Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Font 4. A company that makes up its financial statements annually to 31 December, charges depreciation on its machinery at the rate of 12% per

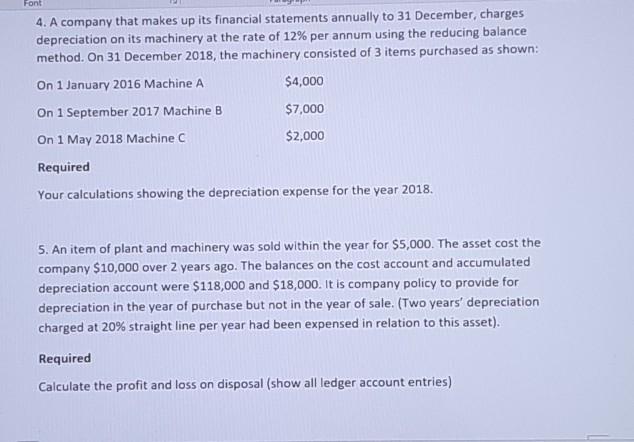

Font 4. A company that makes up its financial statements annually to 31 December, charges depreciation on its machinery at the rate of 12% per annum using the reducing balance method. On 31 December 2018, the machinery consisted of 3 items purchased as shown: On 1 January 2016 Machine A $4,000 On 1 September 2017 Machine B $7,000 On 1 May 2018 Machine C $2,000 Required Your calculations showing the depreciation expense for the year 2018. 5. An item of plant and machinery was sold within the year for $5,000. The asset cost the company $10,000 over 2 years ago. The balances on the cost account and accumulated depreciation account were $118,000 and $18,000. It is company policy to provide for depreciation in the year of purchase but not in the year of sale. (Two years' depreciation charged at 20% straight line per year had been expensed in relation to this asset). Required Calculate the profit and loss on disposal (show all ledger account entries)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started