of a long-term mortgage note, $30,000 cash. 9. Accumulated Depreciation is $52,000 on December 31 of the current year. 10. Retained Earnings on December 31 of the prior year is $67,000. 11. Sold fixed assets; the following entry was made: Following is summary income statement data for GEl. Following is summary income statement data for GEl. Net patent balance on December 31 of the current year is $8,000. a. Prepare comparative balance sheets as of December 31 of the prior year and December 31 of the current year. - Note: Do not use negative signs with your answers. b. Prepare a statement of cash flows using the indirect method to present cash flows from operating activities. - Note: Include a negative sign (-) for any amount that would be subtracted in the statement of cash flows. Note payable settled with common stock $ Indirect Method- Preparing a Statement of Cash Flows and Comparative Balance Sheets from Financial Data Linda Ray, the president of GEl Corporation, requires a statement of cash flows for its annual report ending December 31 . The following balance sheet data are from GEl. 1. The December 31 year-end Cash balance decreased by $25,000 from $43,000 to $18,000. 2. The net balance in Accounts Receivable decreased by $10,000 during the year from $60,000 to $50,000. The company had no short-term investments. 3. Inventory increased $9,000 from $71,000 to $80,000. 4. Accounts Payable increased $3,000 during the year from $29,000 to $32,000. Income Tax Payable increased $4,000 during the year from $4,000 to $8,000. Salaries Payable decreased by $5,000 during the year from $9,000 to $4,000. There were no other current liabilities. 5. During December, the company settled a $10,000 note payable (fully liquidating the outstanding balance) by issuing shares of its own common stock with equal value. $25,000. 7. Sale and issuance of GEI common stock for $20,000 cash. The December 31 , prior year, balance of Common Stock was $50,000. 8. Issuance of a long-term mortgage note, $30,000 cash. 9. Accumulated Depreciation is $52,000 on December 31 of the current year. 10. Retained Earnings on December 31 of the prior year is $67,000. 11. Sold fixed assets; the following entry was made: Following is summary income statement data for GEl