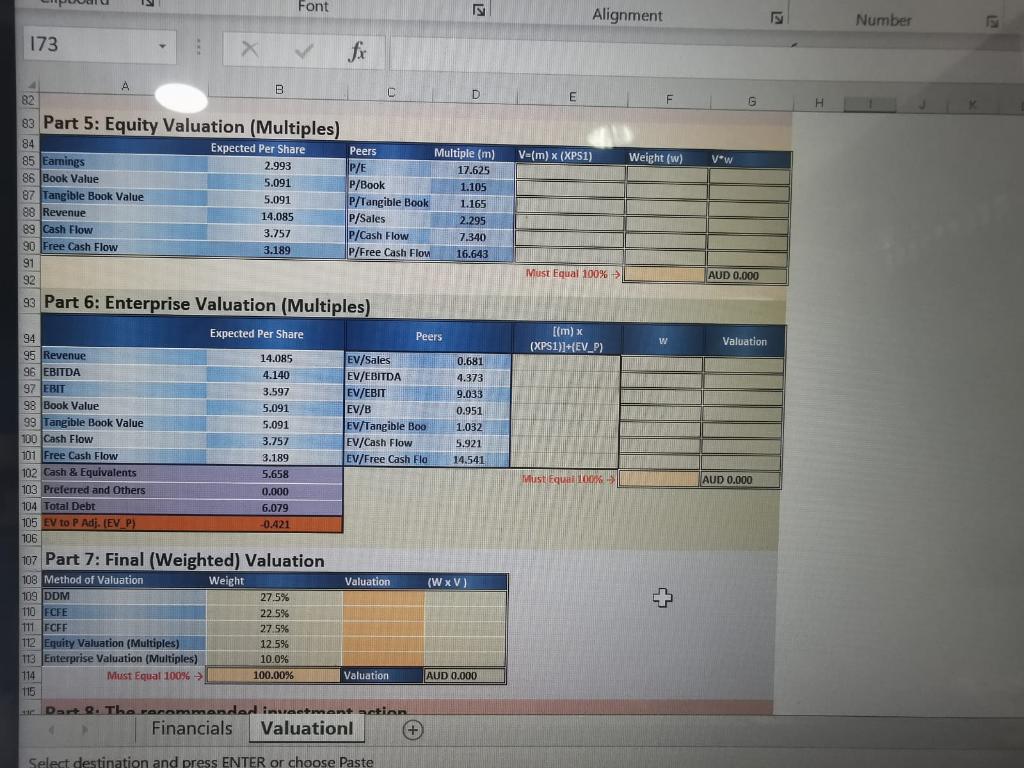

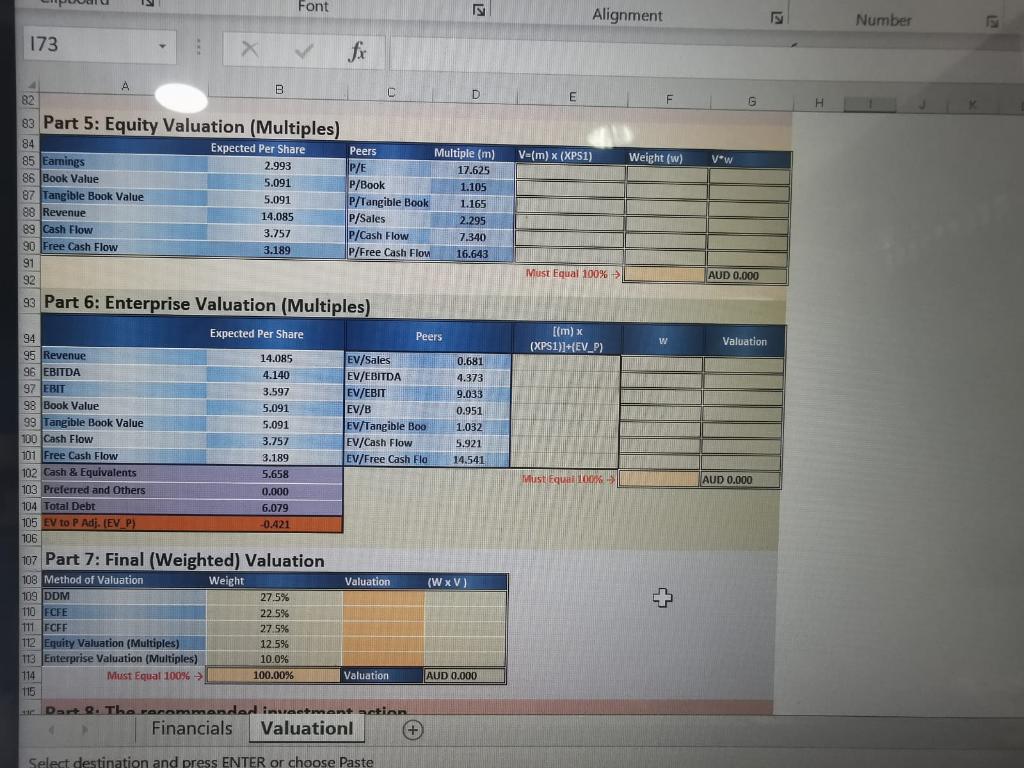

Font Alignment Number 173 A B D 82 E G H 83 Part 5: Equity Valuation (Multiples) V-(m) x (XP51) Weight (w) V*w 84 85 Eamings 86 Book Value 87 Tangible Book Value 88 Revenue 89 Cash Flow 90 Free Cash Flow 91 92 Expected Per Share 2.993 5.091 5.091 14.085 3.757 3.189 Peers Multiple (m) P/E 17.625 P/Book 1.105 P/Tangible Book 1.165 P/Sales 2.295 P/Cash Flow 7.340 P/Free Cash Flow 16.643 Must Equal 100% AUD 0.000 93 Part 6: Enterprise Valuation (Multiples) [(m) x (XPS1)1+{EV_P) W Valuation Must Equal 100% AUD 0.000 0.000 Expected Per Share 94 Peers 95 Revenue 14.085 EV/Sales 0.681 96 EBITDA 4.140 EV/EBITDA 4.373 97 EBIT 3.597 EV/EBIT 9.033 98 Book Value 5.091 EV/B 0.951 99 Tangible Book Value 5.091 EV/Tangible Bog 1.032 100 Cash Flow 3.757 EV/Cash Flow 5.921 101 Free Cash Flow 3.189 EV/Free Cash Fla 14.541 102 Cash & Equivalents 5.658 103 Preferred and Others 104 Total Debt 6.079 105 EV to P Adj. (EV_P) -0.421 106 107 Part 7: Final (Weighted) Valuation 108 Method of Valuation Weight Valuation (WxV) 109 DDM 27.5% 110 FCFE 22.596 111 FCFF 27.5% 112 Equity Valuation (Multiples) 12.5% 113 Enterprise Valuation (Multiples) 10.0% 114 Must Equal 10096 100.00% Valuation AUD 0,000 115 Dart 8. The recommanderlinvaetmant action Financials Valuation + Select