Question

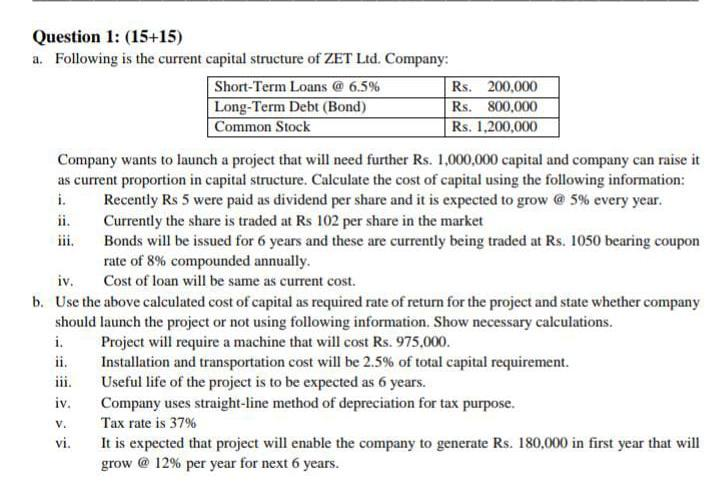

Following is the current capital structure of ZET Ltd. Company: Short-Term Loans @ 6.5% Rs. 200,000 Long-Term Debt (Bond) Rs. 800,000 Common Stock Rs. 1,200,000

Following is the current capital structure of ZET Ltd. Company: Short-Term Loans @ 6.5% Rs. 200,000 Long-Term Debt (Bond) Rs. 800,000 Common Stock Rs. 1,200,000 iii. Company wants to launch a project that will need further Rs. 1,000,000 capital and company can raise it as current proportion in capital structure. Calculate the cost of capital using the following information: i. Recently Rs 5 were paid as dividend per share and it is expected to grow @ 5% every year. ii. Currently the share is traded at Rs 102 per share in the market Bonds will be issued for 6 years and these are currently being traded at Rs. 1050 bearing coupon rate of 8% compounded annually. iv. Cost of loan will be same as current cost. Use the above calculated cost of capital as required rate of return for the project and whether company should launch the project or not using following information. Show necessary calculations. i. Project will require a machine that will cost Rs. 975,000. ii. Installation and transportation cost will be 2.5% of total capital requirement. iii. Useful life of the project is to be expected as 6 years. iv. Company uses straight-line method of depreciation for tax purpose. Tax rate is 37% vi. It is expected that project will enable the company to generate Rs. 180,000 in first year that will grow @ 12% per year for next 6 years. V.

Following is the current capital structure of ZET Ltd. Company: Short-Term Loans @ 6.5% Rs. 200,000 Long-Term Debt (Bond) Rs. 800,000 Common Stock Rs. 1,200,000 iii. Company wants to launch a project that will need further Rs. 1,000,000 capital and company can raise it as current proportion in capital structure. Calculate the cost of capital using the following information: i. Recently Rs 5 were paid as dividend per share and it is expected to grow @ 5% every year. ii. Currently the share is traded at Rs 102 per share in the market Bonds will be issued for 6 years and these are currently being traded at Rs. 1050 bearing coupon rate of 8% compounded annually. iv. Cost of loan will be same as current cost. Use the above calculated cost of capital as required rate of return for the project and whether company should launch the project or not using following information. Show necessary calculations. i. Project will require a machine that will cost Rs. 975,000. ii. Installation and transportation cost will be 2.5% of total capital requirement. iii. Useful life of the project is to be expected as 6 years. iv. Company uses straight-line method of depreciation for tax purpose. Tax rate is 37% vi. It is expected that project will enable the company to generate Rs. 180,000 in first year that will grow @ 12% per year for next 6 years. V.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started