Answered step by step

Verified Expert Solution

Question

1 Approved Answer

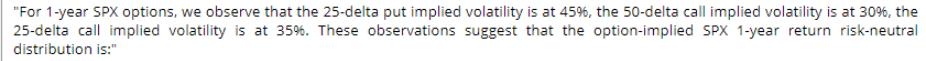

For 1-year SPX options, we observe that the 25-delta put implied volatility is at 45%, the 50-delta call implied volatility is at 30%, the

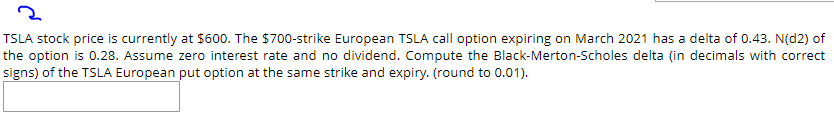

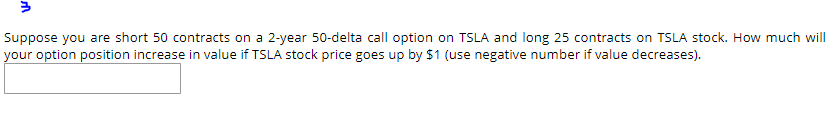

"For 1-year SPX options, we observe that the 25-delta put implied volatility is at 45%, the 50-delta call implied volatility is at 30%, the 25-delta call implied volatility is at 35%. These observations suggest that the option-implied SPX 1-year return risk-neutral distribution is:" 2 TSLA stock price is currently at $600. The $700-strike European TSLA call option expiring on March 2021 has a delta of 0.43. N(d2) of the option is 0.28. Assume zero interest rate and no dividend. Compute the Black-Merton-Scholes delta (in decimals with correct signs) of the TSLA European put option at the same strike and expiry. (round to 0.01). 3 Suppose you are short 50 contracts on a 2-year 50-delta call option on TSLA and long 25 contracts on TSLA stock. How much will your option position increase in value if TSLA stock price goes up by $1 (use negative number if value decreases).

Step by Step Solution

★★★★★

3.30 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Answer Q1 The optionimplied SPX 1year return riskneutral distribution can be inferred from the provided implied volatility values In this case The 25delta put implied volatility at 45 suggests that th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started