destination and press ENTER or choose Paste Font Alignment Number 173 A B D 82 E G H 83 Part 5: Equity Valuation (Multiples) V-(m) x (XP51) Weight (w) V*w 84 85 Eamings 86 Book Value 87 Tangible Book Value 88 Revenue 89 Cash Flow 90 Free Cash Flow 91 92 Expected Per Share 2.993 5.091 5.091 14.085 3.757 3.189 Peers Multiple (m) P/E 17.625 P/Book 1.105 P/Tangible Book 1.165 P/Sales 2.295 P/Cash Flow 7.340 P/Free Cash Flow 16.643 Must Equal 100% AUD 0.000 93 Part 6: Enterprise Valuation (Multiples) [(m) x (XPS1)1+{EV_P) W Valuation Must Equal 100% AUD 0.000 0.000 Expected Per Share 94 Peers 95 Revenue 14.085 EV/Sales 0.681 96 EBITDA 4.140 EV/EBITDA 4.373 97 EBIT 3.597 EV/EBIT 9.033 98 Book Value 5.091 EV/B 0.951 99 Tangible Book Value 5.091 EV/Tangible Bog 1.032 100 Cash Flow 3.757 EV/Cash Flow 5.921 101 Free Cash Flow 3.189 EV/Free Cash Fla 14.541 102 Cash & Equivalents 5.658 103 Preferred and Others 104 Total Debt 6.079 105 EV to P Adj. (EV_P) -0.421 106 107 Part 7: Final (Weighted) Valuation 108 Method of Valuation Weight Valuation (WxV) 109 DDM 27.5% 110 FCFE 22.596 111 FCFF 27.5% 112 Equity Valuation (Multiples) 12.5% 113 Enterprise Valuation (Multiples) 10.0% 114 Must Equal 10096 100.00% Valuation AUD 0,000 115 Dart 8. The recommanderlinvaetmant action Financials Valuation + Select destination and press ENTER or choose Paste