Question

Following is the clothing & accessories department store chain (multi-stores, multi-locations) budget. Due to COVID -19, the company has experienced a reduction in business and

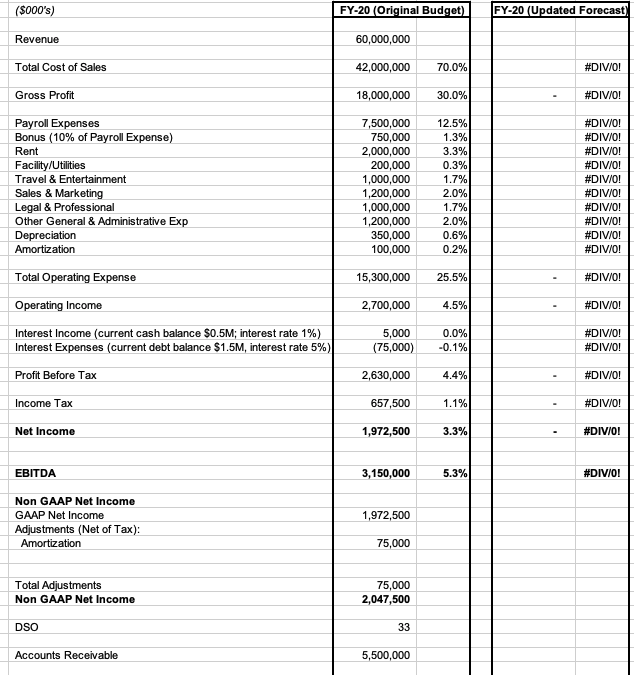

Following is the clothing & accessories department store chain (multi-stores, multi-locations) budget. Due to COVID -19, the company has experienced a reduction in business and they would like to update the forecast from original budget Please update forecast based on following assumptions Provide management commentaries based on the business environment, economy, market trend, demand, other business factors and major items of a forecasted income statement

Please provide recommendations to improve profitability, margin, and reduction in cost.

Please show calculation in excel preferred.

Assumptions:

Revenue:

- Reduce revenue by 25%

-Management decided to give 2% discount on updated revenue

-Create 10% provision for return at year-end. The margin on return products is 20%.

Cost of Sales:

-Management decided to reduce cost of sales by 20% due to a reduction in revenue by terminating some direct temp & full time labor and other direct costs

Operating Expenses:

-Due to a reduction in business, 10 corporate staff with annual $90K salary (plus 20% load for payroll tax and benefits) in the second month of the second quarter were laid off

- Management decided to give one-month severance pay as a one-time payment in Q2 for all impacted staff

- The company has decided to reduce bonus accrual by 50% from the original accrual on update payroll. Terminated staff are not entitled to the bonus

- Due to the current environment, the company announced travel freeze for non-essential travel and plan to reduce travel & entertainment by 30%.

- Sales & Marketing expenses are the same as % of revenue

- Other General & Administrative expenses are the same as % of revenue

- Canceled planned capital expenditure of equipment (with 5 years life) on June 1 for $500K

Other:

-Due to reduction business, the company has used all cash in Q1-20 and no cash balance left

- Due to changes in the business environment, the company has to borrow incremental $1.0M @ 4% interest rate in the beginning of Q2-20 but was able to repay back at the beginning of Q4-20.

- No change in the tax rate

- DSO at yearend increased by 3 days

($000's) FY-20 (Original Budget) FY-20 (Updated Forecast) Revenue 60,000,000 Total Cost of Sales 42,000,000 70.0% #DIV/0! Gross Profit 18,000,000 30.0% #DIV/0! Payroll Expenses Bonus (10% of Payroll Expense) Rent Facility/Utilities Travel & Entertainment Sales & Marketing Legal & Professional Other General & Administrative Exp Depreciation Amortization 7,500,000 750,000 2,000,000 200,000 1,000,000 1,200,000 1,000,000 1,200,000 350,000 100,000 12.5% 1.3% 3.3% 0.3% 1.7% 2.0% 1.7% 2.0% 0.6% 0.2% #DIV/O! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 15,300,000 25.5% #DIV/0! 2,700,000 4.5% #DIV/0! Total Operating Expense Operating Income Interest Income (current cash balance $0.5M; interest rate 1%) Interest Expenses (current debt balance $1.5M, interest rate 5%) 5,000 (75,000) 0.0% -0.1% #DIV/0! #DIV/0! Profit Before Tax 2,630,000 4.4% #DIV/0! Income Tax 657,500 1.1% #DIV/0! Net Income 1,972,500 3.3% #DIV/0! EBITDA 3,150,000 5.3% #DIV/OI 1,972,500 Non GAAP Net Income GAAP Net Income Adjustments (Net of Tax): Amortization 75,000 Total Adjustments Non GAAP Net Income 75,000 2,047,500 DSO 33 Accounts Receivable 5,500,000 ($000's) FY-20 (Original Budget) FY-20 (Updated Forecast) Revenue 60,000,000 Total Cost of Sales 42,000,000 70.0% #DIV/0! Gross Profit 18,000,000 30.0% #DIV/0! Payroll Expenses Bonus (10% of Payroll Expense) Rent Facility/Utilities Travel & Entertainment Sales & Marketing Legal & Professional Other General & Administrative Exp Depreciation Amortization 7,500,000 750,000 2,000,000 200,000 1,000,000 1,200,000 1,000,000 1,200,000 350,000 100,000 12.5% 1.3% 3.3% 0.3% 1.7% 2.0% 1.7% 2.0% 0.6% 0.2% #DIV/O! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! #DIV/0! 15,300,000 25.5% #DIV/0! 2,700,000 4.5% #DIV/0! Total Operating Expense Operating Income Interest Income (current cash balance $0.5M; interest rate 1%) Interest Expenses (current debt balance $1.5M, interest rate 5%) 5,000 (75,000) 0.0% -0.1% #DIV/0! #DIV/0! Profit Before Tax 2,630,000 4.4% #DIV/0! Income Tax 657,500 1.1% #DIV/0! Net Income 1,972,500 3.3% #DIV/0! EBITDA 3,150,000 5.3% #DIV/OI 1,972,500 Non GAAP Net Income GAAP Net Income Adjustments (Net of Tax): Amortization 75,000 Total Adjustments Non GAAP Net Income 75,000 2,047,500 DSO 33 Accounts Receivable 5,500,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started