Answered step by step

Verified Expert Solution

Question

1 Approved Answer

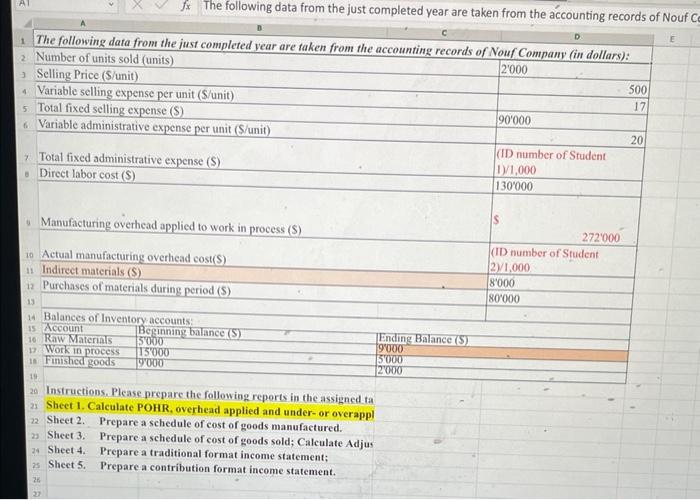

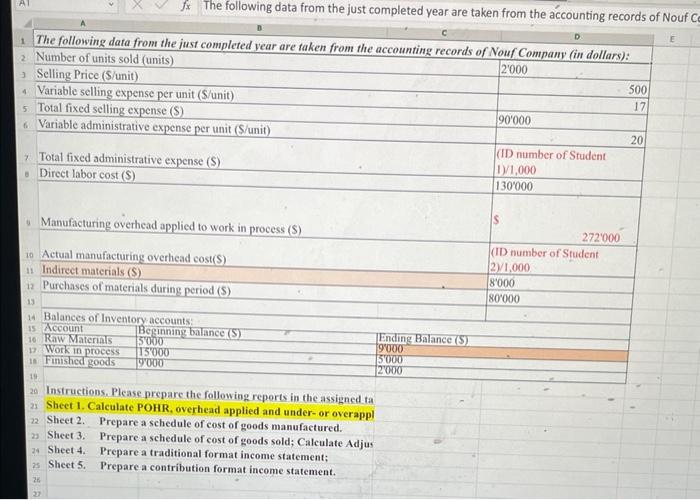

following the same format and order is the following information correct? please explain Sheet 1. Calculate POHR, overhead applied and under-or overappl Sheet 2. Prepare

following the same format and order is the following information correct? please explain

