Answered step by step

Verified Expert Solution

Question

1 Approved Answer

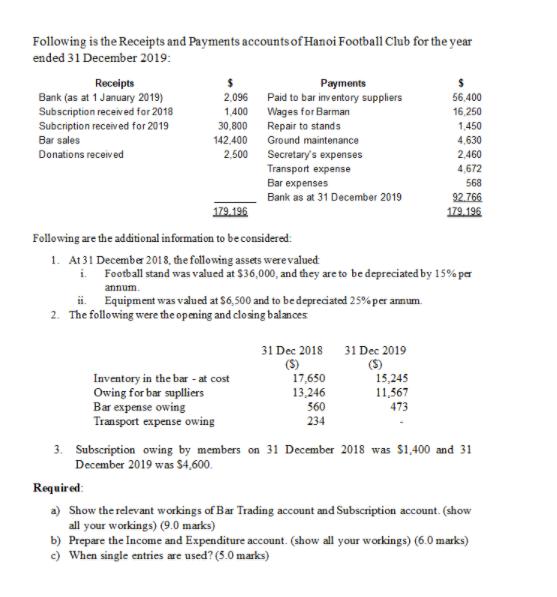

Following is the Receipts and Payments accounts of Hanoi Football Club for the year ended 31 December 2019: Receipts Bank (as at 1 January

Following is the Receipts and Payments accounts of Hanoi Football Club for the year ended 31 December 2019: Receipts Bank (as at 1 January 2019) Subscription received for 2018 Subcription received for 2019 Bar sales Donations received 2,096 1,400 30,800 142,400 2,500 Payments Paid to bar inventory suppliers Wages for Barman Repair to stands Ground maintenance Secretary's expenses Transport expense Bar expenses Bank as at 31 December 2019 179.196 Following are the additional information to be considered: 1. At 31 December 2018, the following assets were valued i. Inventory in the bar - at cost Owing for bar suplliers Bar expense owing Transport expense owing ii. 2. The following were the opening and closing balances Football stand was valued at $36,000, and they are to be depreciated by 15% per annum Equipment was valued at $6,500 and to be depreciated 25% per annum 31 Dec 2018 (S) 17,650 13,246 560 234 31 Dec 2019 ($) 56,400 16,250 15,245 11,567 473 1,450 4,630 2,460 4,672 568 92.766 179.196 3. Subscription owing by members on 31 December 2018 was $1,400 and 31 December 2019 was $4,600. Required: a) Show the relevant workings of Bar Trading account and Subscription account. (show all your workings) (9.0 marks) b) Prepare the Income and Expenditure account. (show all your workings) (6.0 marks) c) When single entries are used? (5.0 marks)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Working Notes 1 Owing for Bar Supplies Dr Cr Particulars Amount Particulars Amount By Balance Brought forward 13246 To Bank Amount paid 56400 By Purch...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started