Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Font Paragraph Styles Dictate Editor Create and Share Request Adobe PDF Signatures Question 6 (12 marks) On July 1, 2021 Work & Safe Consulting

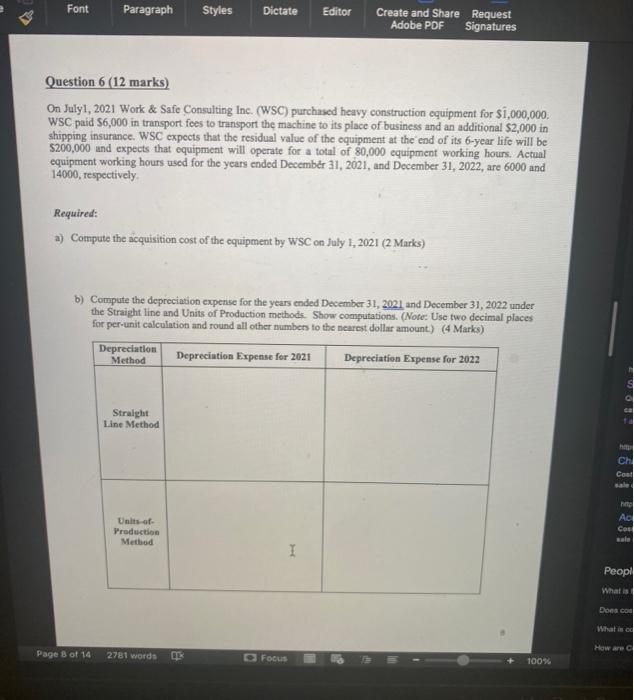

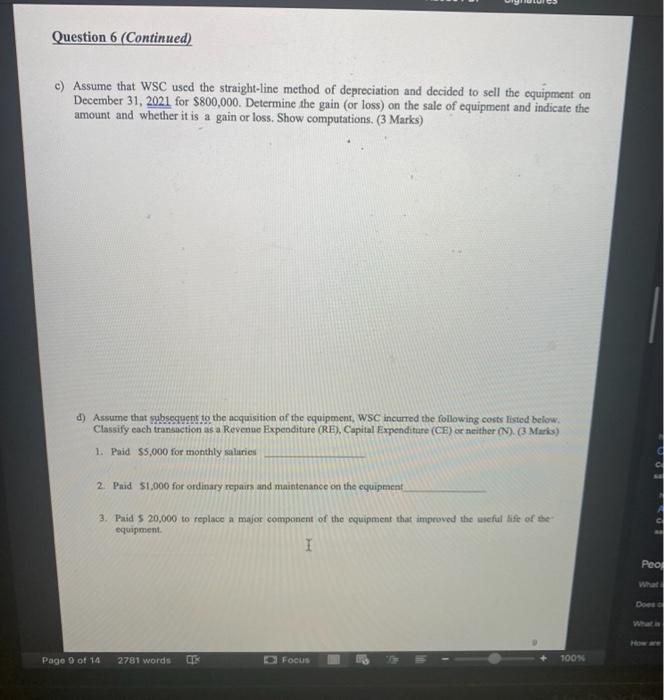

Font Paragraph Styles Dictate Editor Create and Share Request Adobe PDF Signatures Question 6 (12 marks) On July 1, 2021 Work & Safe Consulting Inc. (WSC) purchased heavy construction equipment for $1,000,000. WSC paid $6,000 in transport fees to transport the machine to its place of business and an additional $2,000 in shipping insurance. WSC expects that the residual value of the equipment at the end of its 6-year life will be $200,000 and expects that equipment will operate for a total of 80,000 equipment working hours. Actual equipment working hours used for the years ended December 31, 2021, and December 31, 2022, are 6000 and 14000, respectively. Required: a) Compute the acquisition cost of the equipment by WSC on July 1, 2021 (2 Marks) b) Compute the depreciation expense for the years ended December 31, 2021 and December 31, 2022 under the Straight line and Units of Production methods. Show computations. (Note: Use two decimal places for per-unit calculation and round all other numbers to the nearest dollar amount.) (4 Marks) Depreciation Method Depreciation Expense for 2021 Depreciation Expense for 2022 Straight Line Method Units-of- Production Method Page 8 of 14 2781 words Q Focus 30 I Ch Cos sale c hitp Ace Cost sale Peopl 100% What is Does co What is co How are t

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started