Answered step by step

Verified Expert Solution

Question

1 Approved Answer

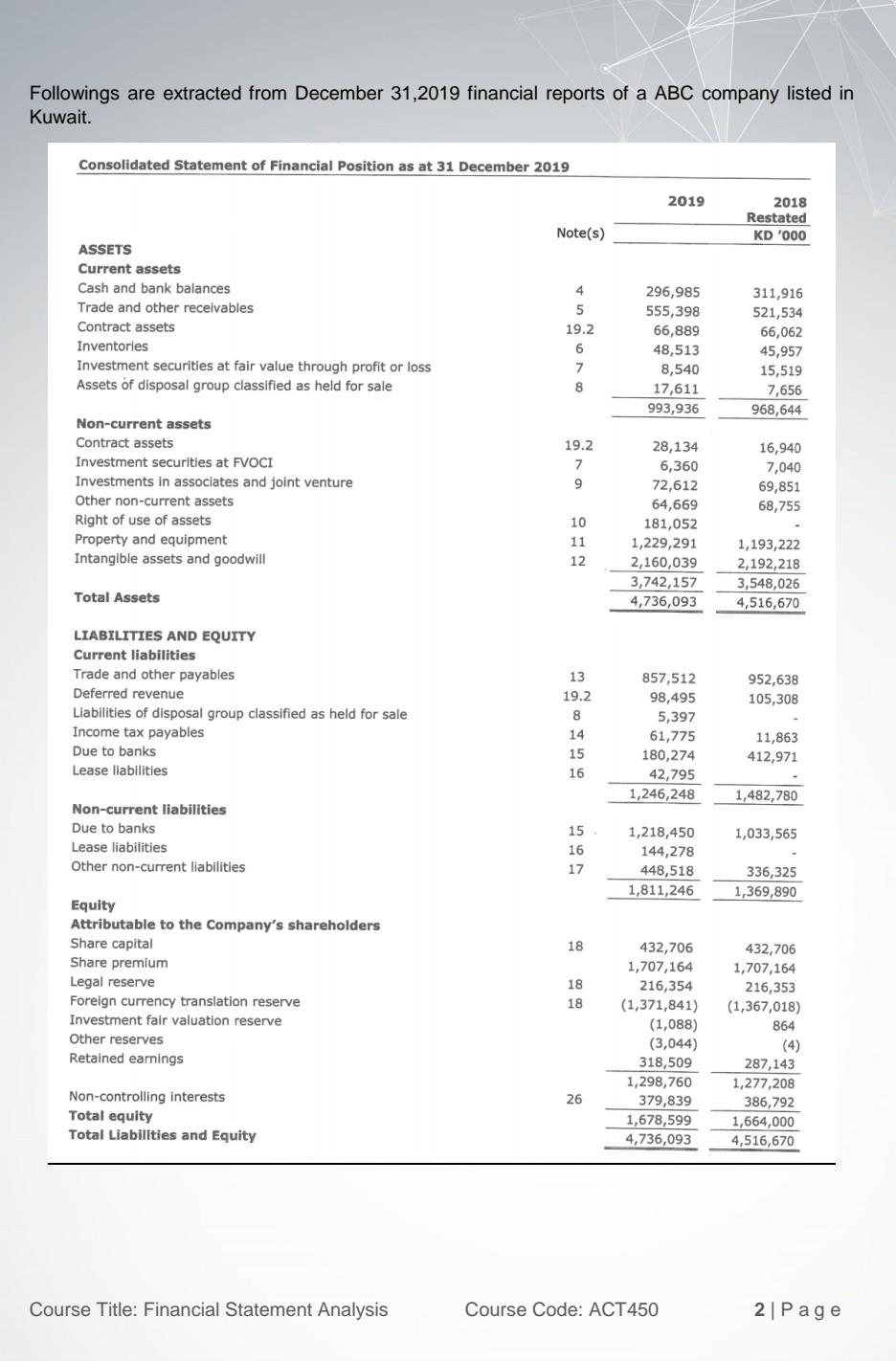

Followings are extracted from December 31, 2019 financial reports of a ABC company listed in Kuwait. Consolidated Statement of Financial Position as at 31 December

