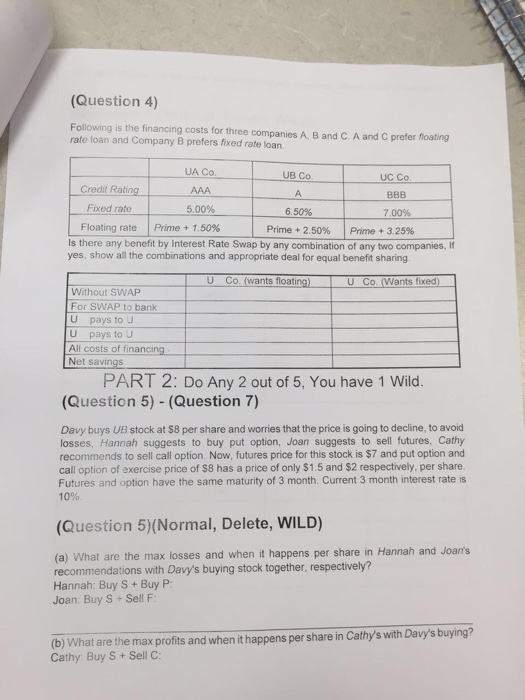

Following is the financing costs for three companies A, B and C prefer floating rate loan and Company B prefers fixed rate loan. Is there any benefit by Interest Rate Swap by any combination of any two companies, If yes, show all the combinations and appropriate deal for equal benefit sharing. PART 2: Do Any 2 out of 5, You have 1 Wild. Davy buys UU stock at dollar 8 per share and worries that the price is going to decline, to avoid losses. Hannah suggests to buy put option, Joan suggests to sell futures. Cathy recommends to sell call option Now. futures price for this stock is dollar 7 and put option and call option of exercise price of dollar 8 has a price of only dollar 1 5 and dollar 2 respectively, per share Futures and option have the same maturity of 3 month Current 3 month interest rate is 10 percentage What arc the max losses and when it happens per share in Hannah and Joans recommendations with Davy's buying stock together, respectively? Hannah: Buy S + Buy P: Joan Buy S + Sell F; What are the max profits and when it happens per share in Cathy's with Davy s buying? Cathy Buy S + Sell C: Following is the financing costs for three companies A, B and C prefer floating rate loan and Company B prefers fixed rate loan. Is there any benefit by Interest Rate Swap by any combination of any two companies, If yes, show all the combinations and appropriate deal for equal benefit sharing. PART 2: Do Any 2 out of 5, You have 1 Wild. Davy buys UU stock at dollar 8 per share and worries that the price is going to decline, to avoid losses. Hannah suggests to buy put option, Joan suggests to sell futures. Cathy recommends to sell call option Now. futures price for this stock is dollar 7 and put option and call option of exercise price of dollar 8 has a price of only dollar 1 5 and dollar 2 respectively, per share Futures and option have the same maturity of 3 month Current 3 month interest rate is 10 percentage What arc the max losses and when it happens per share in Hannah and Joans recommendations with Davy's buying stock together, respectively? Hannah: Buy S + Buy P: Joan Buy S + Sell F; What are the max profits and when it happens per share in Cathy's with Davy s buying? Cathy Buy S + Sell C