Question

Following table shows information of different combination of portfolio weights in a bond and in a stock and each bonds and stocks expected returns and

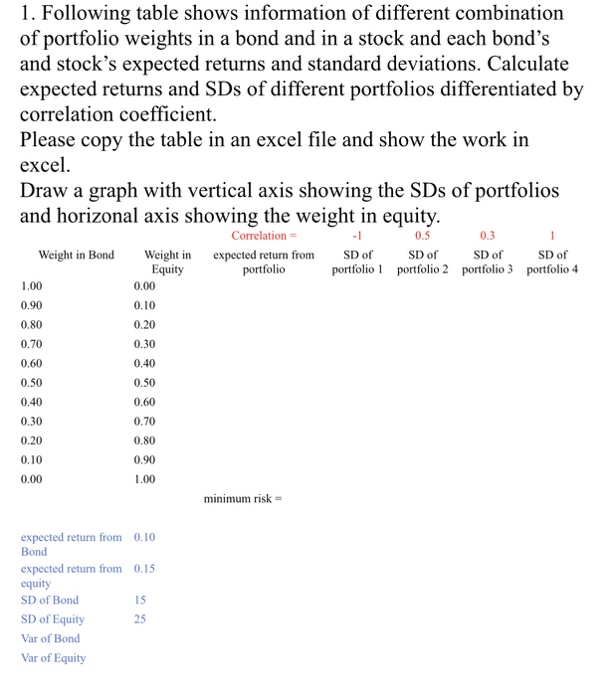

Following table shows information of different combination of portfolio weights in a bond and in a stock and each bonds and stocks expected returns and standard deviations. Calculate expected returns and SDs of different portfolios differentiated by correlation coefficient.

Please copy the table in an excel file and show the work in excel.

Draw a graph with vertical axis showing the SDs of portfolios and horizonal axis showing the weight in equity.

|

|

| Correlation = | -1 | 0.5 | 0.3 | 1 |

| Weight in Bond | Weight in Equity | expected return from portfolio | SD of portfolio 1 | SD of portfolio 2 | SD of portfolio 3 | SD of portfolio 4 |

| 1.00 | 0.00 |

|

|

|

|

|

| 0.90 | 0.10 |

|

|

|

|

|

| 0.80 | 0.20 |

|

|

|

|

|

| 0.70 | 0.30 |

|

|

|

|

|

| 0.60 | 0.40 |

|

|

|

|

|

| 0.50 | 0.50 |

|

|

|

|

|

| 0.40 | 0.60 |

|

|

|

|

|

| 0.30 | 0.70 |

|

|

|

|

|

| 0.20 | 0.80 |

|

|

|

|

|

| 0.10 | 0.90 |

|

|

|

|

|

| 0.00 | 1.00 |

|

|

|

|

|

|

|

| minimum risk = |

|

|

|

|

|

|

|

|

|

|

|

|

| expected return from Bond | 0.10 |

|

|

|

|

|

| expected return from equity | 0.15 |

|

|

|

|

|

| SD of Bond | 15 |

|

|

|

|

|

| SD of Equity | 25 |

|

|

|

|

|

| Var of Bond |

|

|

|

|

|

|

| Var of Equity |

|

|

|

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started