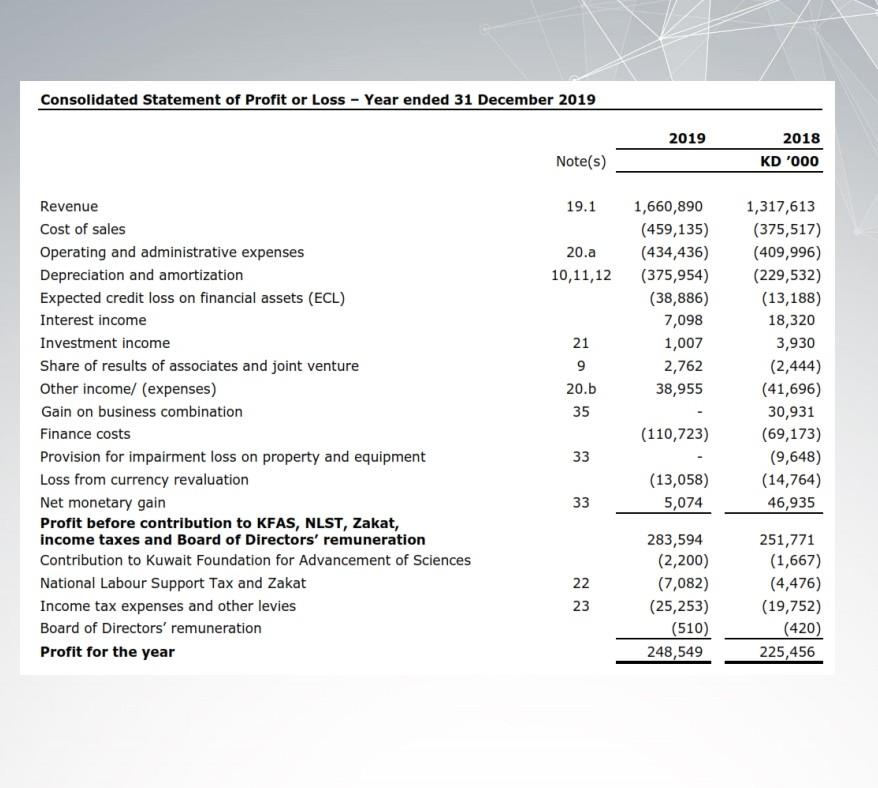

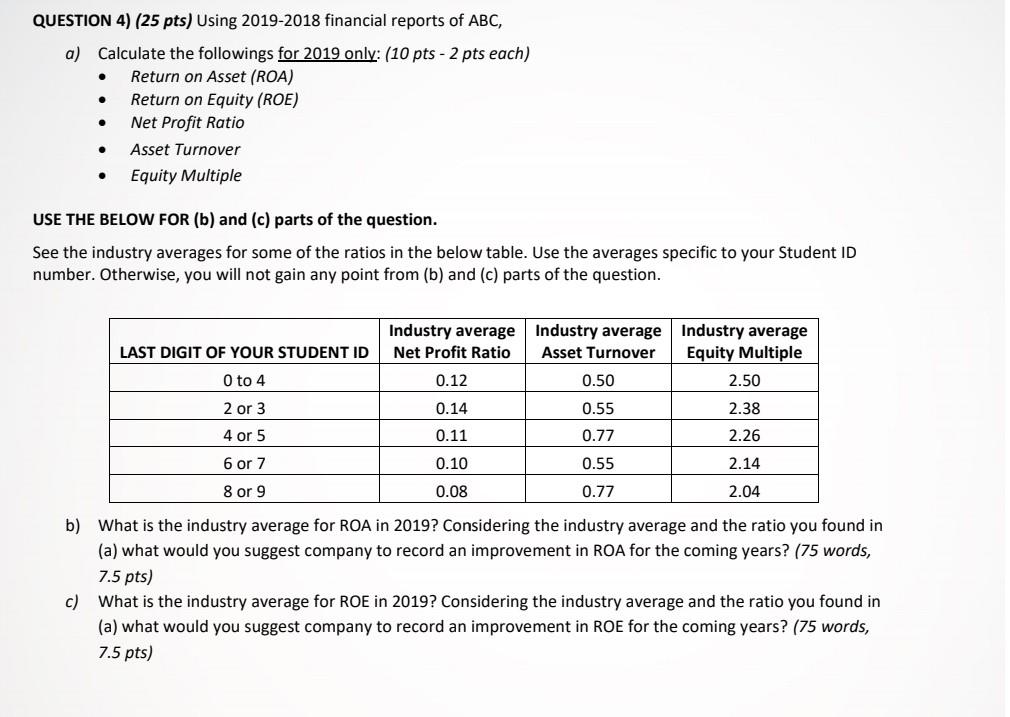

Followings are extracted from December 31, 2019 financial reports of a ABC company listed in Kuwait. Consolidated Statement of Financial Position as at 31 December 2019 2019 2018 Restated KD '000 Note(s) ASSETS Current assets 4 5 19.2 Cash and bank balances Trade and other receivables Contract assets Inventories Investment securities at fair value through profit or loss Assets of disposal group classified as held for sale 296,985 555,398 66,889 48,513 8,540 17,611 6 311,916 521,534 66,062 45,957 15,519 7,656 968,644 7 8 993,936 19.2 7 Non-current assets Contract assets Investment securities at FVOCI Investments in associates and joint venture Other non-current assets Right of use of assets Property and equipment Intangible assets and goodwill 16,940 7,040 69,851 68,755 9 10 28,134 6,360 72,612 64,669 181,052 1,229,291 2,160,039 3,742,157 4,736,093 11 12 1,193,222 2,192,218 3,548,026 4,516,670 Total Assets LIABILITIES AND EQUITY Current liabilities 13 Trade and other payables Deferred revenue 857,512 98,495 952,638 105,308 19.2 8 5,397 Liabilities of disposal group classified as held for sale Income tax payables Due to banks 14 11,863 412,971 15 Lease liabilities 61,775 180,274 42,795 1,246,248 16 1,482,780 Non-current liabilities Due to banks 15 1,033,565 Lease liabilities 16 Other non-current liabilities 1,218,450 144,278 448,518 1,811,246 17 336,325 1,369,890 18 Equity Attributable to the Company's shareholders Share capital Share premium Legal reserve Foreign currency translation reserve Investment fair valuation reserve 18 18 Other reserves Retained earnings 432,706 1,707,164 216,354 (1,371,841) (1,088) (3,044) 318,509 1,298,760 379,839 1,678,599 4,736,093 432,706 1,707,164 216,353 (1,367,018) 864 (4) 287,143 1,277,208 386,792 1,664,000 4,516,670 26 Non-controlling interests Total equity Total Liabilities and Equity Course Title: Financial Statement Analysis Course Code: ACT 450 2 Page Consolidated Statement of Profit or Loss - Year ended 31 December 2019 2019 2018 Note(s) KD '000 Revenue 19.1 20.a Cost of sales Operating and administrative expenses