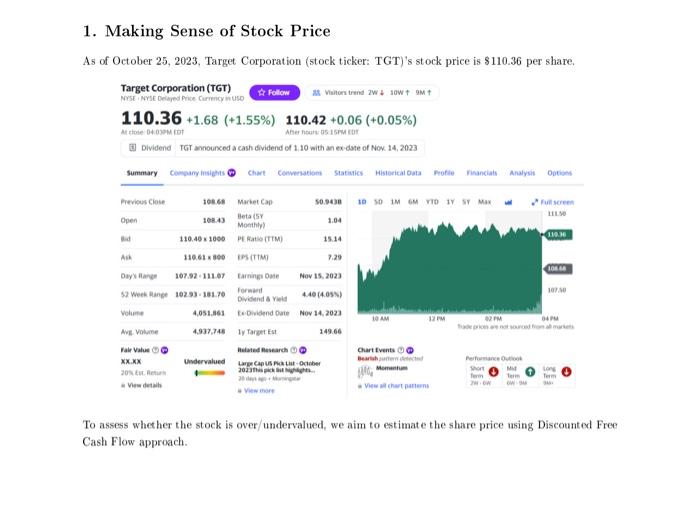

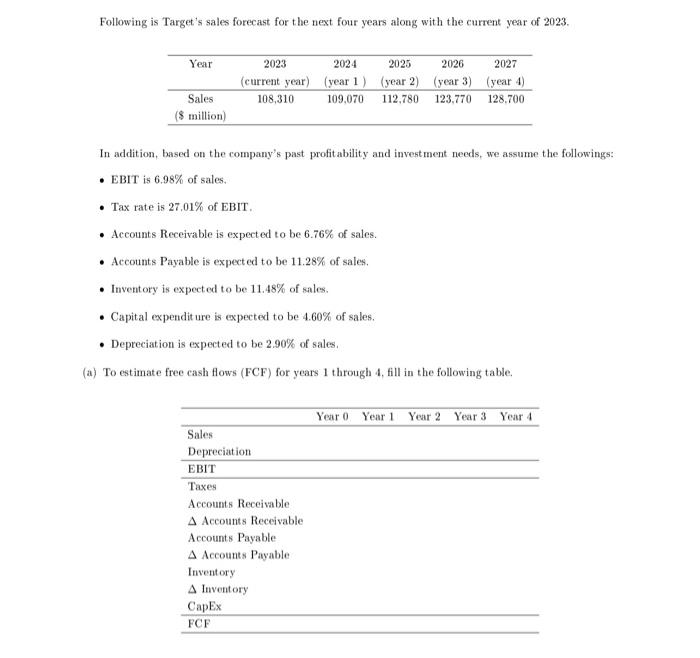

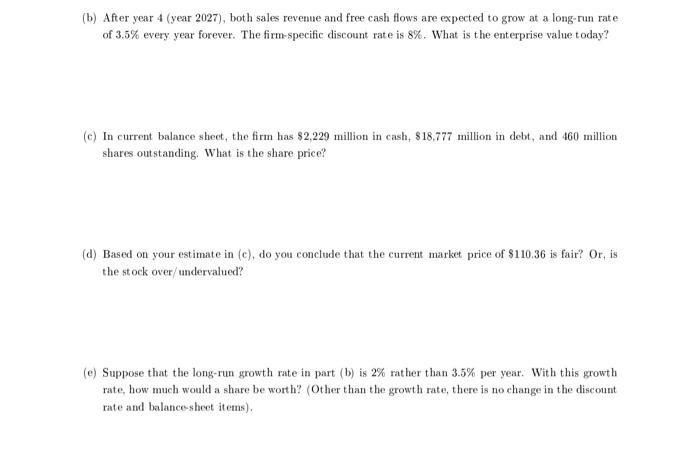

Following is Target's sales forecast for the next four years along with the current year of 2023 . In addition, based on the company's past profitability and investment needs, we assume the followings: - EBIT is 6.98% of sales. - Tax rate is 27,01% of EBIT. - Accounts Receivable is expected to be 6.76% of sales. - Accounts Payable is expected to be 11.28% of sales. - Inventory is expected to be 11.48% of sales. - Capital expenditure is expected to be 4.60% of sales. - Depreciation is expected to be 2.90% of sales. (a) To estimate free cash flows (FCF) for years 1 through 4 , fill in the following table. To assess whether the stock is over/undervalued, we aim to estimate the share price using Discounted Free Cash Flow approach. (b) After year 4 (year 2027), both sales revenue and free cash flows are expected to grow at a long-run rate of 3.5% every year forever. The firm-specific discount rate is 8%. What is the enterprise value today? (c) In current balance shect, the firm has $2,229 million in cash, $18,777 million in debt, and 460 million shares outstanding. What is the share price? (d) Based on your estimate in (c), do you conclude that the current market price of $110.36 is fair? Or, is the stock over/ undervalued? (e) Suppose that the long-run growth rate in part (b) is 2% rather than 3.5% per year. With this growth rate, how much would a share be worth? (Other than the growth rate, there is no change in the discount rate and balance-sheet items). Following is Target's sales forecast for the next four years along with the current year of 2023 . In addition, based on the company's past profitability and investment needs, we assume the followings: - EBIT is 6.98% of sales. - Tax rate is 27,01% of EBIT. - Accounts Receivable is expected to be 6.76% of sales. - Accounts Payable is expected to be 11.28% of sales. - Inventory is expected to be 11.48% of sales. - Capital expenditure is expected to be 4.60% of sales. - Depreciation is expected to be 2.90% of sales. (a) To estimate free cash flows (FCF) for years 1 through 4 , fill in the following table. To assess whether the stock is over/undervalued, we aim to estimate the share price using Discounted Free Cash Flow approach. (b) After year 4 (year 2027), both sales revenue and free cash flows are expected to grow at a long-run rate of 3.5% every year forever. The firm-specific discount rate is 8%. What is the enterprise value today? (c) In current balance shect, the firm has $2,229 million in cash, $18,777 million in debt, and 460 million shares outstanding. What is the share price? (d) Based on your estimate in (c), do you conclude that the current market price of $110.36 is fair? Or, is the stock over/ undervalued? (e) Suppose that the long-run growth rate in part (b) is 2% rather than 3.5% per year. With this growth rate, how much would a share be worth? (Other than the growth rate, there is no change in the discount rate and balance-sheet items)