Question

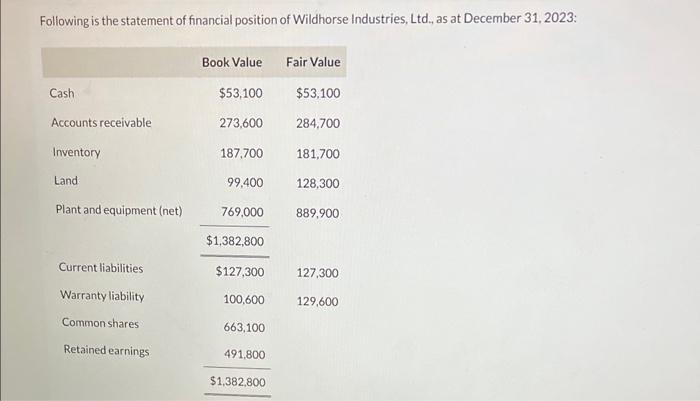

Following is the statement of financial position of Wildhorse Industries, Ltd., as at December 31, 2023: Book Value Fair Value Cash $53,100 $53,100 Accounts

Following is the statement of financial position of Wildhorse Industries, Ltd., as at December 31, 2023: Book Value Fair Value Cash $53,100 $53,100 Accounts receivable 273,600 284,700 Inventory 187,700 181,700 Land. 99,400 128,300 Plant and equipment (net) 769,000 889,900 $1,382,800 Current liabilities $127,300 127,300 Warranty liability 100,600 129,600 Common shares 663,100 Retained earnings 491,800 $1,382,800 The following day (January 1, 2024), Wildhorse was purchased by Crane Enterprises Inc. for a lump-sum cash payment of $1.3 million. Calculate the amount of goodwill acquired by Crane in this transaction. Amount of goodwill $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Intermediate Accounting

Authors: Donald E. Kieso, Jerry J. Weygandt, Terry D. Warfield, Nicola M. Young, Irene M. Wiecek, Bruce J. McConomy

11th Canadian edition Volume 1

1119048532, 978-1119048534

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App