Depreciation and amortization Expected credit loss on financial assets (ECL) 10,11,12 1,660,890 (459,135) (434,436) (375,954) (38,886) 7,098 1,007 2,762 38,955 Interest income Investment income 21 1,317,613 (375,517) (409,996) (229,532) (13,188) 18,320 3,930 (2,444) (41,696) 30,931 (69,173) (9,648) (14,764) 46,935 9 Share of results of associates and joint venture Other income/ (expenses) Gain on business combination 20.b 35 Finance costs (110,723) 33 Provision for impairment loss on property and equipment Loss from currency revaluation Net monetary gain Profit before contribution to KFAS, NLST, Zakat, income taxes and Board of Directors' remuneration (13,058) 5,074 33 Contribution to Kuwait Foundation for Advancement of Sciences 22 National Labour Support Tax and Zakat Income tax expenses and other levies 283,594 (2,200) (7,082) (25,253) (510) 248,549 251,771 (1,667) (4,476) (19,752) (420) 225,456 23 Board of Directors' remuneration Profit for the year QUESTION 4) (25 pts) Using 2019-2018 financial reports of ABC, a) Calculate the followings for 2019 only: (10 pts - 2 pts each) Return on Asset (ROA) Return on Equity (ROE) Net Profit Ratio . . . Asset Turnover . Equity Multiple USE THE BELOW FOR (b) and (c) parts of the question. See the industry averages for some of the ratios in the below table. Use the averages specific to your Student ID number. Otherwise, you will not gain any point from (b) and (c) parts of the question. Industry average Industry average Industry average Net Profit Ratio Asset Turnover Equity Multiple LAST DIGIT OF YOUR STUDENT ID 0 to 4 0.12 0.50 2.50 2 or 3 0.14 0.55 2.38 4 or 5 0.11 0.77 2.26 6 or 7 0.10 0.55 2.14 8 or 9 0.08 0.77 2.04 b) What is the industry average for ROA in 2019? Considering the industry average and the ratio you found in (a) what would you suggest company to record an improvement in ROA for the coming years? (75 words, 7.5 pts) c) What is the industry average for ROE in 2019? Considering the industry average and the ratio you found in (a) what would you suggest company to record an improvement in ROE for the coming years? (75 words, 7.5 pts)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started