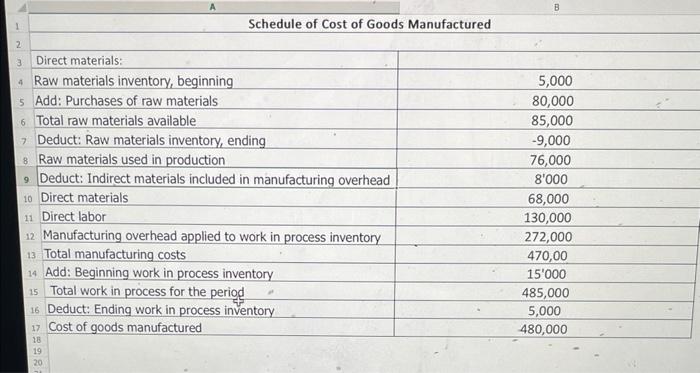

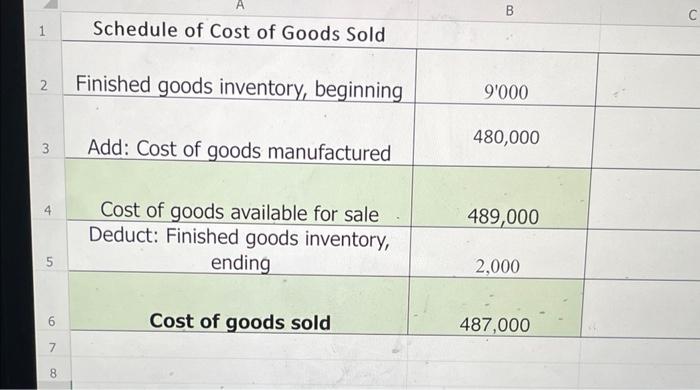

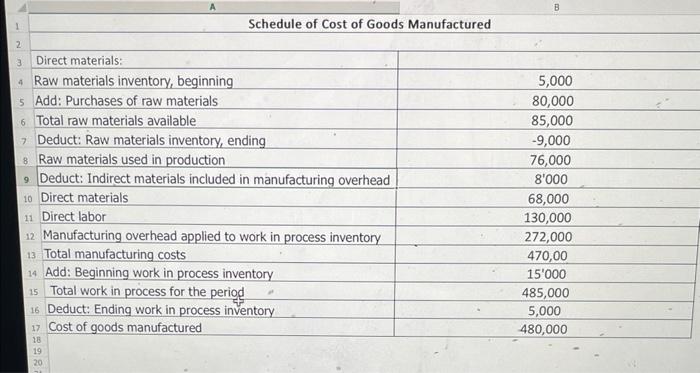

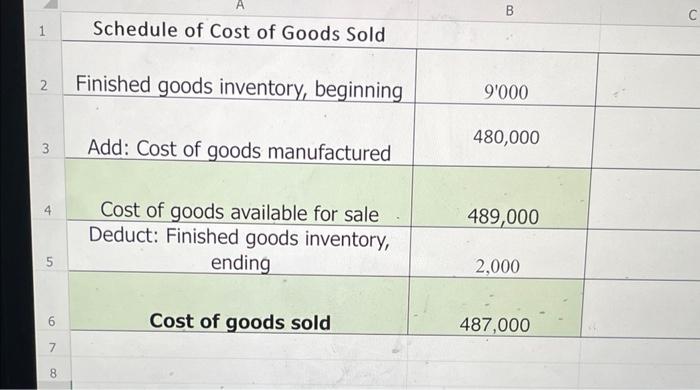

Sheet 1. Calculate POHR, overhead applied and under-or overappl Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjus Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. A Schedule of Cost of Goods Manufactured Direct materials: 4 Raw materials inventory, beginning 5 Add: Purchases of raw materials 6. Total raw materials available 7 Deduct: Raw materials inventory, ending 8 Raw materials used in production 9 Deduct: Indirect materials included in manufacturing overhead 10 Direct materials 11 Direct labor 12. Manufacturing overhead applied to work in process inventory 13 Total manufacturing costs 14 Add: Beginning work in process inventory 15 Total work in process for the period Deduct: Ending work in process inventory Cost of goods manufactured Schedule of Cost of Goods Sold 2 Finished goods inventory, beginning 9000 3 Add: Cost of goods manufactured 480,000 \begin{tabular}{|c|c|c|} \hline 4 & Cost of goods available for sale & 489,000 \\ \hline 5 & Deduct:Finishedgoodsinventory,ending & 2,000 \\ \hline 5 & & \\ \hline 6 & Cost of goods sold & 487,000 \\ \hline \end{tabular} Sheet 1. Calculate POHR, overhead applied and under-or overappl Sheet 2. Prepare a schedule of cost of goods manufactured. Sheet 3. Prepare a schedule of cost of goods sold; Calculate Adjus Sheet 4. Prepare a traditional format income statement; Sheet 5. Prepare a contribution format income statement. A Schedule of Cost of Goods Manufactured Direct materials: 4 Raw materials inventory, beginning 5 Add: Purchases of raw materials 6. Total raw materials available 7 Deduct: Raw materials inventory, ending 8 Raw materials used in production 9 Deduct: Indirect materials included in manufacturing overhead 10 Direct materials 11 Direct labor 12. Manufacturing overhead applied to work in process inventory 13 Total manufacturing costs 14 Add: Beginning work in process inventory 15 Total work in process for the period Deduct: Ending work in process inventory Cost of goods manufactured Schedule of Cost of Goods Sold 2 Finished goods inventory, beginning 9000 3 Add: Cost of goods manufactured 480,000 \begin{tabular}{|c|c|c|} \hline 4 & Cost of goods available for sale & 489,000 \\ \hline 5 & Deduct:Finishedgoodsinventory,ending & 2,000 \\ \hline 5 & & \\ \hline 6 & Cost of goods sold & 487,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started