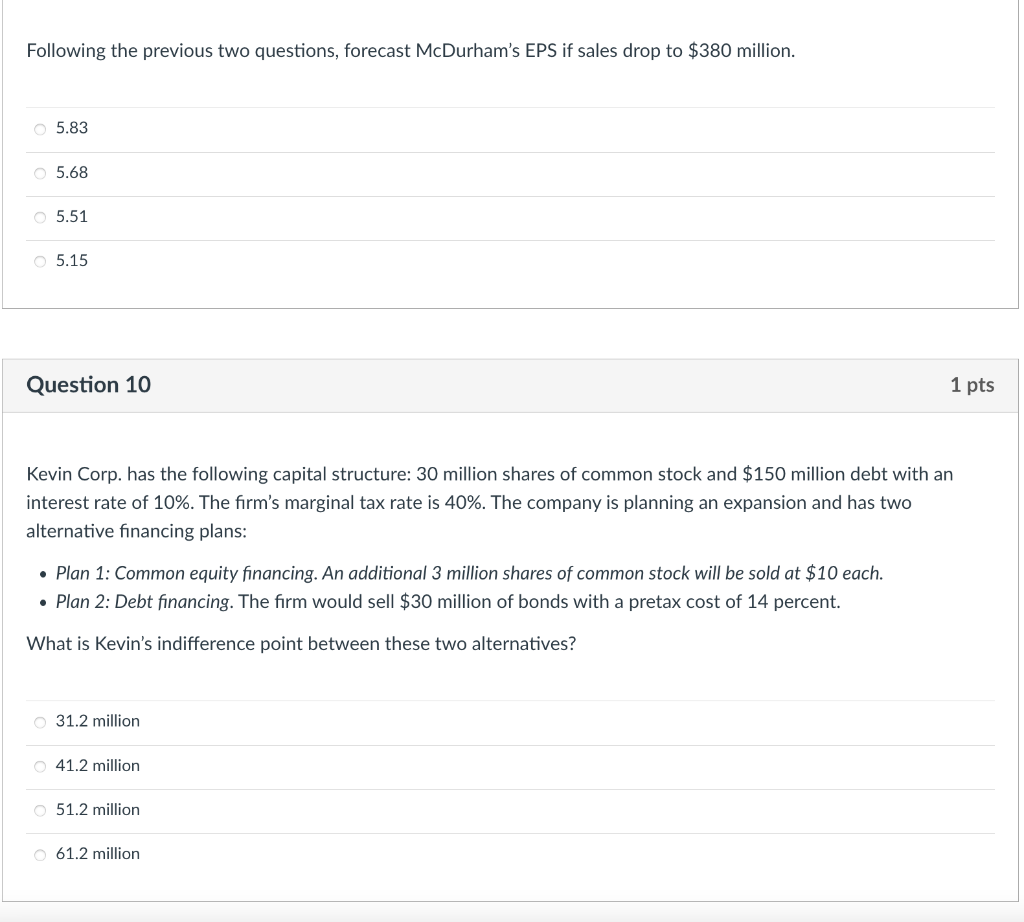

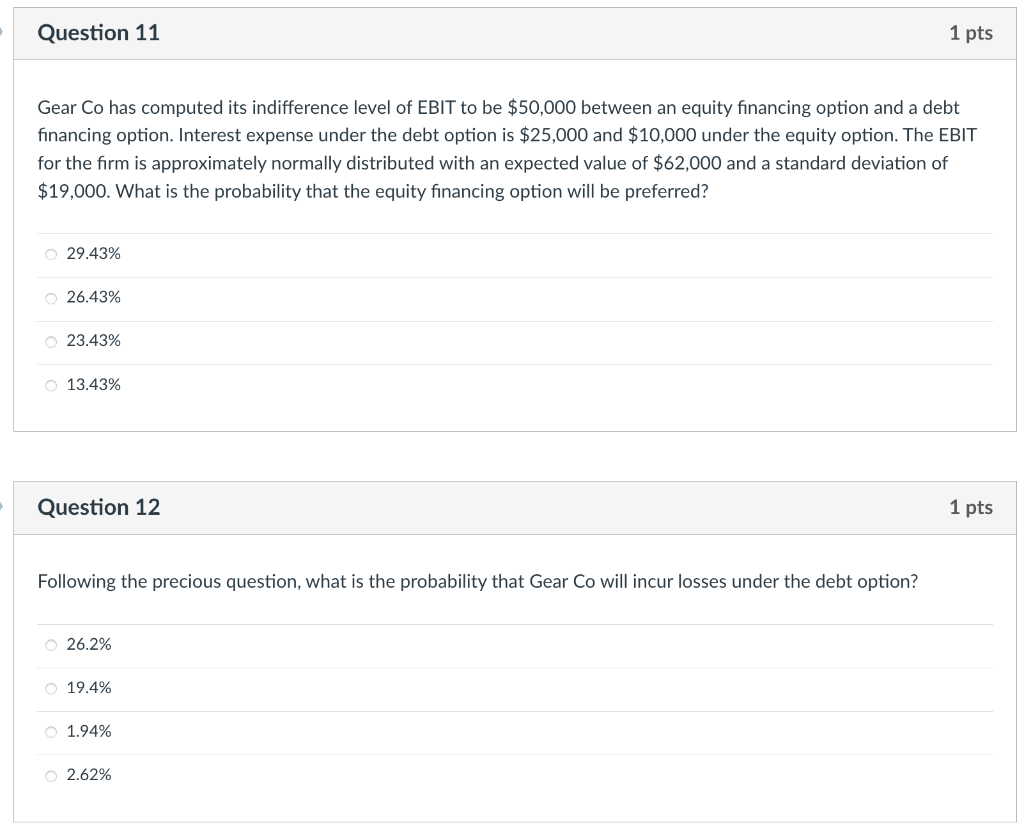

Following the previous two questions, forecast McDurham's EPS if sales drop to $380 million. 5.83 5.68 5.51 5.15 Question 10 1 pts Kevin Corp. has the following capital structure: 30 million shares of common stock and $150 million debt with an interest rate of 10%. The firm's marginal tax rate is 40%. The company is planning an expansion and has two alternative financing plans: Plan 1: Common equity financing. An additional 3 million shares of common stock will be sold at $10 each. Plan 2: Debt financing. The firm would sell $30 million of bonds with a pretax cost of 14 percent. What is Kevin's indifference point between these two alternatives? 31.2 million 41.2 million 51.2 million 61.2 million Question 11 1 pts Gear Co has computed its indifference level of EBIT to be $50,000 between an equity financing option and a debt financing option. Interest expense under the debt option is $25,000 and $10,000 under the equity option. The EBIT for the firm is approximately normally distributed with an expected value of $62,000 and a standard deviation of $19,000. What is the probability that the equity financing option will be preferred? 29.43% 26.43% 23.43% 13.43% Question 12 1 pts Following the precious question, what is the probability that Gear Co will incur losses under the debt option? 26.2% 19.4% 1.94% 0 2.62% Following the previous two questions, forecast McDurham's EPS if sales drop to $380 million. 5.83 5.68 5.51 5.15 Question 10 1 pts Kevin Corp. has the following capital structure: 30 million shares of common stock and $150 million debt with an interest rate of 10%. The firm's marginal tax rate is 40%. The company is planning an expansion and has two alternative financing plans: Plan 1: Common equity financing. An additional 3 million shares of common stock will be sold at $10 each. Plan 2: Debt financing. The firm would sell $30 million of bonds with a pretax cost of 14 percent. What is Kevin's indifference point between these two alternatives? 31.2 million 41.2 million 51.2 million 61.2 million Question 11 1 pts Gear Co has computed its indifference level of EBIT to be $50,000 between an equity financing option and a debt financing option. Interest expense under the debt option is $25,000 and $10,000 under the equity option. The EBIT for the firm is approximately normally distributed with an expected value of $62,000 and a standard deviation of $19,000. What is the probability that the equity financing option will be preferred? 29.43% 26.43% 23.43% 13.43% Question 12 1 pts Following the precious question, what is the probability that Gear Co will incur losses under the debt option? 26.2% 19.4% 1.94% 0 2.62%